This week, Bitcoin (BTC) exchange-traded funds (ETFs) saw four days of consecutive outflows, with another $194.4 million in sales recorded on Thursday, August 21.

BlackRock (IBIT), the leading fund with over $85 billion in assets under management, alone shed approximately $127.5 million worth of BTC, according to August 22 data on SoSoValue.

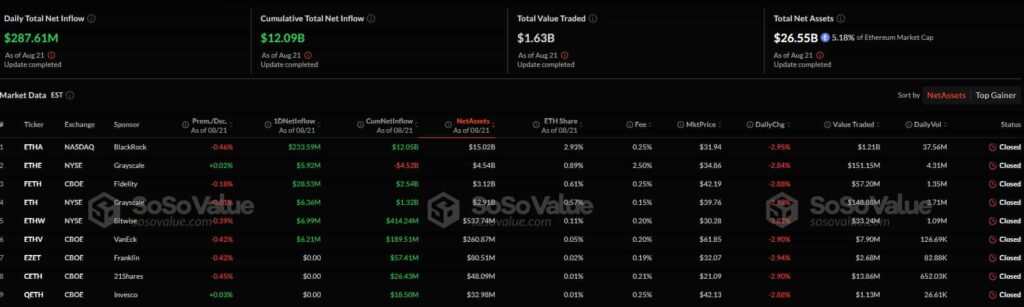

However, Ethereum (ETH) ETFs saw a reversal of fortune, seeing $287.6 million in inflows, with BlackRock (ETHA) adding $233.6 million just one day after reporting $257 million in withdrawals.

Accordingly, investors are speculating whether we’re looking at a short-term profit strategy or whether we might see a rotation from Bitcoin to Ethereum if the trend continues in the future.

Is BlackRock betting on Ethereum?

BlackRock’s Ethereum holdings have grown 230% since January 1, reaching 3.55 million ETH, worth around $15 billion, according to Arkham Intelligence.

More broadly, spot Ethereum ETFs now hold $27.66 billion worth of the crypto.

The appeal is quite clear: the cryptocurrency’s proof-of-stake (PoS) design continues to generate 3–5% staking yields.

Regulatory clarity has also worked in the asset’s favor, as the U.S. Securities and Exchange Commission (SEC) designated it as a non-security, paving the way for broader ETF adoption.

Still, Bitcoin remains BlackRock’s store of value, accounting for around 85% of the firm’s crypto portfolio, while Ethereum drives yield and other assets attempt to seize more niche opportunities.

Featured image via Shutterstock