The Bitcoin (BTC) network activity was in a downtrend, as evidenced by the daily active addresses count dropping since March. However, a recovery in this metric suggests a refreshed interest in using Bitcoin, which could fuel the demand for BTC.

In particular, Ali Martinez, a known on-chain analyst, spotted the daily active addresses downtrend breakout on June 8 on Santiment. Martinez highlighted the 765,480 Bitcoin addresses that turned active in the last 24 hours of posting.

According to the analyst, this is a positive sign that suggests a bull run continuation.

Other Bitcoin network activity metrics

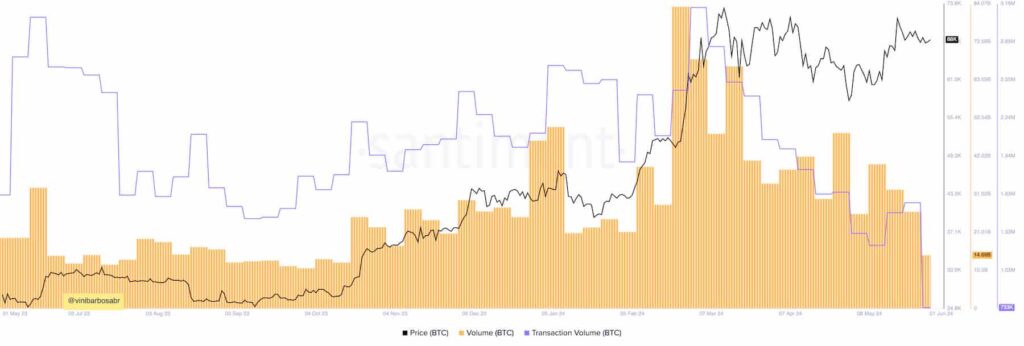

The ongoing drop in Bitcoin network activity also appears in other metrics. For example, Finbold reported an all-time low on-chain transaction volume and yearly low spot trading volume for the leading cryptocurrency.

So far, these metrics have not broken down from the downtrend registered by Santiment‘s data.

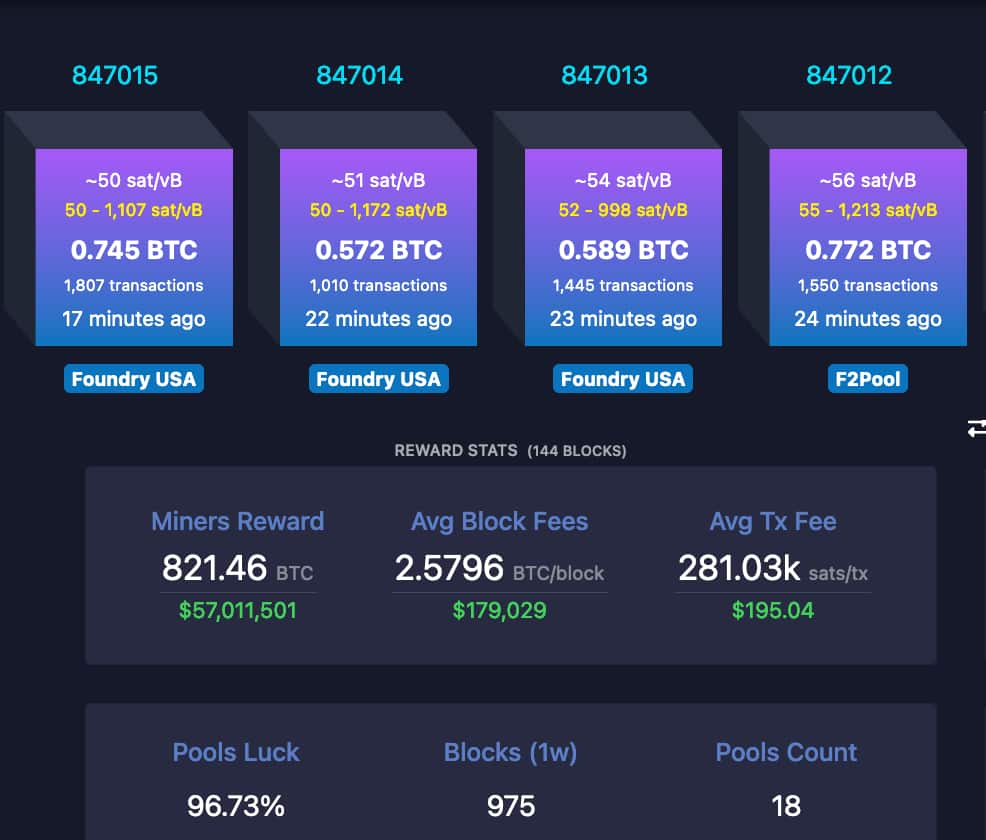

On the other hand, Bitcoin transaction fees reached a new all-time high of $195 on June 8. Notably, the spike happened concomitantly to the network activity increase reported by Martinez.

It is possible that both occurrences are related, as more addresses turning active on the same day increases competition for the limited available block space, causing competition among users that outbid each other to have their transactions confirmed.

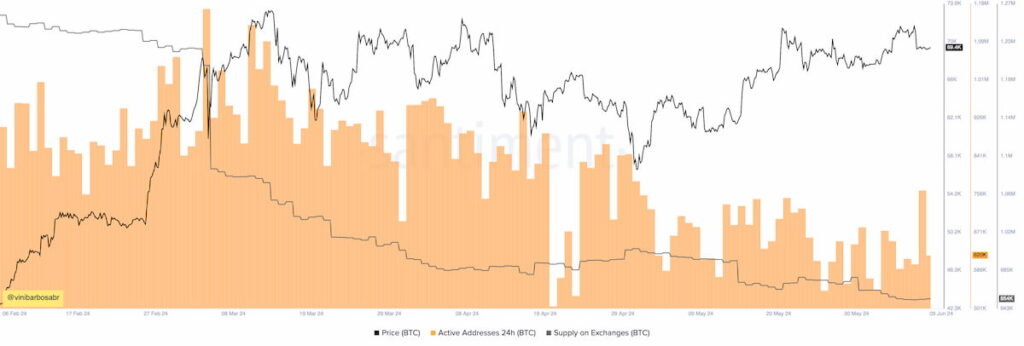

Bullish signal as exchange reserves are in a downtrend

In addition, Finbold looked for complementary data to the increased network activity through the daily active addresses count. Essentially, understanding if these active addresses have sent BTC to exchanges is crucial to establishing a bearish or bullish signal.

On that note, the exchange reserves are currently at their lowest levels, as observed in the following chart. Cryptocurrency exchanges currently hold 954,000 BTC, indicating investors are buying and withdrawing Bitcoin—a bullish signal, as stated by Martinez.

Nevertheless, cryptocurrencies, stocks, and the overall finance market await the FOMC meeting on June 12 to draw further conclusions. Analysts expect a highly volatile week ahead of the interest rate target decision, which can affect Bitcoin.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.