Growth stocks are companies experiencing rapid growth in their share prices, revenue, profits, or cash flow, outpacing the broader market. Investors target growth stocks for substantial price appreciation rather than dividend income.

As of 2024, the S&P 500 index has gained 16.8%, marking a new all-time high and confirming a bull market. This momentum is bolstered by falling inflation, potential interest rate cuts, and robust corporate earnings.

Given this favorable backdrop, Finbold has analyzed the current market conditions and growth outlooks to identify top growth stocks for July 2024.

American Superconductor Corporation (NASDAQ: AMSC) stock

American Superconductor Corporation (NASDAQ: AMSC), currently trading at $27.28, has a market cap of $1.009 billion and operates prominently in the clean energy sector, specifically within wind energy and grid solutions.

In 2024, the company’s share price surged over 132%, reflecting strong market confidence. AMSC’s Windtec Solutions aids manufacturers in launching wind turbines profitably, while Gridtec Solutions offers advanced grid systems enhancing network reliability, efficiency, and performance.

The company’s innovations in superconductor technologies, power electronics, and grid solutions serve various sectors globally, including utilities, renewable energy developers, and industrial customers.

AMSC shares rallied 9.4% on July 9 to $28.06, driven by notable volume with a higher number of shares being traded than in a typical session.

Over the past four weeks, the stock has gained 20.1%, fueled by strong momentum across its Grid business and the solid adoption of its new energy power system.

AMSC’s valuation metrics highlight its investment potential, with a Price-to-Sales (P/S) ratio of 6.93, a Price-to-Book (P/B) ratio of 6.98, and an Enterprise Value (EV) of $998.89 million.

Given the fundamentals, AMSC is considered a reasonable buy given its long-term prospects amid the global shift towards renewable energy.

The average price target from analysts is $54.31, with a high forecast of $63.00, highlighting the stock’s growth potential.

The upcoming quarterly report is expected to show break-even earnings per share, a year-over-year change of +100%, with revenues projected to be $39.55 million, up 30.7% from the same quarter last year according to sources.

These earnings and revenue growth expectations, combined with trends in earnings estimate revisions, suggest strong potential for near-term stock price movements.

Uber Technologies Inc. (NYSE: UBER) stock

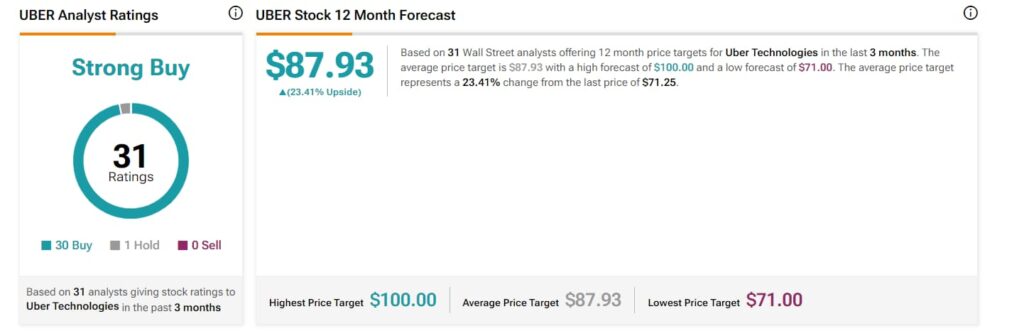

Uber Technologies Inc. (NYSE: UBER) is another strong buy due to its robust financial performance, attractive valuation metrics, and strategic growth initiatives.

In Q1 2024, Uber reported gross bookings of $37.7 billion, a 20% year-over-year increase, and revenue of over $10 billion, up 15%. This growth was driven by a 21% rise in trips, averaging 28 million trips daily.

The company’s adjusted EBITDA soared 82% to $1.4 billion, and its net free cash flow stood at $1.4 billion, showcasing significant operational efficiency and financial health. With $5.8 billion in unrestricted cash and equivalents, Uber is well-positioned to navigate market fluctuations and invest in growth opportunities.

Strategic partnerships with Waymo for autonomous deliveries and collaborations with Tesla and Kia for electric vehicles highlight Uber’s commitment to innovation and sustainability.

Valuation metrics such as a P/E ratio of 13.08, P/S ratio of 1.27, and EV/EBITDA ratio of 16.78 indicate the stock is attractively priced relative to its earnings and revenue.

Analysts’ average 12-month price target of $87.93 suggests a 23.29% potential upside from the current price of $71.32. These factors, combined with Uber’s strong foothold in ride-hailing, food delivery, and freight, position it for sustained growth, making it a compelling investment opportunity.

Both American Superconductor Corporation and Uber Technologies Inc. are strong buys for July 2024, offering significant growth potential and compelling investment opportunities in their respective sectors.

Nevertheless, investors should exercise caution and perform comprehensive research given the inherent volatility and risks associated with the stock market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.