BlackRock’s Ethereum ETF, ETHA, faced heavy selling pressure this week, coinciding with a period of heightened volatility in the asset.

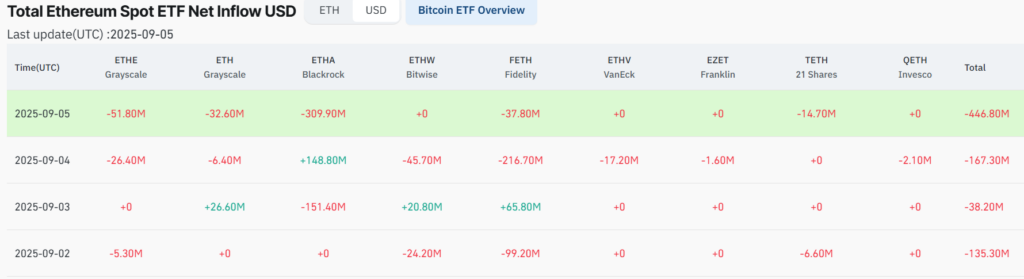

Data indicates that the ETF recorded net outflows of $312.5 million. The only positive session came on September 4, when $148.8 million flowed into the fund.

This gain was immediately offset by three consecutive redemption days, including $151.4 million on September 3, $309.9 million on September 5, and smaller drawdowns on other days, resulting in a deeply negative week.

The outflows come as U.S. spot Ethereum ETFs, which saw strong inflows in August, are now under broad pressure. By contrast, Bitcoin ETFs, including BlackRock’s IBIT, recorded net inflows, suggesting institutions are rotating toward the more established asset.

While large redemptions from spot ETFs signal waning institutional demand, retail and offshore buyers have helped cushion ETH from steeper losses. Even so, the second-largest cryptocurrency is now testing the $4,000 support.

ETH price analysis

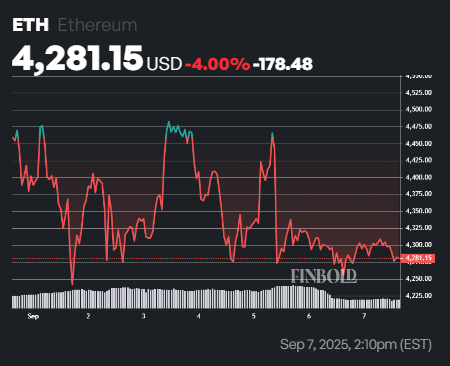

At press time, Ethereum (ETH) was trading at $4,281, up 0.11% over the past 24 hours but down 4% on the week.

On the technical front, analysis by Ali Martinez highlighted that ETH is approaching a decisive level near $4,260, which has repeatedly acted as a key pivot in recent sessions. Failure to hold this threshold could trigger a sharper decline toward the $4,000 psychological mark.

Notably, ETH has struggled to build momentum above the $4,380 and $4,500 resistance zone, with repeated rejections underscoring persistent selling pressure. On the downside, $4,260 remains the critical barrier between relative stability and a deeper retracement.

With volatility elevated and upcoming macro events set to influence risk assets, Ethereum’s reaction around the $4,260 level will likely determine its next major directional move.

Featured image via Shutterstock