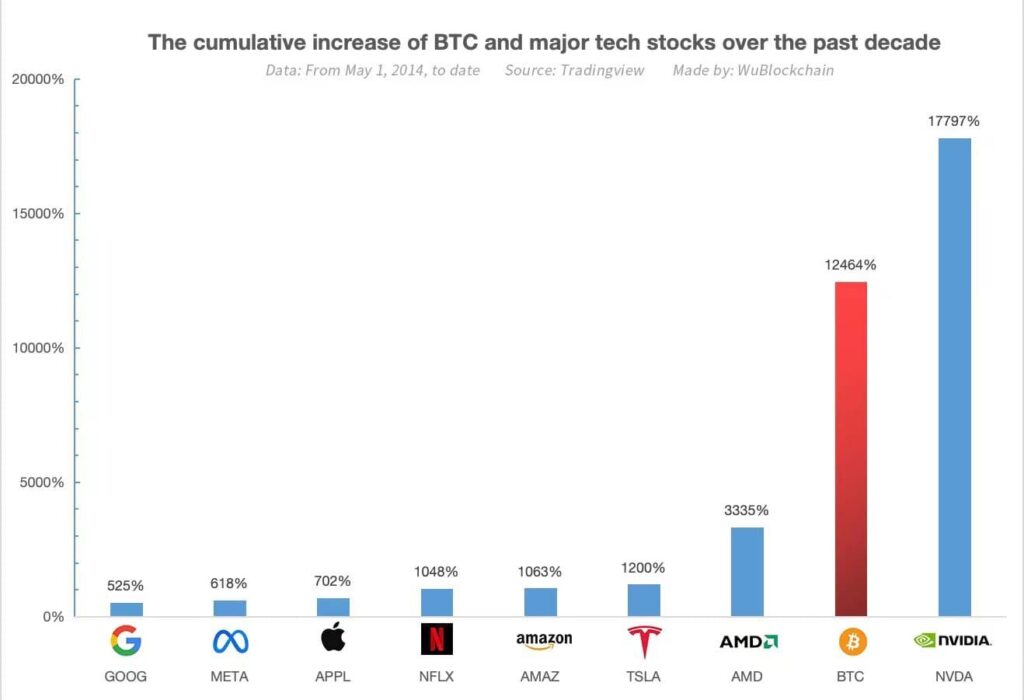

In the past decade, Bitcoin (BTC) has posted an extraordinary 12,464% increase in its price, outshining tech giants such as Amazon (NASDAQ: AMZN), Alphabet Inc (NASDAQ: GOOGL), and Netflix (NASDAQ: NFLX)

The analysis, published on X (formerly Twitter) on May 3 by WuBlockchain, examined Bitcoin’s performance alongside nine major technology stocks. This study highlighted its robust growth, further solidifying its reputation as a powerful investment vehicle

The research revealed that Nvidia (NASDAQ: NVDA) led the pack with an even more impressive gain of 17,797%, dominating the tech sector with its cutting-edge GPUs and semiconductor products. However, Bitcoin’s rise to the second place, especially in such a volatile market, underscores its significant impact and potential within the financial ecosystem.

“The WuBlockchain team compiled the cumulative gains over the past 10 years of BTC and nine major tech stocks including Google, META, Apple, Netflix, and Amazon etc. BTC ranked second with an increase of 12,464%, while NVIDIA took the top spot with a surge of 17,797%”.-Wu Blockchain”

Other tech entities like Advanced Micro Devices (NASDAQ: AMD) and Tesla (NASDAQ: TSLA) also showed considerable gains, with increases of 3,335% and 1,200% respectively. These figures demonstrate the dynamic growth within the tech industry, yet Bitcoin’s performance remains a notable story of success and resilience.

Investment landscape transformation

Despite the inherent volatility and uncertainties associated with cryptocurrencies, Bitcoin’s impressive growth trajectory over the past decade showcases its resilience and potential as a viable investment avenue.

As investors continue to diversify their portfolios and seek avenues for potentially high returns, the findings of this analysis offer a valuable reference point, highlighting the noteworthy performance of both established tech stocks and emerging digital assets like Bitcoin.

With technological innovation driving the markets forward, the intersection of traditional finance and digital assets presents new opportunities for investors to explore and capitalize on in the years to come.

Market Cap reshuffle among the Magnificent Seven

Recently, Nvidia has demonstrated a positive trajectory by rising above its 50-day moving average, setting a target for a stable price base with a buy point of 974. Google has maintained its upward momentum following a positive earnings report, whereas Meta experienced a significant setback on April 24, falling below its 50-day moving average.

In contrast, Tesla(TSLA), has rebounded above this key technical level after reporting strong earnings, a recovery mirrored by Amazon which also rallied following impressive earnings.

These movements have led to notable shifts in the market capitalization rankings among the top tech companies, often dubbed the “Magnificent Seven.” Microsoft has overtaken Apple in terms of Nasdaq market cap share, now making up 9.5% of the index compared to Apple’s 8.6%.

Nvidia, with a market cap share of 6.9%, has surpassed both Alphabet at 6.6% and Amazon at 6.2%. Meanwhile, Meta’s share has declined to 3.6%.

These market dynamics have also impacted the Composite Ratings of these firms. Apple’s rating has dropped to 53, despite a recent earnings boost. This reshuffling reflects the volatile yet dynamic nature of tech stock performance and market valuations.

The Road ahead for Bitcoin

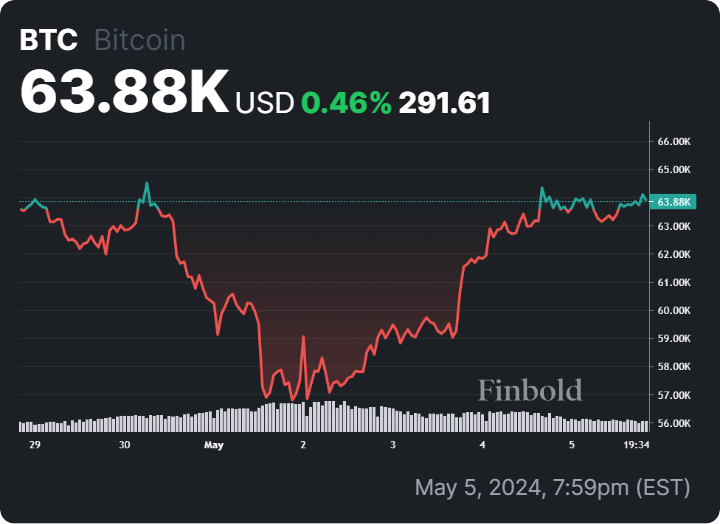

By press time, Bitcoin was trading at $63,800 with daily corrections of almost 0.86%. On the weekly chart, Bitcoin is down over 0.07%

Despite recent market downturns and a significant reduction in block mining rewards experts remain optimistic about Bitcoin’s long-term prospects.

Concerns about mining centralization and regulatory challenges persist, but the scarcity of Bitcoin, capped at 21 million tokens, is a critical factor that continues to drive its value. Looking ahead, industry insiders suggest that while the market may face short-term fluctuations, the long-term trajectory for Bitcoin looks promising.

As Bitcoin continues to compete with and even surpass major tech stocks, its role as a transformative asset in the investment landscape is becoming more pronounced.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.