Bitcoin (BTC) reached a new all-time high on Monday, July 14, smashing through the $122,000 barrier and trading at $121,959 at press time.

Largely driven by institutional exchange-traded fund (ETF) inflows and growing optimism in regard to crypto legislation, the momentum is going parabolic.

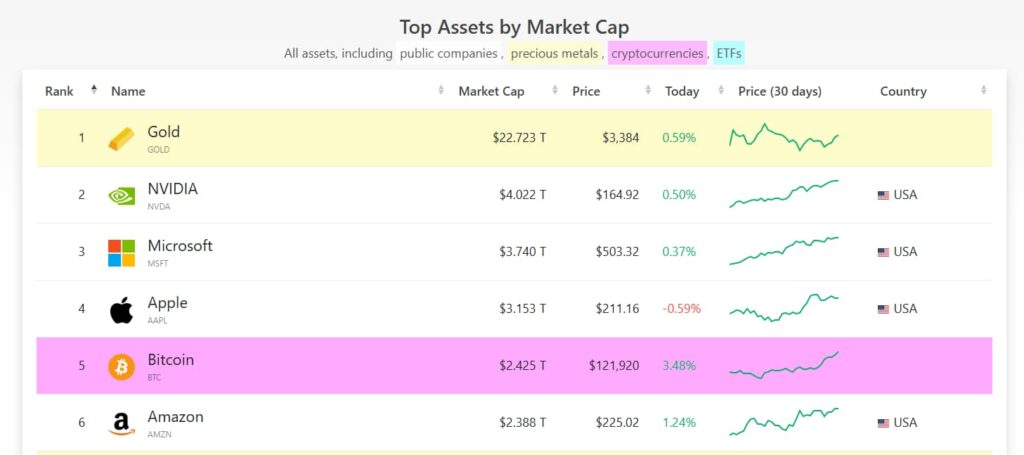

In fact, Bitcoin has managed to surpass Amazon (NASDAQ: AMZN) with a market cap of over $2.4 trillion, now being the fifth-largest asset globally.

Accordingly, traders are already expecting even bigger moves ahead, with Polymarket data suggesting a 84% chance that the token will reach $130,000 by the end of the year..

Huge Bitcoin moves

The Bitcoin rally is sending fresh bullish signals across the market, but the new price is the result of growing institutional adoption.

For example, Japanese firm Metaplanet has just acquired 797 BTC, worth around $93.6 million, while BlackRock’s IBIT fund pulled in $1.3 billion in inflows last week.

Likewise, the market has been quite optimistic about stablecoin legislation, with the U.S. House advancing three major crypto bills, including a bill to ban the Federal Reserve from issuing a central bank digital currency (CBDC).

Meanwhile, macroeconomic factors provided additional support. For instance, the U.S. dollar has lost 11% of its value over the past six months, driving investors toward crypto as a hedge.

As a result, the Crypto Fear & Greed Index jumped to 70 (“Greed”) from 52 last week, while the Altcoin Season Index surged 23% in just seven days, as per the data on CoinMarketCap.

Technically, Bitcoin’s breakout is well-supported, with the Relative Strength Index (RSI) currently at 75.12 (bullish but not in overbought territory), while the daily spot volume has surged by 142% to $105.6 billion since yesterday.

Featured image via Shutterstock