The first quarter of 2025 is shaping up to be challenging for the stock market, with most equities ending the first three months of the year in the red.

Notably, technology stocks, which led the market rally toward the end of 2024, have since retreated, struggling to find stability and weighing down the S&P 500, which has dropped 5% year-to-date. Meanwhile, experts are projecting more pain ahead.

The broader market has been impacted by growing economic uncertainty, driven partly by the revival of President Donald Trump’s trade policies, including new tariffs that have left investors uneasy.

As a result, investors are likely to opt for investments that can potentially withstand any prolonged downturn in Q2.

In response to these shifting dynamics, Finbold turned to artificial intelligence (AI) tool ChatGPT to set up an “ideal stock portfolio.” The AI model focused on growth and stability.

Exxon Mobil (NYSE: XOM)

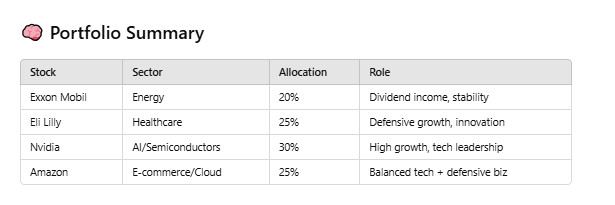

Energy giant Exxon Mobil (NYSE: XOM), receiving a 20% allocation, leads the portfolio. According to ChatGPT, Exxon serves as a defensive anchor thanks to its reliable dividend yield, strong cash flow, and inflation hedge function.

Exxon is also poised for production growth following its acquisition of Pioneer, which expanded its footprint in the Permian Basin. The company aims to increase output from 4.3 million to 5.4 million barrels per day by 2030.

However, investing in XOM carries risks as Exxon is exposed to oil price volatility and geopolitical instability, particularly in oil-producing regions.

At the time of writing, XOM was trading at $117.73, up nearly 10% year-to-date.

Eli Lilly (NYSE: LLY)

The pharmaceutical giant Eli Lilly (NYSE: LLY) is second on ChatGPT’s list, with a 25% weighting. The model cited Eli Lilly’s leadership in obesity and diabetes treatment as key growth drivers.

Notably, its obesity drugs, Mounjaro and Zepbound, generated $16.5 billion in 2024, accounting for 36% of total revenue. The company plans to invest over $50 billion to boost production and expand globally, leaving more room for upside growth.

That said, investors should remain aware of risks, including patent expirations, regulatory delays, and intensifying scrutiny over drug pricing.

At the last market close, LLY traded at $822.51, up 5.7% year-to-date.

Nvidia (NASDAQ: NVDA)

For those seeking high-growth exposure, ChatGPT allocated the largest share, 30%, to semiconductor leader Nvidia (NASDAQ: NVDA). The company continues to dominate AI and data center technologies despite suffering massive price swings in the first three months of the year.

Nvidia’s momentum has been weighed down by cooling AI hype and broader market instability. Despite reporting blockbuster Q4 2024 earnings, the stock has struggled to gain traction above the $120 mark. Looking ahead, revenue growth is expected to be driven by demand for its next-generation Blackwell chips.

ChatGPT also cautioned that Nvidia’s lofty valuation could invite volatility, particularly if earnings disappoint. Nvidia is also exposed to supply chain risks, especially given U.S.-China tensions and reliance on Taiwan’s chip manufacturing.

So far, in 2025, Nvidia’s performance has paled compared to 2024. The stock is down more than 20% year-to-date, closing the last session at $109.67.

Amazon (NASDAQ: AMZN)

Amazon (NASDAQ: AMZN), with a 25% allocation, rounds out the AI-inspired portfolio. The company’s strength lies in its dual engines: a high-margin cloud computing arm (AWS) and a vast, cash-generating e-commerce platform.

AWS continues to deliver solid margins, while retail operations offer scale and liquidity. Overall, Amazon’s diversification positions it well in the face of market uncertainty.

In its Q4 2024 earnings report, Amazon recorded $187.79 billion in revenue, an increase of 10.49% from a year earlier, beating analyst expectations by $563.26 million. EPS came in at $1.86, exceeding estimates by $0.38.

Still, the company faces ongoing antitrust scrutiny in the U.S. and Europe and fierce competition from Microsoft Azure and Google Cloud in the cloud space.

As of the latest trading session, Amazon is down over 12% year-to-date, trading at $192.72.

In addition to the growth and resilience-focused portfolio, ChatGPT also emphasized that investors should consider factors likely to drive market volatility, such as macroeconomic uncertainty, interest rate decisions, persistent inflation, and the potential for a surprise recession.

Featured image via Shutterstock