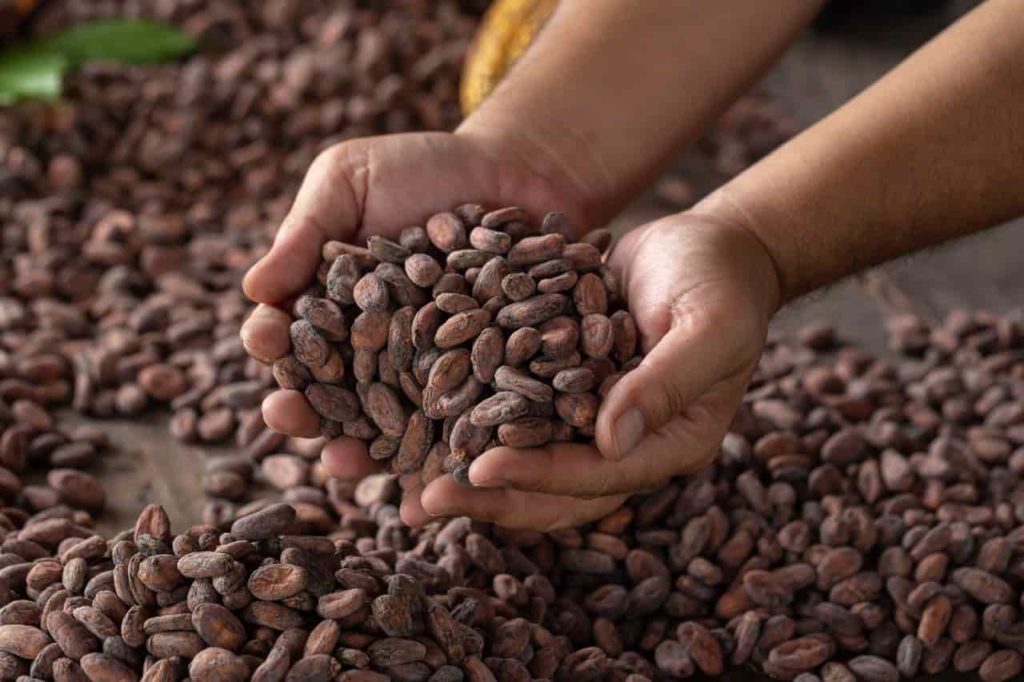

Cocoa prices surged to a 12-year high on August 29, with the Cocoa Sep ’23 (CCU23) futures contract hitting 3,555s, marking a remarkable gain of 113 points (3.28%).

This unprecedented rally comes amid escalating concerns about global cocoa supply disruptions, primarily triggered by adverse weather conditions and diseases plaguing major cocoa-producing regions.

Over the past three months, prices of the commodity have witnessed a relentless upward trend driven by a series of adverse events. The recent heavy rains in West Africa have aggravated the spread of black pod disease, a menace that turns cocoa pods black and causes them to rot. This disease outbreak, catalyzed by the excessively wet weather, jeopardizes the quality and quantity of cocoa crops, raising the specter of a third consecutive year of deficit for the 2023/24 season.

Supply turmoil

Adding to the supply turmoil is the alarming spread of the swollen shoot virus in Ivory Coast, a key cocoa-producing country. This virus, transmitted by mealybugs that feed on cocoa plants, not only diminishes crop yields significantly but ultimately leads to the death of the cocoa plants. Reports suggest that approximately 20% of Ivory Coast’s cocoa crop is now afflicted by this destructive virus.

In Ghana, the world’s second-largest cocoa producer, a combination of factors has hampered cocoa output. The cocoa regulator’s announcement that its cocoa farmers are unlikely to meet contracts for a second season, postponing 44,000 MT of cocoa shipments due to supply shortages, has further tightened the supply outlook. Ghana’s cocoa yield for the 2022/23 season is anticipated to hit a 13-year low of around 650,000 MT, marking a steep 24% decline from initial estimates of 850,000 MT.

Bolstering these supply-side concerns are projections from industry experts, including Marex Financial, indicating a deficit of -279,000 MT in the global cocoa market for the 2023/24 season. The stock-to-consumption ratio is expected to plummet to 30%, the lowest level seen since 1985.

Amid these challenges, robust demand for cocoa remains a supporting factor for prices. Gepex, a leading exporter group, reported a 3% year-on-year increase in Q2 cocoa processing, indicating strong consumption trends. Furthermore, the looming threat of an El Niño weather event, which historically has disrupted cocoa production, has sparked further supply worries.

10% increase in dollar sales of chocolate in the past year

As the global economy reopens post-pandemic, chocolate consumption has surged, driving up cocoa demand. Nielsen data reveals a 10% increase in dollar sales of chocolate in the past year, while research firm Euromonitor forecasts a 5.8% growth in global chocolate confectionery sales, reaching nearly $26 billion in 2023.

In light of these converging factors, cocoa prices have reached multi-year highs, highlighting the intricate interplay between supply disruptions and demand dynamics in shaping commodity markets. As the industry grapples with these challenges, market participants are bracing for a period of heightened volatility and strategic decision-making.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.