The growth of artificial intelligence (AI) is driving an increasing demand for clean energy to power the sector. This rising demand presents opportunities for investors in nuclear energy-related equities.

With several options in the market, an advanced AI tool has provided insights into which nuclear energy stocks investors can capitalize on to benefit from this emerging trend.

Indeed, this demand is tied to uranium, a critical component in nuclear energy production. In this regard, investment products related to uranium have also witnessed increased investor interest in recent weeks.

Below are the two stocks recommended by OpenAI’s ChatGPT-4o for purchase in the nuclear electricity sector.

Cameco (NYSE: CCJ)

The AI tool pointed out that Cameco (NYSE: CCJ) ranks as one of the largest uranium producers globally, which should give investors confidence in its equity.

According to ChatGPT-4o, notable growth drivers for Cameco include recent partnerships with nuclear energy players such as Brookfield Renewable Partners, enhancing its relevance in clean energy.

A section of Wall Street also sees upside potential for CCJ. For instance, in early October, BofA Securities raised its price target for Cameco to $63 from the previous $60 while maintaining a ‘Buy’ rating. Analysts at Goldman Sachs (NYSE: GS) echoed this rating, setting a price target of $55.

Additionally, the upcoming earnings report slated for November 7 could provide more bullish catalysts for the uranium producer. In this case, Cameco is expected to report $0.28 per share, marking year-over-year growth of 16.67%. Revenue is expected to reach $532.06 million, up 24.12% from last year.

Despite this optimistic outlook, investors should consider a few drawbacks. BofA Securities warned that the stock might face challenges due to a projected uranium deficit likely to persist through 2027.

At the latest close of the market session, CCJ was valued at $53.79, with year-to-date gains of about 28%.

NuScale Power (NYSE: SMR)

NuScale Power (NYSE: SMR) was the second pick from the AI tool, highlighting the company’s role at the forefront of small modular reactor (SMR) technology. NuScale offers a new approach to nuclear energy with compact, scalable reactor designs.

Beyond benefiting from the ongoing momentum around nuclear energy, the stock’s growth potential can also be attributed to the company’s key partnerships.

Recently, NuScale Power entered an agreement with Fluor (NYSE: FLR) and Transworld Services for the Front-End Engineering and Design (FEED) services related to NuScale’s small modular reactor project in Romania.

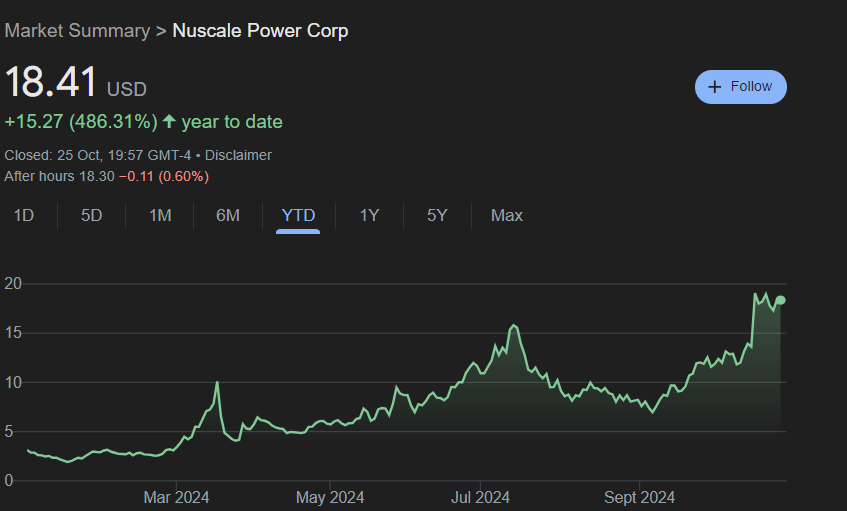

At the same time, the company has recorded strong stock price momentum despite reporting mixed results for Q2 2024. During the quarter, NuScale reported a net loss of $74.4 million but maintained a solid cash position of $136 million.

Analysts also maintain a bullish stance on SMR stock, with Craig-Hallum and TD Cowen issuing ‘Buy’ ratings.

Looking at the stock’s performance, SMR remains one of the best-performing equities of 2024, hitting a record high of nearly $20. At the time of reporting, the stock was valued at $18.41, with year-to-date returns of 86%.

In conclusion, as AI accelerates the demand for clean energy, Cameco and NuScale Power stand out as top picks, each uniquely positioned to leverage this growing trend.