Tether, the world’s largest stablecoin issuer, has minted an additional 1 billion USDT through its treasury.

This minting has sparked significant discussion within the cryptocurrency community about its potential impact on the market, particularly for Bitcoin (BTC).

Tether’s CEO, Paolo Ardoino, clarified on X (formerly Twitter) that this issuance was for “inventory replenishment” and was an “authorized but not issued transaction.”

Market dynamics and historical context

The latest minting follows Tether’s previous issuance on April 16, which occurred during a period of market liquidity drain.

Over the past year, Tether’s treasury has minted a substantial 31 billion USDT across the Tron (TRX) and Ethereum (ETH) blockchains, according to the on-chain analytical platform Lookonchain.

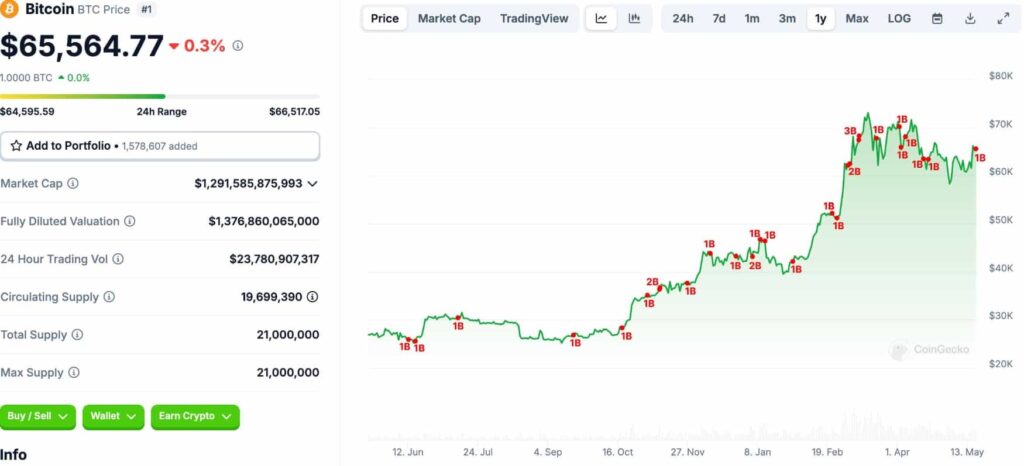

Historically, these issuances have correlated with upward movements in Bitcoin’s price, suggesting that the new USDT could again influence Bitcoin’s market performance.

According to CryptoQuant, a recent surge in stablecoin inflows has been observed, indicating a notable increase in liquidity entering the cryptocurrency market. This influx of liquidity has the potential to influence the supply and demand dynamics of Bitcoin, potentially leading to heightened price volatility.

Lookonchain’s analysis noted that last year’s significant USDT mintings contributed to Bitcoin’s price surge, pushing it from $27,000 to the $73,000 mark. This past pattern fuels speculation that the latest minting could similarly drive Bitcoin’s price upwards.

Current market conditions

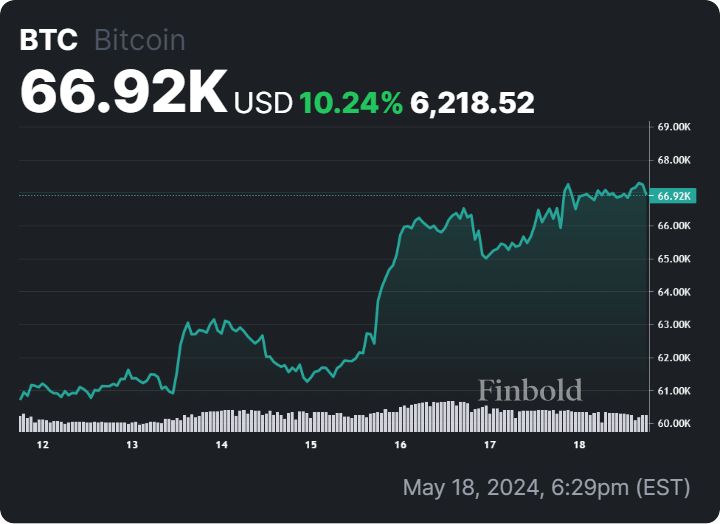

Bitcoin is currently trading with a bullish bias at $66,000. Despite these potentially bullish indicators, Bitcoin’s price has remained relatively stable, fluctuating between $64,000 and $66,000.

With Tether’s market capitalization now exceeding $110 billion, this new minting could act as a catalyst for Bitcoin to achieve new all-time highs.

On March 31, Tether acquired 8,888 BTC worth $618 million, elevating it to the position of the seventh-largest Bitcoin holder globally, according to Bitinfocharts. Currently, Tether’s wallet holds over 78,317 BTC, valued at over $5.18 billion, reflecting its significant influence on the market.

Bitcoin’s ongoing bullish momentum follows the April CPI release, signaling a steady recovery after starting May in a red zone and dropping as low as $56,000.

A Bitcoin correction to below $63,500 would liquidate over $1.76 billion worth of cumulative leveraged long positions, according to Coinglass data. Liquidations would reach $1.87 billion under the $63,000 mark.

As the cryptocurrency market anticipates the potential effects of Tether’s latest USDT minting, the interplay between stablecoin liquidity and Bitcoin’s price movement continues to be a focal point for investors.

With historical trends suggesting a positive correlation, market participants are watching closely to see if this latest minting will propel Bitcoin to new heights

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.