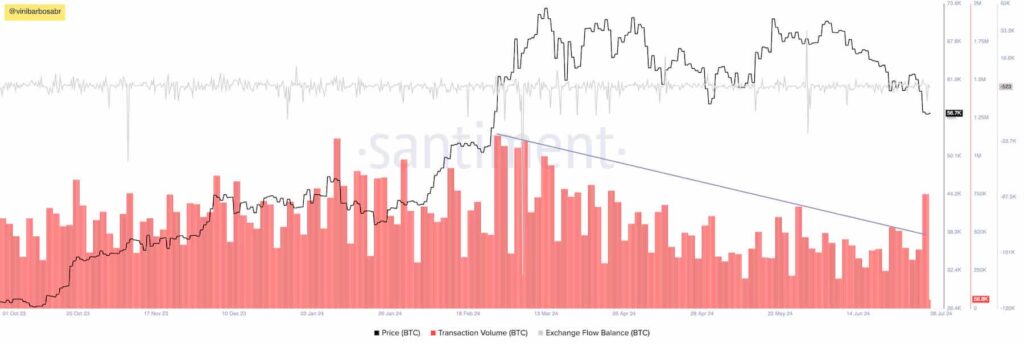

Bitcoin (BTC) investors are back using the blockchain as Bitcoin’s transaction volume surged, breaking a four-month downtrend. Meanwhile, the crypto exchange‘s flow and social context indicators suggest people are buying the recent price dip.

Previously, a transaction volume uptrend sent Bitcoin’s price from $26,500 to the $73,800 all-time high. BTC then consolidated in a four-month price range. As this developed, the transaction volume indicator entered a downtrend, which the cryptocurrency just broke from July 3 to 5.

Finbold gathered this data from Santiment on July 6, as shown in the following chart. Notably, the network moved over 750,000 BTC on July 4, while exchange outflows peaked at a month’s high.

All this happened as the BTC price broke down from the four-month range to as low as $53,500. The leading cryptocurrency currently trades at $56,700, still below the range’s support of $60,000.

Bitcoin investors buy the dip

In this context, Santiment‘s social indicator shows increased mentions of “buy the dip” and related variations on social platforms. The increase happened at the same time as the price dropped to the local bottom.

Historically, these “buy the dip” chants surge when Bitcoin’s price falls aggressively, and they usually consolidate local bottoms. The current spike is at the same level as of May, when BTC briefly lost the four-month range, trading as low as $56,685 in a standard deviation from the $60,000 support. If history repeats itself, Bitcoin could be getting ready to retrieve its previous levels, although nothing is guaranteed.

However, as investors buy the dip and withdraw Bitcoin from the exchanges, significant sell-offs loom the maiden cryptocurrency.

On that note, Mt. Gox has started its repayments after over a decade of creditors’ waiting. The defunct exchange will repay over $8 billion worth of BTC and Bitcoin Cash (BCH), which may create a relevant selling pressure for both cryptocurrencies. Additionally, the German government has been selling millions of dollars in Bitcoin for the last few days.

Thus, investors must be extremely cautious with leverage, as economic developments could drive Bitcoin in any direction. Crypto traders lost over $600 million from leverage position liquidations during the crash, and analysts expect further liquidations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.