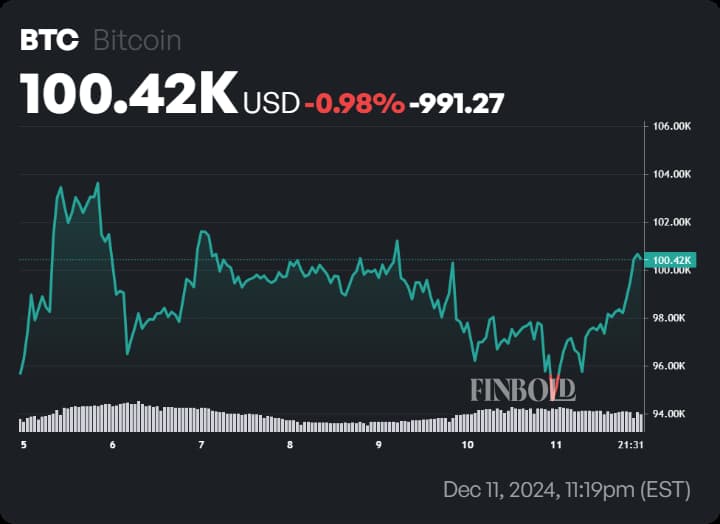

Bitcoin (BTC) has regained ground, trading at $100,582.99 at press time after briefly pulling back to $94,000 earlier this week.

The cryptocurrency market remains in flux, with investor sentiment split between optimism driven by institutional interest and concerns over ongoing economic uncertainties.

Institutional players like MARA Holdings (NASDAQ: MARA) and Riot Platforms have increased their Bitcoin exposure, showing confidence in the asset’s long-term potential.

However, skepticism persists, highlighted by Microsoft’s (NASDAQ: MSFT) shareholders rejecting a proposal to add Bitcoin to the company’s balance sheet, reflecting lingering hesitancy among traditional corporate players.

The mixed signals have sparked speculation across the market, leaving investors questioning where Bitcoin, the world’s leading cryptocurrency, will stand as 2024 draws to a close.

Institutional demand strengthens optimism

One of the week’s most significant developments came from MARA Digital Holdings, which purchased 11,774 BTC for approximately $1.1 billion at an average price of $96,000. This acquisition, completed following a zero-coupon convertible note offering, brings MARA’s total holdings to 40,435 BTC, currently valued at $3.92 billion.

Riot Platforms has similarly expanded its reserves, further signaling institutional confidence in Bitcoin’s long-term potential.

Adding to the positive sentiment, billionaire investor Ray Dalio, founder of Bridgewater Associates, endorsed Bitcoin as a hedge against what he described as a looming “debt money problem.”

Dalio’s backing of hard assets like Bitcoin and gold underscores the growing recognition of Bitcoin’s role in the global financial landscape.

Inflation data shapes market sentiment

The latest US Consumer Price Index (CPI) report revealed that inflation edged up to 2.7% in November from 2.6% in October, meeting market expectations. The Core CPI held steady at 3.3% year-over-year and 0.3% month-over-month, mirroring the prior month.

This data has intensified speculation of a 25-basis-point rate cut at next week’s Federal Reserve meeting, with the CME FedWatch Tool placing the probability at 97%. Historically, lower interest rates provide a favorable environment for risk assets, which could offer a tailwind for Bitcoin’s price in the weeks ahead.

Meanwhile, institutional demand continues to surge, exemplified by BlackRock’s (NYSE: BLK) iShares Bitcoin Trust ETF (IBIT). On Monday, IBIT reported inflows exceeding $394 million, according to data from Farside Investors, showing growing institutional interest in Bitcoin as an investment vehicle.

Historical context: December’s mixed record

December has been a historically unpredictable month for Bitcoin, with an average return of 5%, though six out of the past 11 Decembers have posted negative results.

However, bull markets have delivered standout performances, such as a 46.92% gain in 2020 and a 38.89% rise in 2017. Conversely, the volatility of year-end trading is evident in years like 2013, when Bitcoin dropped 34.81% in December despite a massive 449.35% rally in November, as reported by Finbold.

ChatGPT’s Bitcoin price prediction

Based on historical trends and current market dynamics, ChatGPT envisions two potential scenarios for Bitcoin’s price by December 31, 2024.

In a bullish scenario, AI predicts that Bitcoin could rise to $105,000, fueled by sustained institutional inflows, easing monetary policies, and a stable macroeconomic environment.

Conversely, in a bearish scenario, Bitcoin may consolidate around $94,000, reflecting cautious investor sentiment and potential market headwinds.

That being said, the market is closely monitoring the upcoming US Producer Price Index (PPI) data, which will shed light on inflationary trends and inform the Federal Reserve’s rate-cut trajectory.

Combined with ongoing institutional activity, these factors are poised to shape Bitcoin’s performance in the final weeks of the year.

Featured image via Shutterstock