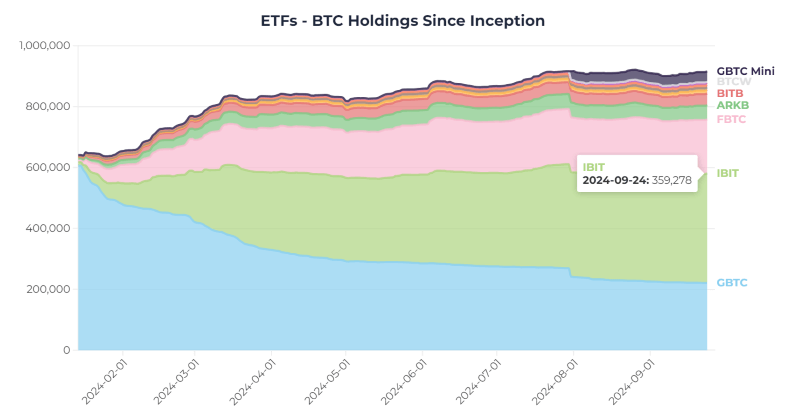

Following the monumental approval of the first spot Bitcoin (BTC) exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC) in January 2024, including the one created by BlackRock (NYSE: BLK), the investment behemoth has continued buying Bitcoin.

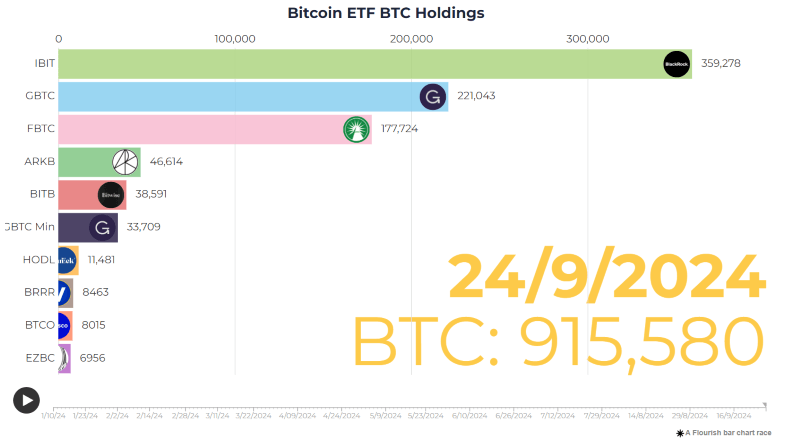

As it happens, BlackRock Bitcoin stash has been growing as part of its IBIT iShares Bitcoin Trust ETF, and its total holdings of the maiden cryptocurrency currently stand at 359,278 BTC, worth around $22.9 billion, as per the data retrieved from Apollo Bitcoin Tracker on September 25.

BlackRock Bitcoin purchases intensify

It is also worth noting that over the previous day, BlackRock’s spot Bitcoin ETF saw as much as $99 million worth of Bitcoin or 1,548 BTC in inflows, the highest amount in a month as the supply increased from 357,730 BTC on September 23 to 359,278 on September 24.

This also places BlackRock in the clear leadership position in this regard, way ahead of the other spot Bitcoin ETF managers, including Grayscale, which holds 221,043 BTC, Fidelity with 177,224 BTC, ARK Invest with 46,614 BTC, Bitwise with 38,591 BTC, and others, with a total of 915,570 BTC in spot ETFs.

BlackRock Bitcoin investment policy

Commenting on his company’s Bitcoin investment policies, BlackRock’s Head of Digital Assets, Robbie Mitchnick, recently explained that it was likely a misunderstanding in the perception of the flagship decentralized finance (DeFi) asset as ‘risk-on.’ Specifically, in his words:

“When we think of Bitcoin, we think of it primarily as an emerging global monetary alternative. It is a scarce, global, decentralized, non-sovereign asset, and it is an asset that has no country-specific risk, there’s no traditional counter-party risk, so these are the interesting properties when you think of it from an investment perspective, particularly in a world where there’s growing concerns over money printing, currency debasement risks, political, fiscal, sustainability challenges, in the U.S. or elsewhere.”

On the other hand, “when people talk about it as risk-on,” it “confuses investors,” as “based on the [above] properties, (…) you would think of it as risk-off.” Furthermore, as he clarified, “the reality is, there’s only two or three things a year that happen typically that actually impact the fundamental value of Bitcoin.” However:

“But that makes it hard to write daily stories and you see this instinct to point at whatever’s happening in equities or unemployment or jobs numbers or manufacturing, which really has no connection to Bitcoin.”

Bitcoin price analysis

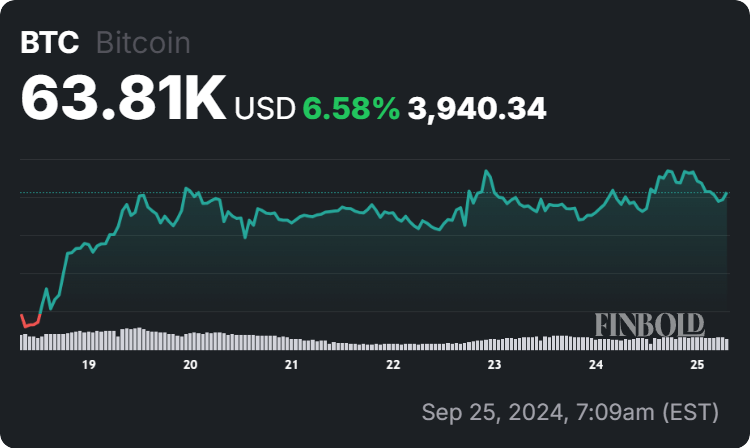

At press time, Bitcoin is changing hands at the price of $63,810, which indicates an increase of 0.38% in the last 24 hours, an advance of 6.58% across the previous seven days, and a 0.35% gain over the past month, according to the data retrieved on September 25.

Overall, BlackRock’s Bitcoin buying activities demonstrate the level of its commitment and bullish sentiment compared to other Bitcoin spot ETF asset managers, as well as investment companies in general. However, this does not guarantee a price increase and returns, so doing one’s own research is critical when investing.