Beyond his renown as Microsoft’s (NASDAQ: MSFT) co-founder, Bill Gates is recognized as a savvy investor who keeps his capital actively mobilized.

Through the Bill & Melinda Gates Foundation Trust, the billionaire maintains positions in 23 stocks. The portfolio is highly concentrated — with Microsoft, Berkshire Hathaway (NYSE: BRK.B), Waste Management (NYSE: WM), and Canadian National Railway (NYSE: CNI) making up the bulk of his holdings, accounting for a total of 84%.

One of Gates’ long-standing investments is Ecolab (NYSE: ECL), a position he first established in 2010 and has steadily increased over the years.

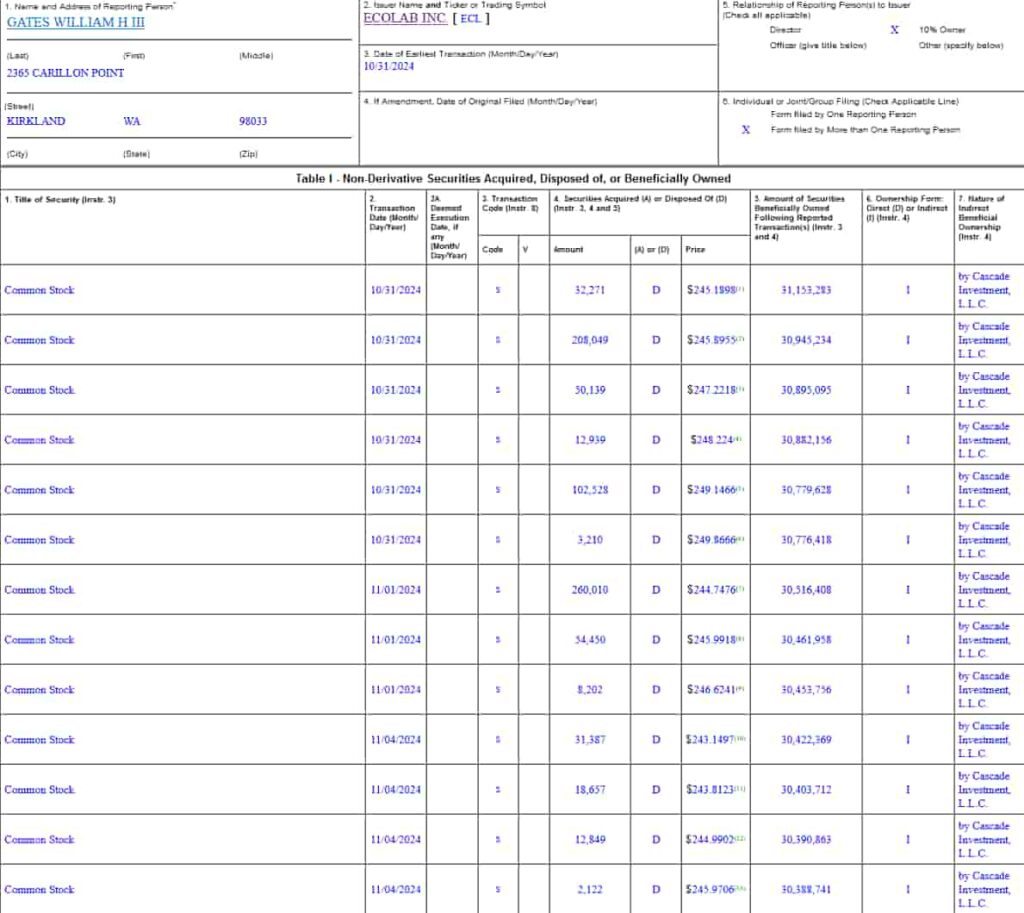

Now, an SEC Form 4 filing released on November 4 reveals that the foundation has sold off roughly $200 million in ECL stock. While Gates still maintains a large stake, this has led to questions regarding Ecolab’s long term prospects.

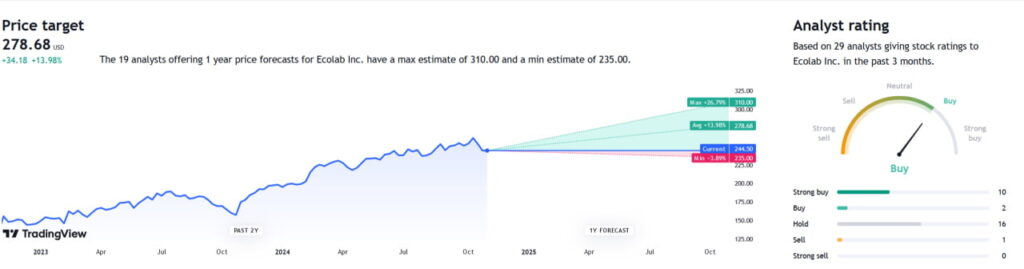

At press time, Ecolab stock was trading at $244.49 — having seen a year-to-date (YTD) price increase of 23.36%, although shares have shed 4.78% over the course of the last week.

Gates sold more than $200 million in ECL stock after earnings

On October 29, the water purification business released its Q3 2024 earnings report. Earnings-per-share (EPS) came in at $1.83, slightly above analyst estimates of $1.82, while revenue fell short at $3.99 billion compared to average forecasts of $4.03 billion.

The company also increased full-year EPS guidance, up from a prior range of $6.50 – $6.70 to $6.60 – $6.70.

Just two days later, Gates started selling ECL stock. A total of 13 transactions were executed from October 31 to November 4. The prices at which the securities were sold ranged from $243.14 to $249.86. Altogether, Gates sold 796,813 ECL shares — for a combined worth of approximately $193,625,559.

While the dollar amount might appear significant at first glance, at present the Microsoft co-founder still holds 30,388,741 Ecolab shares.

Have Ecolab stock’s future prospects changed?

At press time, there are no significant bullish factors that could serve as an explanation behind the sale. It should be noted that Gates still maintains a sizable position and that this is most likely an instance of profit-taking — as ECL stock is trading near all-time high (ATH) levels.

Wall Street equity analysts remain optimistic on the whole — the business remains a consensus ‘Buy’ with an average price target of $278.68, which would represent a 13.98% upside.

For now, at least, it appears that there is no cause for concern — however, if the Microsoft co-founder were to continue to reduce his holdings in ECL, that could indicate worries on his part regarding long-term outlooks.

Featured Image:

Alexandros Michailidis, Brussels, Belgium — October 13, 2023. Digital Image. Shutterstock.