The finance market’s attention is turning to silver as a promising commodity to invest in 2024. In this context, Claude 3 Opus AI highlights what to expect for silver’s price this year.

Currently, silver is the world’s eighth-most valuable asset with a $1.44 trillion market capitalization, ten times lower than gold. The precious metal has been on Robert Kiyosaki’s radar for a while, now deemed “the best bargain” for investors.

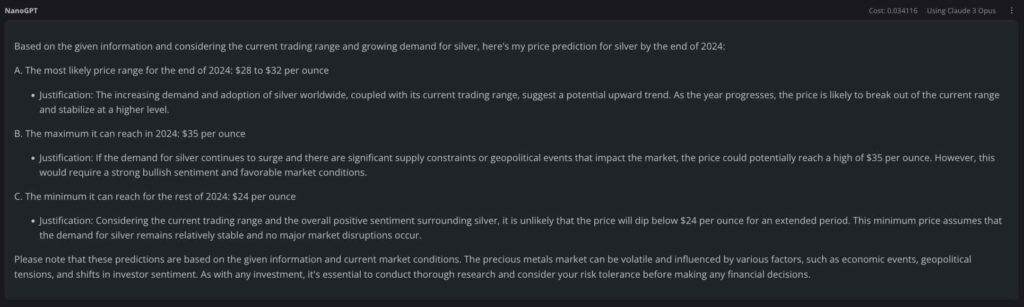

For that reason, Finbold turned to Antrophic’s most advanced artificial intelligence (AI) model, Claude 3 Opus, for a price prediction. According to the AI, silver will likely trade in a range between $28 to $32 at the end of 2024.

Claude AI forecast and analysis for silver’s price this year

Interestingly, Claude Opus sets this price based on an “increasing demand and adoption of silver worldwide.” This is aligned with Kiyosaki’s vision, of silver being both an industrial and a strategic metal.

Notably, Claude AI said it is unlikely that silver’s price will drop below $24 per ounce for an extended period. Therefore, this level is the minimum expected if the market does not face meaningful changes.

Moreover, a $35 per ounce is on sight under the proper conditions, according to Anthropic’s artificial intelligence. On that note, supply constraints or geopolitical events could be the fuel needed for such a bullish rally.

Silver price analysis

Meanwhile, silver was exchanged at $25.81 per ounce by press time, according to the TradingView index. In particular, the commodity has been trading in a range between $22 and $26 since April 2023. This price action has set strong support and resistance levels, respectively.

However, Claude 3 Opus AI seems to think silver will break from this range by the end of 2024. In the meantime, Antrhopic’s model also believes the precious metal will set higher support, strengthening a possible uptrend.

A run to the forecasted targets would mean 8.5% to 24% gains in the most likely scenario, while up to 35% in the most bullish prediction. Yet, investors must understand that the market is uncertain, and different factors could positively or negatively influence silver this year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.