Palantir (NYSE: PLTR) is set to release its Q2 earnings report on August 5, 2024. As a leader in data analytics and artificial intelligence (AI), Palantir has seen substantial growth in 2024, with its stock price hitting a new 52-week high of $29.83 on July 18.

Investors and traders are keenly anticipating the upcoming earnings call, which will provide crucial insights into the company’s performance and future prospects.

In this context, Finbold elected to seek further insights from OpenAI’s flagship AI platform, ChatGPT-4o, to understand the key factors influencing Palantir’s stock price and to provide a prediction for its post-Q2 earnings performance.

Picks for you

Factors affecting Palantir’s stock price

Several factors are influencing Palantir’s stock price ahead of its Q2 earnings report. First, Palantir’s advancements and deployments in artificial intelligence are significant. The company’s Artificial Intelligence Platform (AIP), launched in early 2023, continues to gain traction.

At the AIPCon4 event in June 2024, over 70 customers showcased their AI use cases developed through Palantir’s bootcamps, highlighting the platform’s growing adoption. The company has completed over 1,300 AIP bootcamps since 2023, with nearly 500 occurring since March 2024.

This momentum underscores Palantir’s pivotal role in the AI revolution, positioning it for long-term growth.

Second, Palantir’s government contracts remain a strong revenue driver. The U.S. Army extended Palantir’s Maven Smart System (MSS) contract for five years, valued at approximately $90 million annually.

Additionally, the Department of Defense Chief Digital and Artificial Intelligence Office (CDAO) awarded Palantir a contract potentially worth $480 million over five years.

Recent contract wins, such as the $178 million U.S. Army project TITAN, further solidify Palantir’s standing as a key player in defense and intelligence sectors, leveraging AI to enhance military operations.

Third, market performance and valuation play a crucial role. Palantir’s stock has advanced 66% in 2024, reflecting robust investor confidence.

However, the stock fell after Q1 earnings report due to concerns over international market performance and commercial growth in the U.S.

Despite these challenges, Palantir’s strong government contracts and AI advancements have helped maintain its stock price. Investors are keen to see if Q2 earnings can address these concerns and sustain the upward momentum.

ChatGPT-4o Palantir stock price prediction

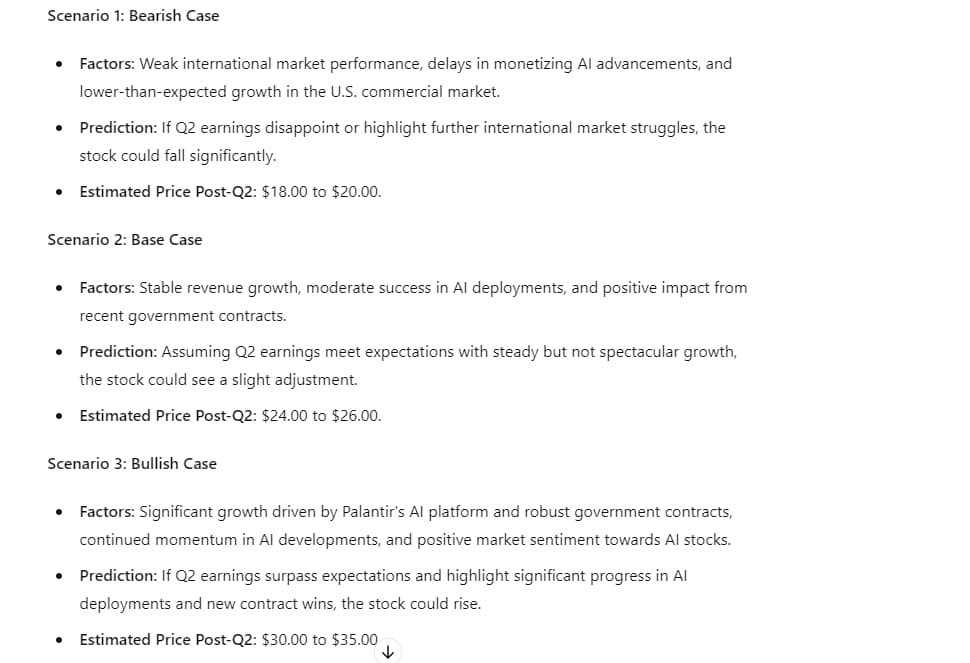

ChatGPT-4 predicts three scenarios for Palantir’s stock price following the release of the Q2 earnings report.

Bearish Case – If Q2 earnings reveal weak international performance, delays in monetizing AI advancements, and lower-than-expected growth in the U.S. commercial market, Palantir’s stock could fall significantly.

This scenario anticipates that Palantir will struggle to meet its growth targets due to challenges in expanding its international footprint and effectively monetizing its AI offerings. The stock could drop to between $18 and $20 if these issues dominate the earnings report.

Base Case – Assuming stable revenue growth and moderate success in AI deployments, Palantir’s stock is expected to stabilize around $24 to $26. This scenario reflects a balanced outlook where Palantir meets market expectations with steady performance.

Positive impacts from recent government contracts, such as the extended Maven Smart System contract and the new DoD CDAO contract, are likely to support this outcome. Investors would view this as a sign of consistent growth and operational stability.

Bullish Case – If Q2 earnings surpass expectations, highlighting significant progress in AI deployments and new contract wins, Palantir’s stock could rise. This scenario is driven by strong government contracts, continued momentum in AI advancements, and a broader tech rally.

If Palantir demonstrates exceptional growth and profitability, leveraging its AI capabilities and securing new contracts, the stock could surge to between $30 and $35.

In conclusion, Palantir’s Q2 earnings report will be critical for investors and traders, offering insights into the company’s performance and future prospects.

With substantial advancements in AI, robust government contracts, and the broader market’s positive sentiment toward AI technologies, Palantir is well-positioned for potential growth.

Investors should closely monitor the Q2 earnings call to gauge the company’s trajectory and make informed decisions based on the outcomes.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.