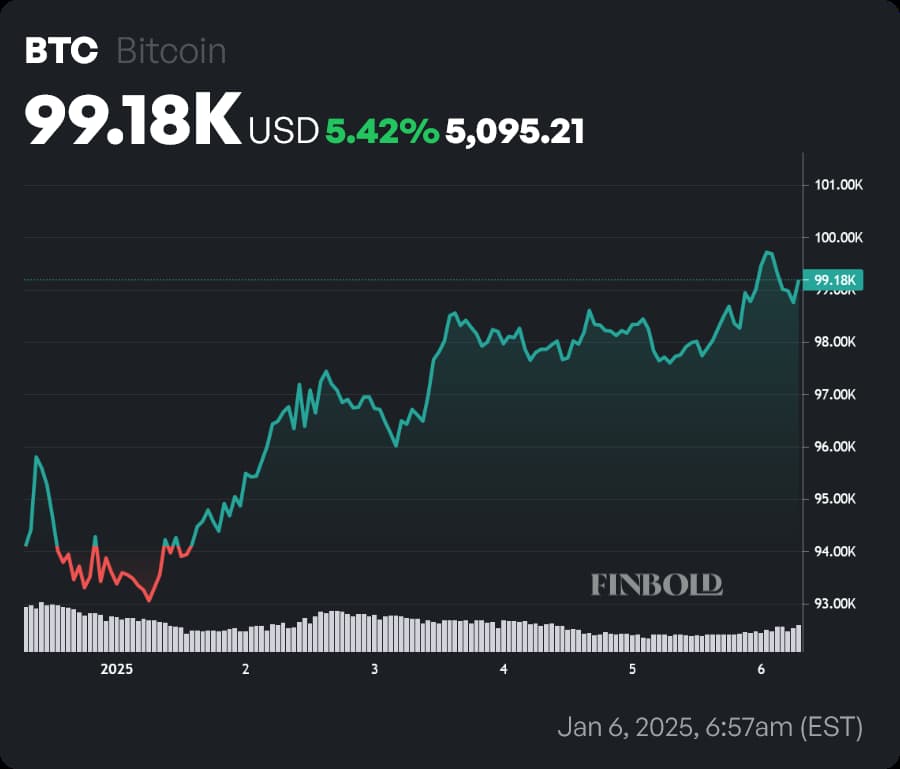

After reaching an all-time high (ATH) of $106,000 on December 17, Bitcoin (BTC) receded to the $95,000 mark. Following this initial move, the $92,000 level was tested and prices rebounded — although they have struggled to surpass the psychologically important $100,000 barrier since.

At press time on January 5, BTC was trading at $99,180 — having marked a 5.42% rally since the beginning of 2025. Despite these recent challenges, a general sense of optimism is present — none of the fundamental, underlying reasons behind the initial November surge have dissipated.

Still, investors have become a bit weary — and a prolonged accumulation phase could see many go off in search of greener pastures, particularly as altcoins have seen strong upward momentum as of late.

Recently, a renowned cryptocurrency technical analysis expert pinpointed an inflection point by identifying a chart pattern — one that outlines both the severity of the potential correction and the level above which BTC would have to close in order to avoid it.

Is Bitcoin in a head-and-shoulders pattern?

A head and shoulders pattern is a reversal pattern — it indicates that a thus-prevailing bullish trend is about to come to a close. One such pattern was spotted by Ali Martinez, who shared his findings in a January 4 post on social media platform X.

The head-and-shoulders pattern is characterized by three peaks — with the highest one in the middle representing the ‘head’. The troughs between the peaks are used to draw a ‘neckline’ — and if prices fall below that level on strong volume, the pattern is confirmed.

What usually follows is a drop to a level that is equivalent to the distance between the ‘head’ and the low point of either shoulder, subtracted from the ‘neckline’. In this case, that level equates to roughly $78,000 — a mark that would equate to a 21.35% drop from the current price of Bitcoin.

Will Bitcoin crash to $78,000?

Chart patterns are a useful part of the toolkit provided by technical analysis — but they do not provide an insight into foregone conclusions. For Bitcoin to fall below the ‘neckline’, it would have to see prices drop by approximately 7.2%, below $92,000 — which, while it is a possible scenario, remains unlikely.

In contrast, if price action moves above the ‘shoulders’, the chart pattern is invalidated. Seeing as how the ‘shoulders’ equate to a $100,000 price point, that seems like the much more likely option — as it would require just a 0.82% move to the upside.

Featured image via Shutterstock