At 2:00 p.m. EDT. on October 2, the Federal Reserve will release the Federal Open Market Committee (FOMC) minutes for the monetary policy body’s September 2024 meeting.

Investors, particularly those holding Bitcoin (BTC), are anxiously awaiting the release — as it will provide an in-depth view of the Fed’s reasoning behind the recent unexpectedly dovish 50 basis point interest rate cut.

The effects of monetary decisions and macro factors such as these on BTC have become increasingly apparent over the years — as noted by renowned crypto analyst Michaël van de Poppe in an X post, Bitcoin could test support levels at $61,500, following a reversal back to $65,000 and a breakout toward a new all-time high.

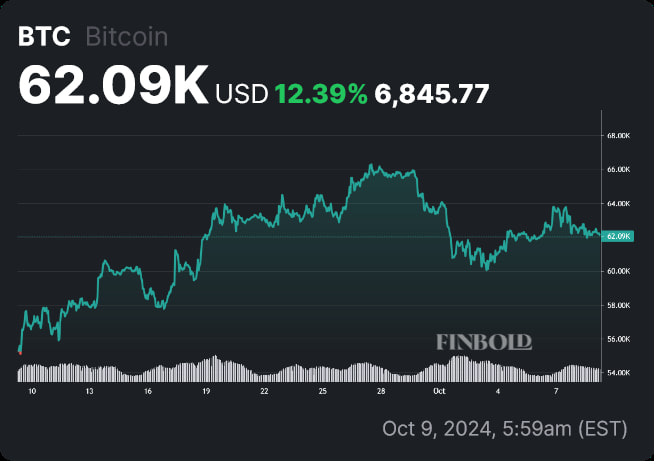

At press time, BTC is trading at $62,098, marking a 0.64% loss on the daily chart, trimming weekly gains to 1.32%. Over the course of the last 30 days, Bitcoin is up 12.39%, and 47.19% year-to-date (YTD).

However, it should be noted that since reaching a notable high of $66,300 on September 24, the asset is down 6.3%.

The Fed, interest rates, and BTC

While the correlation was not clear in the early days of Bitcoin, as the cryptocurrency is increasingly adopted both by the public and institutional investors, interest rates play an ever-larger role in determining investors’ appetites for BTC.

On September 18, when the last major Fed announcement took place, declaring the 50 basis point interest rate cut, Bitcoin was trading at $60,320. By the close of the next trading day, prices had skyrocketed to $63,940.

Amidst a rough and tumble period, where neither the bulls nor the bears have taken a decisive lead, and where crypto analysts offer conflicting predictions, a behind-the-scenes at the Fed’s decision-making process will prove to be a tipping point.

If the minutes reveal a propensity toward further interest rate cuts, traders can expect significant bullish momentum. In the case that steep course correction — rate hikes, however unlikely, or concerns about inflation are revealed, selling pressure will likely increase, resulting in crucial support levels and psychological barriers at the $60,000 mark being tested.

Should the minutes reveal a mostly neutral outlook, this would still favor the bulls — with the inertia of the prior, unexpectedly strong decision serving to calm worries on the macroeconomic front during a time when many crypto researchers are presenting bearish technical analyses.

Analysts weigh in on BTC

Opinions are split on Bitcoin’s short-term and medium-term price action. JPMorgan sees the cryptocurrency as having much more room to grow amid geopolitical strife. Ben Sporn, CEO of Joy Wallet, expects prices to be between $65,000 and $70,000 by Halloween.

On the other end of the spectrum, crypto expert Ali Martinez outlined a case based on technical analysis that would support a drop to as low as $52,000, while analyst RLinda pointed toward a double-top formation that signals weakness in the upward bullish moves retesting crucial short-term resistance levels.

Soon enough, traders will see whose analysis was more accurate and actionable — the release of the FOMC minutes is sure to be the factor that tips the scales one way or another.