Coinbase’s (NASDAQ: COIN) Layer-2 (L2) network Base is one of the most popular second-layers built on top of Ethereum (ETH). On September 21, Base experienced an outage, going through 20 minutes without producing any blocks, similar to Solana’s outages.

The event went unnoticed in the cryptocurrency market, with a discreet communication labeling it “degraded performance ” – after it was resolved. However, the problem was bigger than a simple “degraded performance,” as Base had its block production stalled, being effectively down.

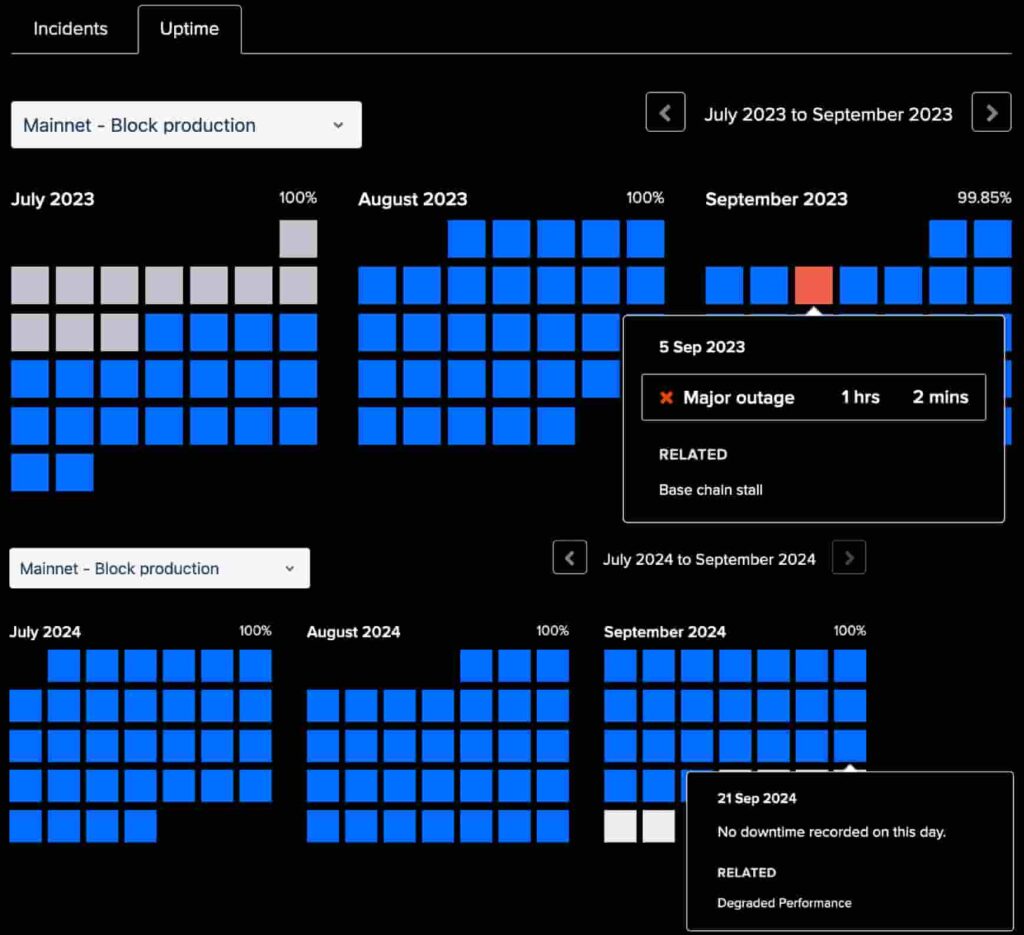

Jesse Pollak, creator of Base and leading developer on Coinbase, explained it was the network’s second outage since its creation. The first was resolved faster, leaving the blockchain 15 minutes without new blocks in early September 2023.

Base’s outage goes unnoticed, raising concerns from Solana fans

Interestingly, this most recent outage took 20 minutes, and it was even worse than the first. What raised some concerns within the crypto community is that the occurrence had a low coverage overall. This was both from Base’s official channels and by the crypto-native media.

According to a commentator on X who goes by Slorg, there were no official announcements on Base’s Discord server.

Moreover, Coinbase’s network uptime chart does not recognize this recent issue as a block stall or network outage. Meanwhile, it listed the first outage Pollak mentioned, although considering a one-hour downtime.

Slorg also traced a parallel to Solana network outages, which usually receive large coverage.

“In contrast, Solana outages are picked up by the majority of crypto-adjacent News outlets. From Coindesk to Cointelegraph, Solana is relentlessly pummeled — evident based on the tone of the headlines below.”

– Slorg

The cryptocurrency influencer MartyParty voiced concerns about this recent outage and the way Coinbase dealed with its communication. Meanwhile, Mert Mumtaz, founder of Helius, explained Base had more than 500 blocks with zero transactions, defining an outage.

COIN stock price analysis amid Base’s outage

As of this writing, Coinbase stock is trading at $169.02 on NASDAQ, up 4.53% in the last five days. COIN peaked in this period at $174.97 on September 19, losing 3.4% since this local top.

It is worth noting that Base still accrues a small share of Coinbase’s revenue, diminishing the potential negative impacts of the recent outage.

Nevertheless, related cryptocurrencies may suffer from that, while the network does not have a native token to take the hit. Base is one of the most popular Ethereum L2s, accruing for the majority of fee revenue in the ecosystem despite its centralized nature around Coinbase.

Therefore, suffering from an outage can raise uncertainties about the system’s reliability and damage Ethereum decentralized applications. Conversely, the team was praised for its fast response and technical skills in fixing the issue quickly.