BlackRock’s crypto portfolio has shifted significantly over the past week, with blockchain data showing a sharp reduction in its Ethereum holdings alongside renewed accumulation of Bitcoin.

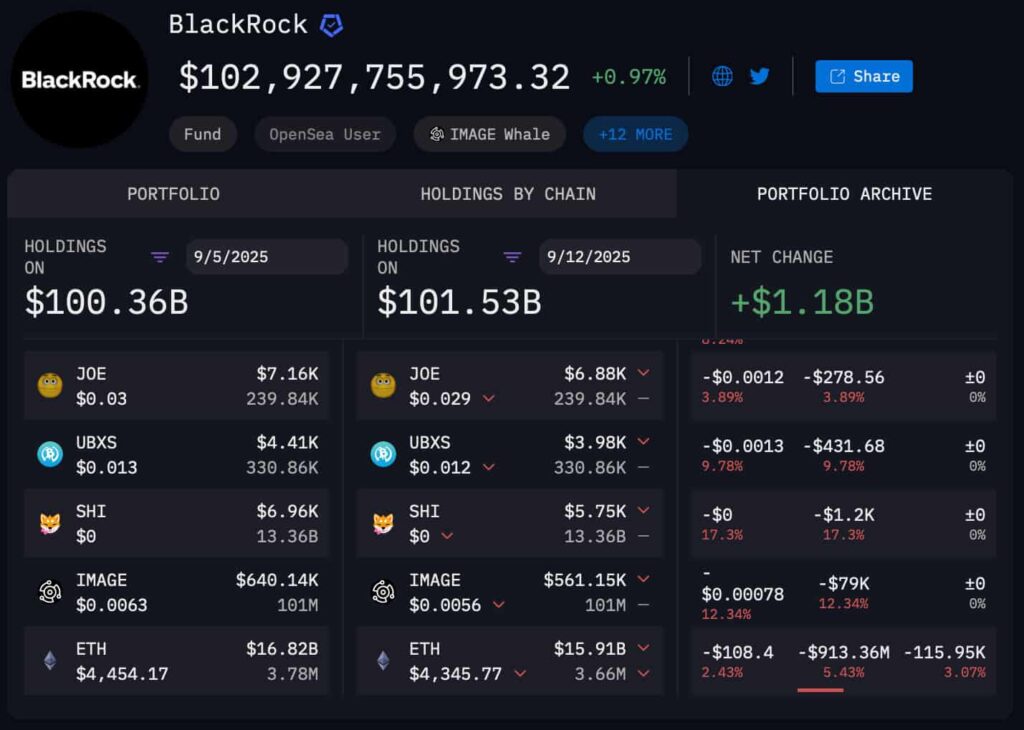

According to data retrieved by Finbold from on-chain intelligence from Arkham, BlackRock’s Ethereum position fell from 3.78 million ETH worth $16.82 billion on September 5 to 3.66 million ETH worth $15.91 billion on September 12. That marks a reduction of 115,950 ETH, equating to more than $913 million in value within just seven days.

Ethereum’s share of BlackRock’s crypto exposure dropped from 16.7% to 15.7%, a clear tilt away from the second-largest cryptocurrency by market cap.

BlackRock boosts its BTC holdings

In contrast, BlackRock added to its Bitcoin position. Holdings rose from 747,470 BTC ($83.53 billion) to 751,400 BTC ($85.62 billion) over the same period. An increase of 3,930 BTC, worth more than $2.09 billion, expanded Bitcoin’s dominance within the fund’s crypto portfolio from 83.2% to 84.4%.

The portfolio moves coincided with BlackRock’s overall crypto assets climbing back above the $100 billion mark, reaching $101.53 billion on September 12. This recovery was largely powered by Bitcoin’s week-on-week rally of 1.97%, as well as gains in smaller positions like SPX (+23.28%) and TUA (+61.15%).

Ethereum, meanwhile, faced headwinds, slipping 2.43% in price to $4,345 and triggering over $900 million in unrealized losses across BlackRock’s ETH allocation. Despite this trim, Ethereum remains BlackRock’s second-largest crypto holding, well ahead of other assets in its portfolio such as IMAGE ($561,000) and JOE ($6,880).