Silver has been on a record-breaking surge since the beginning of 2024 — outpacing even gold in terms of returns. Over the past two years, silver prices have increased by 80% — while gold has risen by 60% in the same period.

At press time, the iShares Silver Trust (NYSE: SLV) is up 38.23% year-to-date (YTD).

The precious metal’s status as a hedge against inflation, its outsized returns, and rising industrial demand have made it quite the attractive investment — but a recent X post from Ronald Stöferle, managing partner and fund manager at Liechtenstein-based Incrementum AG reveals that we’re quite a ways away from silver’s all-time high.

Silver’s all-time high price when inflation is factored in

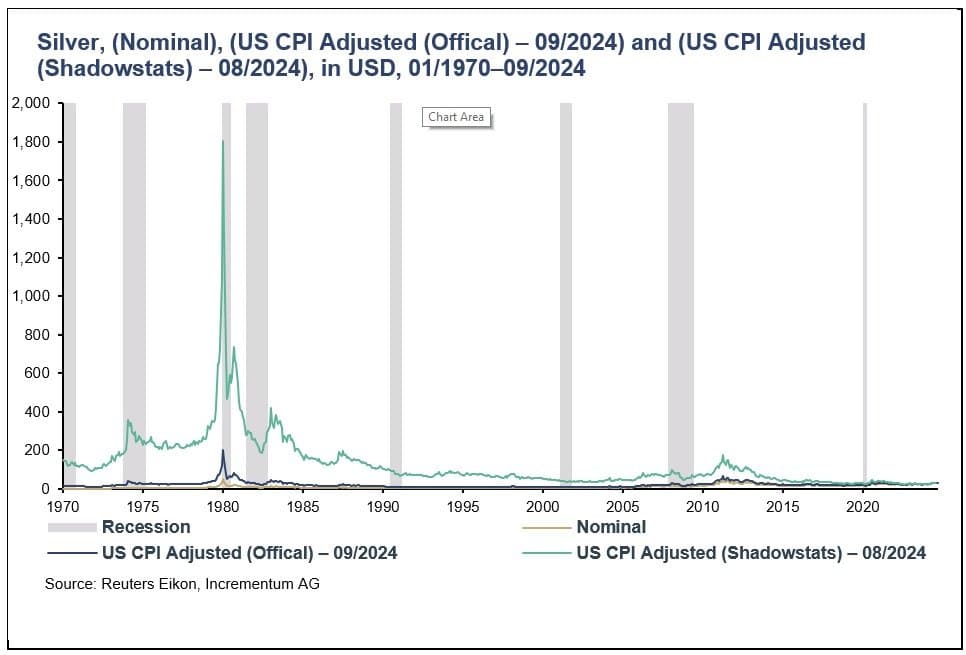

Stöferle’s chart is based on data provided by Shadowstats — a website popular with skeptics that recalculates official economic data based on the methodology previously used by government agencies — arguing that methodological changes are regularly put in place to overstate growth and understate inflation.

The chart shows silver’s historical price in nominal terms, adjusted for official CPI, and adjusted using Shadowstats’ revised data.

Even a cursory look at the data shows that, even accounting for silver’s recent performance, we’re still quite far even from inflation-adjusted highs. The same holds true when the price is adjusted for CPI based on Shadowstats’ revision.

Whichever of the two figures you go with, they’re a sobering reminder of how inflation’s effects, while keenly felt in the short term, are no less destructive over longer periods.

So, since there’s a significant distance from the all-time high either way, is this a bullish sign?

No — the 1980s spike in silver prices was not ‘organic’ — rather, it was the result of one of the biggest instances of market manipulation in history, in which the Hunt brothers used futures to accumulate one-third of the privately-held silver in the world. After government intervention, a short squeeze occurred, and prices dropped from $50 to $11 on March 27, 1980 — a day known as Silver Thursday.

While interesting, the chart, which does provide some cause for optimism, does not present a credible signal. However, that’s not to say that another rally will not occur — the precious metal is at a 12-year high, U.S. politicians have recently invested in silver mining companies, and some analysts estimate that it could even reach prices as high as $50.