Tesla (NASDAQ: TSLA) continues to capture the attention of analysts and investors as it navigates a challenging yet promising landscape in the electric vehicle (EV) market.

As the industry faces a broader slowdown, Tesla has retained its position even amid growing competition from rivals like BYD Co., expanding their plug-in hybrid offerings and a shift in focus among European automakers scaling back their EV ambitions.

Heading into 2025, discussions surrounding Tesla’s growth trajectory are more pertinent than ever, with both optimism and caution shaping market sentiment.

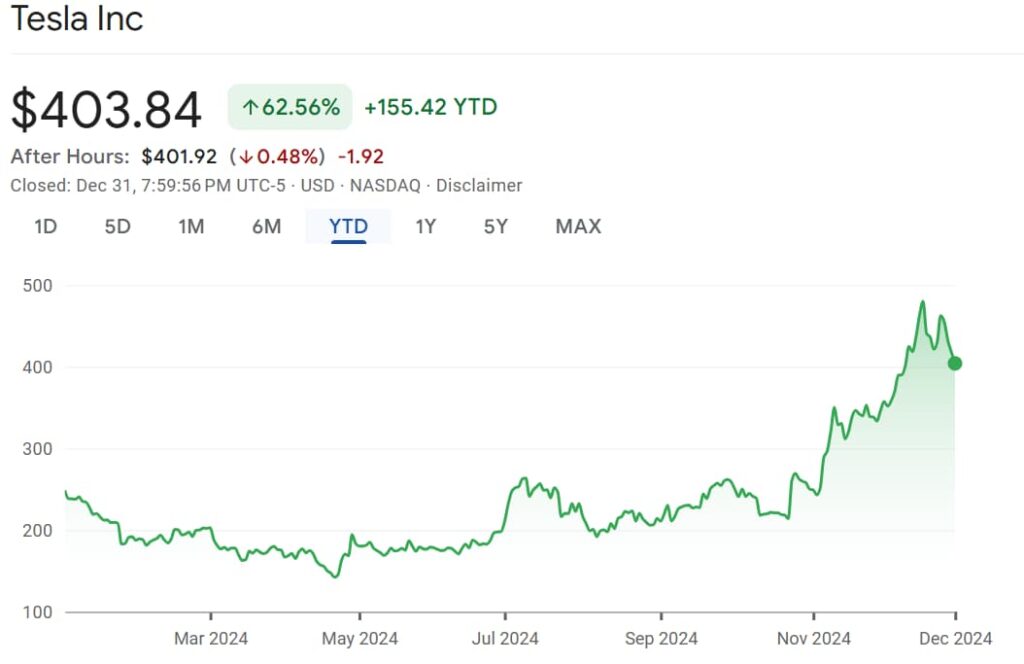

As of December 31, Tesla’s stock closed at $403.84, recording a monthly gain of 13.09% and a 62% year-to-date increase. The company’s market capitalization surged to $1.27 trillion, buoyed by a $733 billion rise since Election Day.

Much of this optimism is tied to expectations of regulatory tailwinds and growth under the Trump administration, which has reinforced investor confidence in Tesla’s ability to expand further.

ChatGPT prediction for Tesla stock price in 2025

To explore Tesla’s outlook for 2025, Finbold consulted ChatGPT-4o, which forecasts that the company’s stock could reach $500 to $550 in a bullish scenario, while a more conservative estimate places it between $440 and $470, reflecting Tesla’s ability to adapt to varying market conditions and navigate upcoming challenges.

According to ChatGPT’s analysis, Tesla is poised for significant growth in 2025, underpinned by political tailwinds and solid business fundamentals.

As noted by AI, Tesla’s performance in 2025 will be heavily influenced by its production and delivery figures, which are scheduled for release on January 2. These results will serve as a barometer of the company’s ability to sustain investor confidence and will be a critical indicator of its trajectory.

From a political perspective, ChatGPT identifies deregulation under the Trump administration as a key advantage. This regulatory shift includes easing legal and compliance burdens, such as the rollback of crash reporting requirements and the potential fast-tracking of autonomous vehicle approvals.

On the business front, ChatGPT predicts that Tesla is well-positioned to capitalize on the ramp-up of its Cybertruck production and the anticipated launch of an affordable EV model.

These initiatives are expected to boost production volumes and expand Tesla’s market share significantly.

Simultaneously, cost reductions in Tesla’s flagship models—including the Model 3, Model X, and Model Y—and increased factory utilization will likely enhance profitability, strengthening the company’s financial foundation.

Furthermore, ChatGPT emphasizes Tesla’s strategic expansion into new markets and the growth of its energy generation and storage division as essential pillars of its long-term success.

In addition, advancements in artificial intelligence, particularly through the development of the Optimus robot, are seen as adding another layer of diversification to Tesla’s income streams, helping to sustain its growth across multiple sectors.

However, challenges persist. ChatGPT points to Tesla’s high valuation as a significant concern, along with sales volatility, potential delays in Full Self-Driving (FSD) approvals, and geopolitical risks that could impact global operations.

While ChatGPT acknowledges that removing U.S. EV tax credits could dampen demand, it also notes that Trump’s policy proposals—such as rolling back electric vehicle subsidies, fuel economy standards, and pollution regulations—might undercut some of Tesla’s revenue streams.

Nevertheless, ChatGPT asserts that Tesla’s strong competitive positioning allows it to absorb these impacts more effectively than its competitors.

Despite these obstacles, ChatGPT sees Tesla’s recent pullback as a temporary dip. Supported by strong technical indicators and solid fundamentals, the current valuation presents what ChatGPT considers a potential buying opportunity for investors.

As the company continues its growth trajectory, Tesla remains poised to navigate the challenges ahead and capitalize on its strategic initiatives in 2025.

Featured image via Shutterstock