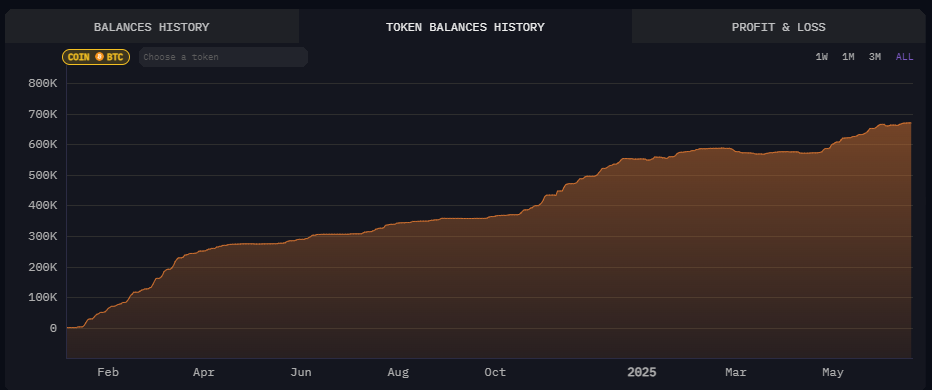

On June 17, BlackRock’s iShares Bitcoin Trust ETF (IBIT) recorded $639 million in inflows, having added 6,088 Bitcoin (BTC) to its holdings.

Since its inception in January 2024, IBIT’s cumulative inflows have amounted to over $50.67 billion.

With roughly 670,295 BTC under management, the fund now commands roughly 54% of the total U.S. Bitcoin ETF market, currently valued at $131 billion, according to CoinMarketCap.

BlackRock continues to dominate

Continuing its week-long buying streak, IBIT outperformed every other U.S.-listed spot Bitcoin ETF.

Its major competitors, like Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB), for instance, all saw major net outflows on the same day.

Fidelity SOLD.

— Arkham (@arkham) June 18, 2025

Ark SOLD.

Bitwise SOLD.

BUT BLACKROCK BOUGHT $640M OF BITCOIN pic.twitter.com/kQTpa3WcCg

BlackRock isn’t the only one buying, though. Strategy (formerly Microstrategy), for example, recently disclosed a $1,05 billion Bitcoin purchase, reaffirming its role as the largest corporate holder of BTC.

Strategy has acquired 10,100 BTC for ~$1.05 billion at ~$104,080 per bitcoin and has achieved BTC Yield of 19.1% YTD 2025. As of 6/15/2025, we hodl 592,100 $BTC acquired for ~$41.84 billion at ~$70,666 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/n7q77DmqCY

— Michael Saylor (@saylor) June 16, 2025

In this light, BlackRock’s aggressive moves simply underscore the fact that institutional adoption of Bitcoin is gaining full steam.

What’s more, its tokenized U.S. Treasury fund, BUIDL, is now valid as collateral on Crypto.com and Deribit, which further highlights the ongoing interplay between traditional finance (TradFi) and crypto.

Featured image via Shutterstock