Blockchain technology is rapidly transforming industries far beyond cryptocurrencies, offering unparalleled transparency, security, and efficiency. This innovation has made blockchain stocks—shares in companies that develop or integrate blockchain technology—highly attractive to savvy investors.

Numerous companies leverage blockchain to enhance their operations, deliver cutting-edge services, or spearhead advancements in the cryptocurrency sector. While some companies are dedicated entirely to blockchain and cryptocurrency innovation, others integrate blockchain to bolster their existing, successful enterprises.

Recognizing this dynamic potential, Finbold has pinpointed two standout stocks with strong buy ratings, promising to add significant value to any investment portfolio through exposure to distributed ledger technologies

Mastercard Incorporated (NYSE: MA) stock

Mastercard Incorporated’s (NYSE: MA) innovative approach to blockchain has earned it a spot on Forbes’ 2023 Blockchain 50 list, underscoring its aggressive pursuit of distributed ledger technology.

Mastercard has been actively involved in exploring and adopting blockchain technology through several key initiatives. The Mastercard Multi-Token Network (MTN), launched in 2023, is a blockchain-based platform designed to make transactions within digital asset and blockchain ecosystems more secure, scalable, and interoperable.

Additionally, Mastercard is actively involved in trials and discussions regarding Central Bank Digital Currencies (CBDCs), offering expertise and guidance to governments exploring CBDC implementation, as announced by the company.

The company also runs the Start Path Crypto Program,which fosters innovation by supporting startups in the blockchain and digital asset space, helping them scale their businesses while prioritizing solutions that are energy-efficient and promote a positive social impact.

Mastercard boasts a market cap of $406.96 billion and has demonstrated robust financial health, generating $25.7 billion in revenue over the past year and earning $11.85 per share.

The company offers a dividend of $2.64 per share with an impressive growth rate of 15.91% year-over-year, making it attractive for both growth and income-focused investors.

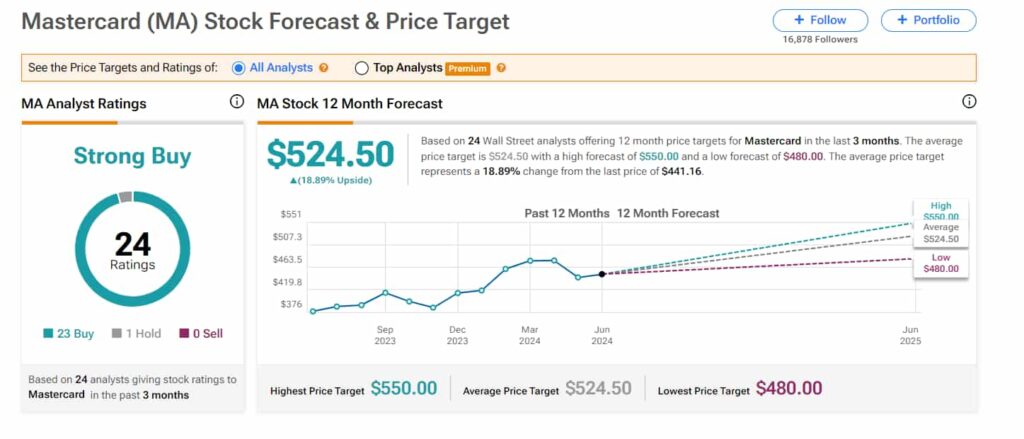

Analyst confidence is high, with a consensus price target of $524.50, representing an 18.89% upside from the current price of $441.16. Mastercard’s strategic acquisitions, strong cash flow, and continuous innovation position it well for sustained growth, making it a compelling buy.

Riot Blockchain, Inc. (NASDAQ: RIOT) stock

Riot Blockchain (NASDAQ: RIOT) is a prominent player in the Bitcoin mining sector, continuously expanding its capabilities to capitalize on blockchain technology’s potential. Riot recently signed a deal to purchase 31,500 next-generation miners from MicroBT, boosting its self-mining hash rate from 12.4 EH/s to 15.1 EH/s by the end of July.

Additionally, Riot’s Corsicana Facility, now the world’s largest Bitcoin mining site with a developed capacity of 1 GW, further enhances its mining capacity as announced by the company.

Financially, Riot has shown strong performance, reporting $79.3 million in revenue, up from $73.2 million last year, and achieving a net income of $211.8 million, or $0.82 per share, driven by a 131% rise in Bitcoin (BTC) prices.

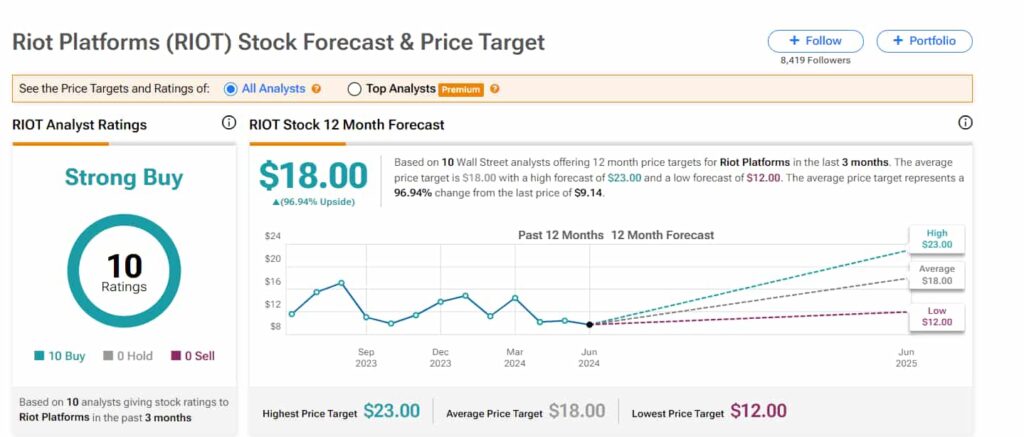

Analysts are highly optimistic about Riot’s future, with an average price target of $18, indicating a substantial 96.94% increase from the current price of $9.14. Riot’s aggressive expansion and investment in advanced technology make it an attractive option for investors looking to capitalize on the growth of blockchain technology.

Mastercard and Riot Blockchain are at the forefront of blockchain innovation in their respective sectors, making them compelling investment opportunities for July 2024. Mastercard’s integration of blockchain into financial services, combined with its strong financial performance and strategic initiatives, positions it as a reliable long-term investment.

Riot Blockchain’s expanding mining operations, strong financial metrics, and significant growth potential underscore its value as a high-growth investment. These stocks are well-positioned to leverage the transformative power of blockchain, providing investors with opportunities for substantial returns.

However, investors should remain cautious and conduct thorough research due to the inherent volatility and risks of stock markets

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.