Bitcoin’s (BTC) recent surge to a record $73,750, followed by a pullback to $61,000, has set the stage for what many in the cryptocurrency sector believe could be the onset of an altcoin season. Diverse predictions from analysts hint at a massive upswing in altcoin valuations.

While Bitcoin traditionally kickstarts market cycles with a strong surge, the real action often unfolds during its consolidation phases, where other cryptocurrencies typically take the lead. This trend is expected to be more pronounced in the upcoming period, fueled by varying forecasts from leading analysts.

The integration of decentralized finance (DeFi), advancements in blockchain scalability, and the expanding use of smart contracts are key factors contributing to a potential altcoin rally, which could significantly alter the dynamics of the cryptocurrency market.

Expert predictions on altcoin breakouts

Ted, an expert analyst, recently shared an analysis on X (formerly Twitter) suggesting a significant upturn in the altcoin market.

He pointed out a potential breakout, underpinned by technical patterns like the inverse head-and-shoulders formation, hinting at a bullish trend that could push the total market cap to $4 trillion.

This growth is expected to unfold over the coming months, potentially reigniting significant interest from retail investors.

Furthermore, another trader and analyst Moustache highlighted in a recent post that “we are entering the largest altcoin season in at least four years”, drawing parallels from historical data.

On April 24, he noted that the total market cap of altcoins, represented by TOTAL2, had completed the ABC-correction phases of the Wyckoff method and was experiencing a breakout. This has stirred anticipation among crypto investors, as altcoins often offer higher risk-to-reward returns.

Despite these optimistic assessments, there’s a contrasting signal from the altcoin season index by Blockchain Center.

According to this index:

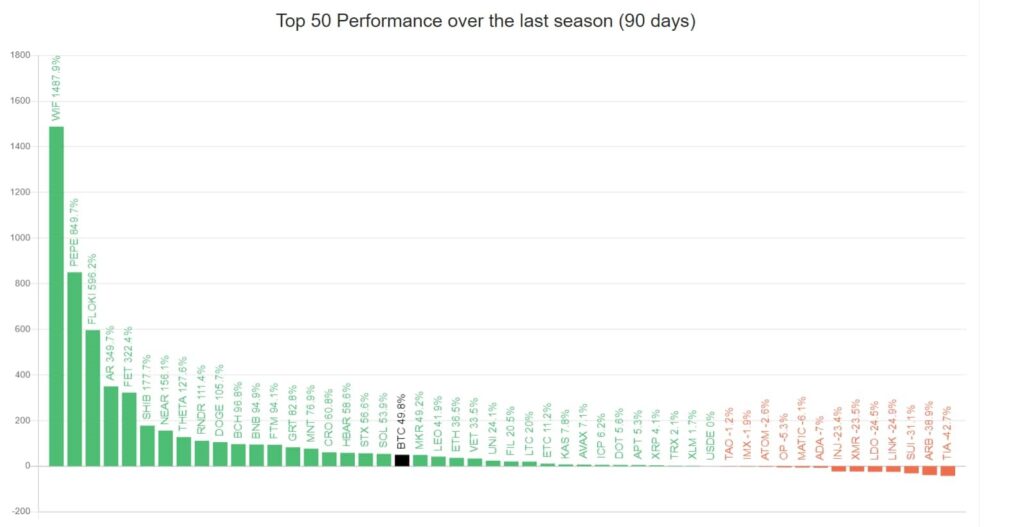

“If 75% of the top 50 coins performed better than Bitcoin over the last season (90 days), it is Altcoin Season.”

The index shows that only 51% of the top 50 altcoins have outperformed Bitcoin over the last 90 days. As the index is below 75, it suggests that it is not yet officially altcoin season, providing a more cautious perspective amid the enthusiastic forecast.

While the enthusiasm around an impending altcoin season is palpable, driven by technological advances and bullish analyst predictions, the more cautious altcoin season index reminds investors of the risks and uncertainties in predicting market movements.

This blend of optimism and caution underscores the complex and dynamic nature of cryptocurrency markets, where opportunities and risks coexist.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.