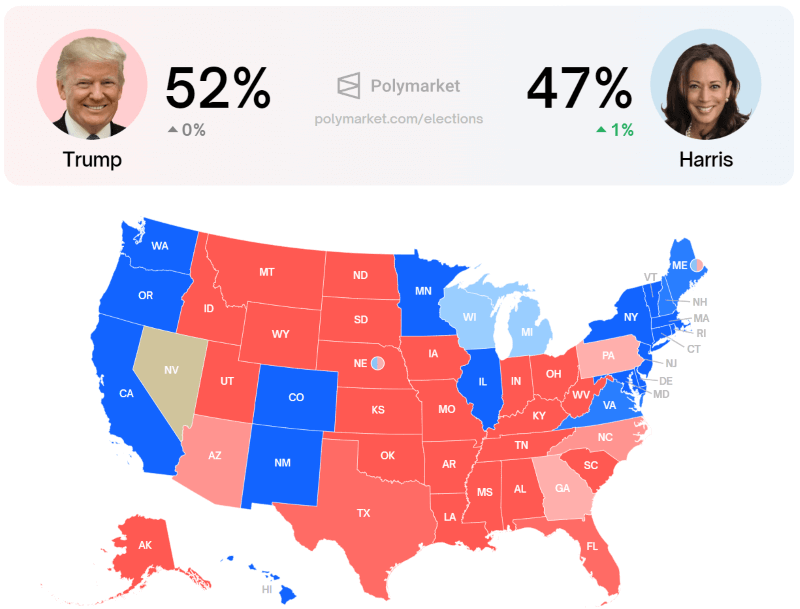

As the prediction markets turn in favor of the former United States President Donald Trump over his rival in the presidential race, Vice President Kamala Harris, analysts at renowned investment firm Bernstein have set the price target for Bitcoin (BTC) if the Democratic Party’s candidate wins the election.

Specifically, if Kamala Harris wins the U.S. presidential election in November, the price of Bitcoin could break the current $50,000 support and drop down to the area between $30,000 and $40,000, Bernstein analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia said on September 9.

According to them, Trump has warmed up more to the cryptocurrency community than the VP, despite the recent attempts by the Harris campaign to reach out and the support from certain crypto members. Hence, they expect BTC between $80,000 and $90,000 if the Republican candidate prevails:

Picks for you

“While crypto industry leaders have been more open-minded with the Harris campaign and are hoping for a more constructive policy, we expect the delta between the two political outcomes to be wide.”

Harris vs. Trump on crypto

Furthermore, Bernstein analysts have highlighted the differences in the clarity on crypto policy coming from the opposite sides of the presidential arena, with Trump promising to make the U.S. “the Bitcoin and crypto capital of the world” and talking about it in his speeches and plans.

On the other hand, Harris has yet to clarify her crypto stance, although her campaign staff has met with representatives of blockchain company Ripple and Coinbase (NASDAQ: COIN), one of the largest crypto exchanges, while Brian Nelson, senior advisor for policy for the Harris campaign stated that:

“She’s going to support policies that ensure that emerging technologies and that sort of industry can continue to grow.”

In fact, at a North Carolina event, Harris promised she would “focus on cutting needless bureaucracy and unnecessary regulatory red tape” and encourage “innovative technologies while protecting consumers and creating a stable business environment with consistent and transparent rules of the road.”

Moreover, billionaire Mark Cuban and Wall Street financier Anthony Scaramucci spoke in her favor at a Crypto4Harris group town hall in August, while crypto investors and executives urging Harris to pursue a softer regulatory stance are planning to raise over $100,000 for her, as Finbold reported on September 3.

Bitcoin price analysis

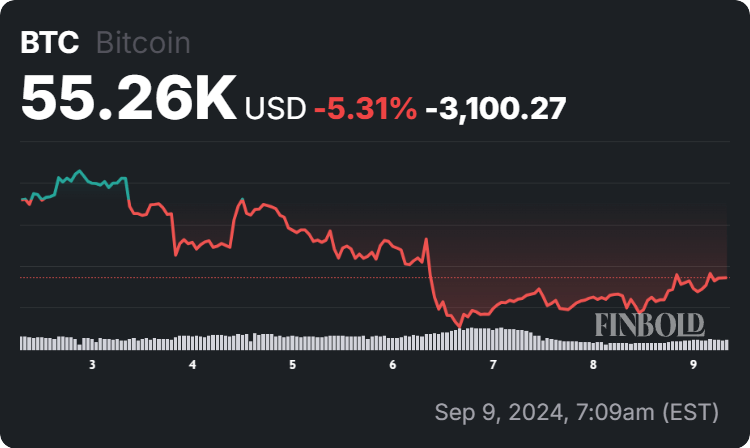

Meanwhile, Bitcoin was at press time trading at the price of $55,260, recording a 1.18% gain in the last 24 hours, having declined 5.31% across the previous seven days, and losing 9.06% over the month, as per the most recent data retrieved on September 9.

Ultimately, considering the increasingly polarized views on the crypto industry in the U.S. political spectrum, the results of the upcoming presidential election could impact the price of the sector’s representative asset. However, only time will tell just how strong this influence will be.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.