Bitcoin (BTC) price closed September at $63,333, its best monthly performance during what the market calls the “September Effect.” Despite the overall positive performance from day one to September 30, the last day experienced a crash and long liquidations.

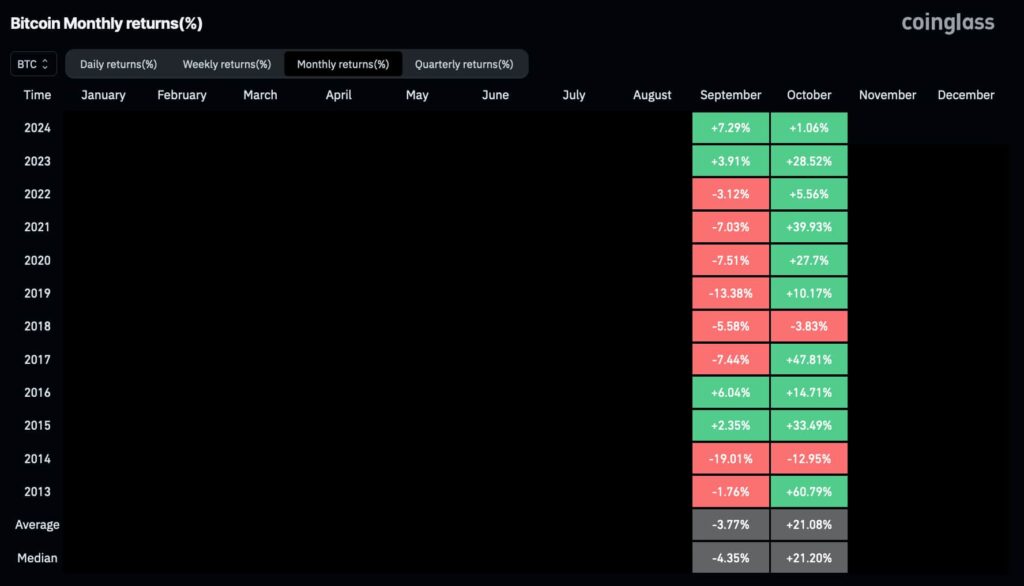

According to data Finbold retrieved from CoinGlass on October 1, Bitcoin registered 7.29% gains in September. This result considers the opening to closing price variation from the first to the last day of the month, respectively.

Historically, 2024 was one of the only four positive years Bitcoin price had in September. Moreover, this year was the best September’s monthly return to date, only behind another Bitcoin halving year, in 2016, with 6.04% gains.

What’s next for Bitcoin price in October amid ‘Uptober’ expectations

Interestingly, for every winning September, an even better October followed – rendering it the “Uptober” moniker. In 2023, for example, Bitcoin saw 3.91% gains in September, followed by 28.52% price performance in October.

The other two “winning” Septembers in 2016 and 2015 registered 6.04% and 2.35% gains, followed by 14.71% and 33.49% Uptobers, respectively.

With an average of 21.08% returns in October, Bitcoin could surpass its $73,800 all-time high this month. Following OpenAI’s o1 artificial intelligence logic, BTC could reach $76,600 if it reproduces the average from Bitcoin price’s opening.

Finbold reported the o1’s projection of $80,800 to $83,900 for Bitcoin in “Uptober” considering a higher base price. However, the leading cryptocurrency experienced a significant crash, causing a long squeeze Finbold had previously warned of.

During this event, Bitcoin’s price action liquidated $304,950 in long-position trades out of $310,530 overall liquidations.

Notably, this move now sets a clearer path to the upside, accomplishing what Finbold reported was needed before Uptober started. On that note, Ali Martinez, a known BTC analyst, is optimistically looking ahead for what could be a bull run ignite this month, based on historical patterns.

Despite the positive historical performance in October, traders and investors must remain cautious, as last month demonstrated – although positively – that historical patterns can fail.