The cryptocurrency market was hit by a huge shakeout on December 20, the last Friday before the Christmas holidays. Crypto traders have lost over $1.4 billion for position liquidations in the last 24 hours, causing a trading bloodbath.

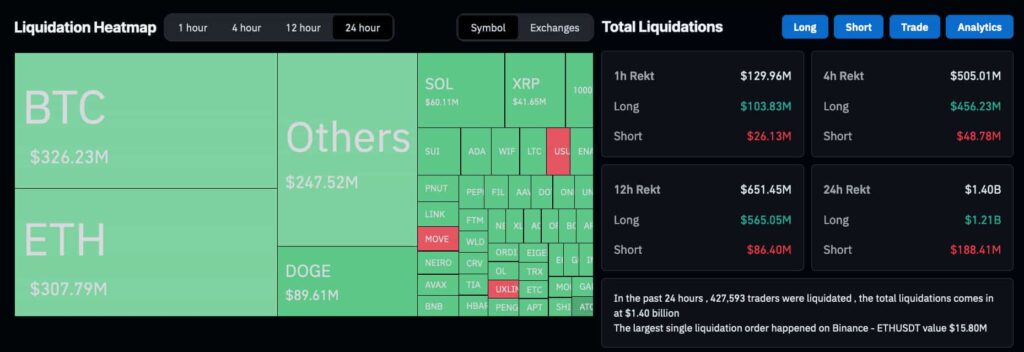

According to data Finbold retrieved from CoinGlass this Friday morning, 427,593 traders were liquidated since Thursday. The total liquidations sum up to $1.40 billion, out of which $1.21 billion were from long positions.

In particular, most of the liquidations occurred in the last four hours, liquidating $505.10 million from crypto traders. Most projects are crashing below relevant support levels, triggering panic selling in exchanges all over the world.

Notably, Bitcoin (BTC) and Ethereum (ETH) led the bloodbath with $326.23 million and $307.79 million liquidations each, respectively. Ethereum also had the largest single liquidation order on Binance against Tether’s USDT, erasing a $15.80 million long position.

Crypto projects lost over $400B of market cap in the last 24 hours

Moreover, TradingView’s Crypto Total Market Cap Index (TOTAL) shows that over $400 billion simply vanished from cryptocurrencies in the same period – a drop of 11.61%.

As of this writing, TOTAL has a $3.08 trillion capitalization, reaching a local bottom of $3.05 trillion. On December 17, the index peaked at a $3.71 trillion market cap, with current values representing a 17% crash.

While all cryptocurrencies have shown losses, some, like Bitcoin, have outperformed the index. On the other hand, memecoins are, by far, the biggest losers of this recent crash, experiencing significant losses.

In the meantime, crypto analysts and traders went to X to share insights, vent frustrations, and urge caution.

💸 With Bitcoin falling as low as $95.5K today, the ratio of crypto discussions that are about buying crypto's dip has reached its highest level in over 8 months. The last time we saw the crowd nearly this enthusiastic about dip buying was the major crash on August 4th. Since… pic.twitter.com/39NlpnGMCs

— Santiment (@santimentfeed) December 20, 2024

Some believe this is a dip worth buying, but there is no consensus right now on whether the market will see further drops – requiring proper risk management as things develop amid a growing fear, uncertainty, and doubt (FUD) on what is next for the previously rallying cryptocurrencies.

Overall, the most popular advice now is to be careful with leverage, favoring spot buys for those who remain bullish.

Featured image from Shutterstock.