Morgan Stanley (NYSE: MS) has revised its outlook for Apple’s (NASDAQ: AAPL) share price, citing concerns around the lead time estimates for the company’s latest iPhone 16 series.

In the updated outlook, the bank’s analyst Erik Woodring predicted a near-term target of $200 or an 8% drop from the stock’s current valuation of around $219, the banking giant said in an investor note on September 18.

To back this sentiment, Morgan Stanley’s data indicated that iPhone 16 lead times are down 33% year-over-year in the United States, currently averaging 14.4 days compared to 21.6 days for the iPhone 15 at the same stage last year.

Lead times for the iPhone 16 Pro Max are 22.5 days, an increase from the 18 days recorded for the iPhone 15 Pro Max and 14 days for the iPhone 14 Pro Max. On the other hand, lead times for the iPhone 16 Plus are longer year-over-year at 10 days, matching the iPhone 15 Plus but extending 10 days beyond the iPhone 14 Plus.

However, all might not be lost for Apple, as Woodring acknowledged that it might be too early to make predictions based on the current metrics.

“iPhone 16 lead times are down year-over-year, but early lead times as a proxy for demand have little predictive power this early in the cycle. Historically, first 2-week lead times are directionally predictive of next 12-month (N12M) shipments at the model level, but they don’t provide much insight into December-quarter iPhone build revisions or total iPhone shipments. What’s more important is how iPhone 16 lead times trend over the next 10 days. We see near-term stock downside to $200, which we’d be buyers of, given that the multi-year upgrade cycle is a ‘when, not an if,” Woodring said.

Morgan Stanley also forecasted near-term downside support for Apple’s stock at around $197 while reiterating an ‘Overweight’ rating and a long-term price target of $273.

iPhone 16 pre-order sales concerns

Besides lead time concerns, analyst Ming-Chi Kuo from TF International Securities, who focuses on Apple’s supply chain, suggested on September 16 that Apple recorded a drop in first-weekend pre-order sales for the iPhone 16 series. The figures came in at approximately 37 million units, a decline of 12.7% year over year compared to the iPhone 15 series.

Although the figures surrounding the iPhone remain gloomy, some analysts believe the stock will likely recover once new features, such as Apple Intelligence, are integrated into the devices.

This view is supported by Wall Street analyst TD Cowen, who on September 10 projected that Apple is likely to trade at $250 in the next 12 months, maintaining his buy rating. According to Cowen, introducing new features will enhance Apple’s competitive edge in the market.

iPhone 16’s impact on Apple stock

The latest analyst rating regarding iPhone 16’s lead times could come as a setback for Apple investors, who have been enjoying bullish momentum in the last four months after a disappointing start to the year.

The rally was guided by investors betting on Apple’s artificial intelligence features for the latest line of iPhones.

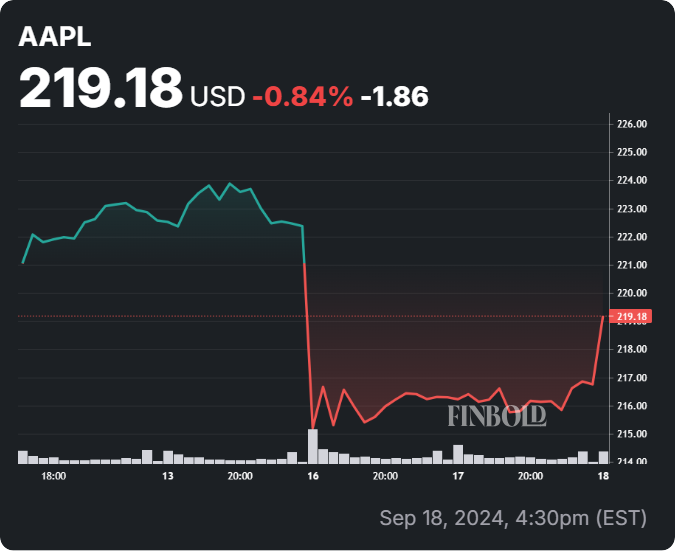

As things stand, AAPL seems less swayed by the latest Morgan Stanley, with the stock rising over 1% to trade at $219 as of press time.

AAPL stock chart analysis

Elsewhere, based on the current trading levels, a stock trader with the pseudonym Optionsprochick, in an X post on September 18, highlighted key levels for Apple shares to watch in the short term. The analysis suggested that the technology giant appears to be stabilizing near a key support level of around $215 following a period of volatility.

To validate any bullish scenario, the expert stated that AAPL’s first target is $219.19, followed by $221.71, with a further stretch to $222.50. A break above these levels could spark renewed buying momentum. However, a break below the $215 support level could invalidate the bullish outlook and lead to further downside risk.

In conclusion, while Morgan Stanley’s revised outlook and other analysts point to short-term challenges for Apple’s stock, there remains optimism for the tech giant’s long-term growth.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.