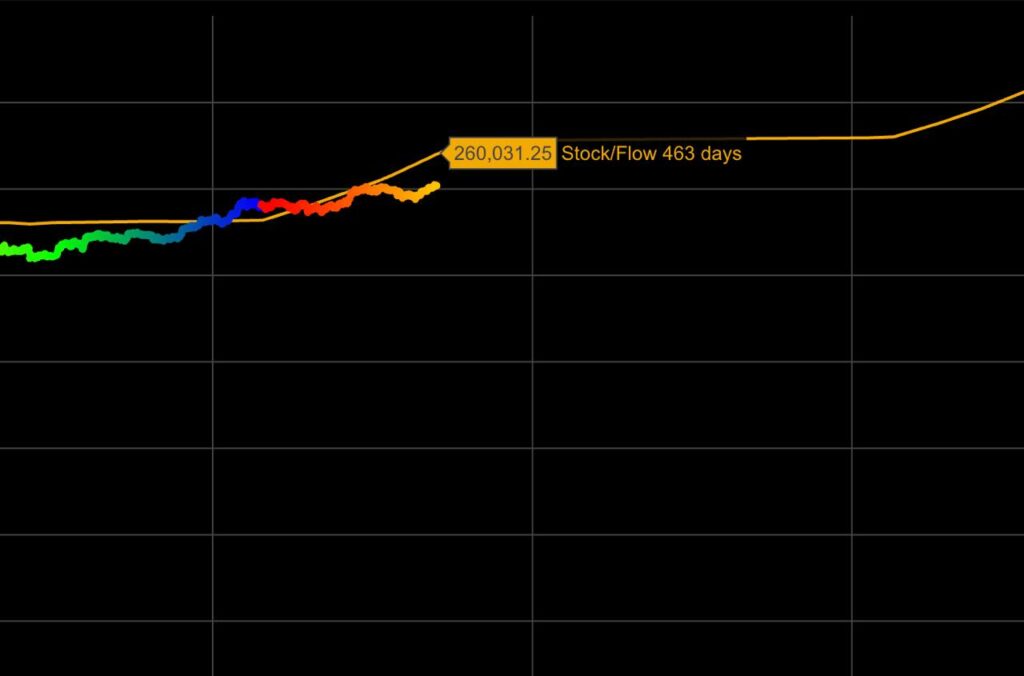

Despite a steady climb past $110,000, Bitcoin (BTC) remains meaningfully below its projected valuation according to the long-term Stock-to-Flow (S2F) model popularized by pseudonymous analyst PlanB.

The model’s latest 463-day forecast suggests Bitcoin should currently be trading at approximately $260,031, a more than 130% premium over its current price.

For those unfamiliar, stock-to-flow is a ratio derived from the total existing supply of Bitcoin (stock) divided by the new issuance (flow) entering circulation through mining. It is, in essence, a measure of absolute scarcity.

The orange trajectory on the model indicates that Bitcoin’s price historically gravitates toward the S2F curve over time, albeit with volatility. The closer Bitcoin tracks to this model, the more confidently one might view BTC as behaving like a commodity with predictable scarcity-driven value appreciation, akin to gold or silver.

Yet at the moment, Bitcoin is trailing the model’s predicted path. This divergence has raised eyebrows but is not unprecedented. Historically, periods of underperformance versus the S2F baseline have often preceded parabolic surges, as seen during the 2013 and 2020 bull runs.

The current discrepancy between the S2F model and actual price suggests a significant asymmetry in sentiment versus on-chain fundamentals. While skeptics might argue that Bitcoin is overheating, proponents of S2F view this lag as latent potential, evidence that the market has yet to fully price in the asset’s post-halving supply dynamics.

Why does this matter for BTC?

Because stock-to-flow is not only a technical model, but a proxy for behavioral dynamics. When Bitcoin trades below its modeled valuation, it often signals a period of consolidation, disbelief, or macro headwinds. But in the past, such gaps have presaged major upside moves.

In psychological terms, these dislocations can be seen as moments of latent potential energy, times when market participants are failing to fully integrate the implications of emergent scarcity.

This is especially relevant in a world where sovereign actors, institutions, and public companies are rapidly acquiring Bitcoin, not merely as an asset, but as a hedge against systemic fragility. Trump Media’s $2.5 billion Bitcoin treasury announcement is only the most recent example of this structural rotation.

Featured image via Shutterstock