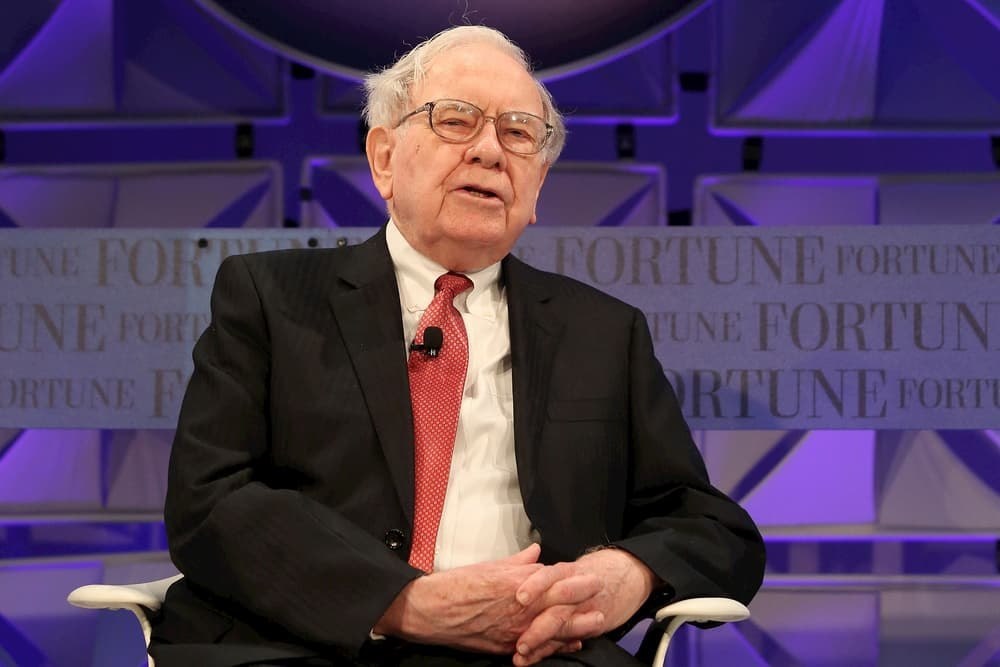

Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) offloaded a chunk of U.S. Bancorp stock earlier this week. The sale of 497,786 U.S. Bancorp shares (NYSE: USB) by subsidiaries of Berkshire Hathaway happened on May 11 and 12, according to the SEC filings. The transaction was worth $16.3 million.

Berkshire Hathaway now has cumulative ownership of 150.5 million shares of the bank, as indicated in a form that Buffett filed with the Securities and Exchange Commission (SEC).

Buffet said in the SEC filing that Berkshire Hathaway’s stake in U.S. Bancorp has dropped below 10%. Thus, Buffett and his company will not have to report trades in the stock from now henceforth. Nevertheless, they are compelled to publish their holdings by the end of every quarter.

The U.S. Bancorp stock has been profoundly affected by coronavirus-induced volatility. On May 13, shares closed at $29.45 for a 50.3% year-to-date loss. Analysts believe that it is one of the reasons that pushed Buffett to dump some of the bank’s shares.

The S&P 500 index, a measure of the broader market, has lost 12.7% year-to-date.

Berkshire stock thriving

Although Berkshire has not disclosed all of the stocks that it acquired in Q1 yet, it highlighted its share repurchases in its quarterly report.

The conglomerate repurchased almost $1.58 billion worth of its stock in Q1 2020. That is a significant buy-back compared to the company’s cumulative purchases in the same period. Thus, it seems like the Berkshire Hathaway stock was the most favorite stock for Buffett in Q1 2020.

In general, Buffett reportedly spent $4 billion buying stocks in Q1. Thus, Berkshire represented almost 40% of all the equities bought in that duration.

The Bancorp stock dump might be a restructuring strategy. But, analysts think that Buffett is offloading the weak performing stocks and replacing them with others that show some potential.