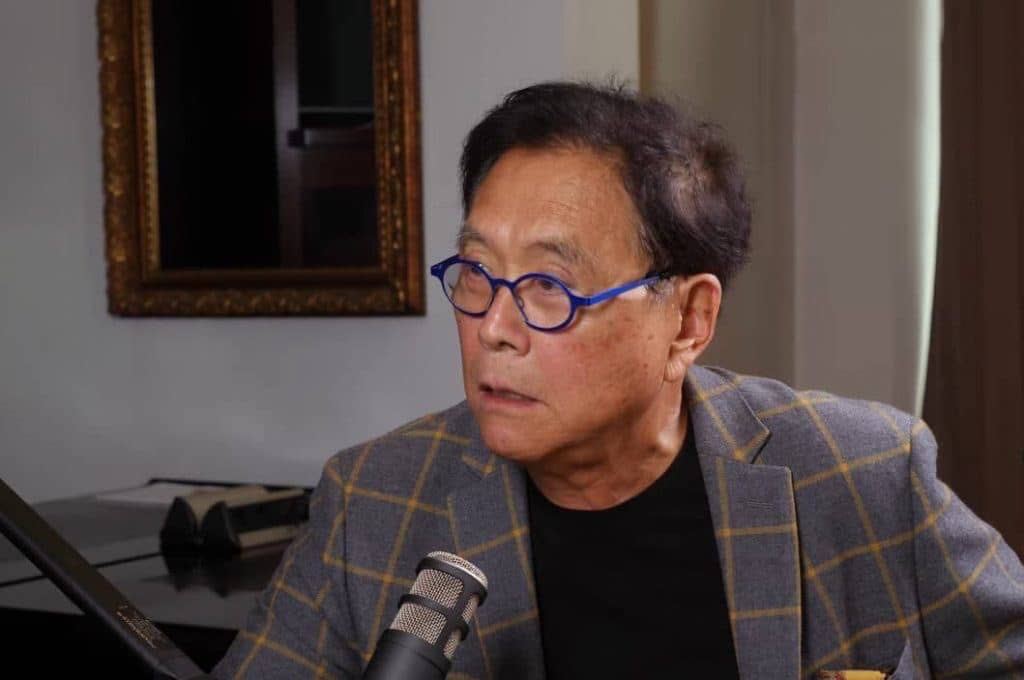

Although his dark predictions of a large-scale financial crash are yet to come true, the renowned investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad’ Robert Kiyosaki has had a good hunch regarding several specific commodities in 2023.

Specifically, it is no secret that Kiyosaki is a staunch supporter of Bitcoin (BTC), gold, and silver, having them labeled as the three “hottest subjects on earth” due to the deteriorating value of the United States dollar (USD), and his views were pretty much on point this year.

#1 Bitcoin

In fact, back in February, he revealed that he had “backed up the truck” and purchased some of the flagship decentralized finance (DeFi) asset for himself as its price reached $6,000 after he had watched it climb to $20,000 and then drop to practically nothing.

More recently, he urged his followers to “buy Bitcoin today, not tomorrow,” when the price of the maiden cryptocurrency stood at the relatively low $27,000, reiterating his warning to do so “before it’s too late” in November when it moved to $37,000. Not long after his second call, Bitcoin began its rally toward the current $44,000.

#2 Gold

At the same time, Kiyosaki has long touted his other favorite commodity, gold, as having more value than cash, arguing that gold, besides silver and Bitcoin, was “the real money” for him, stating back in April that he would buy more of it even if it dropped to $1,000 per ounce.

With this statement, the finance educator was implying his steadfast belief that the precious metal would recover from any price depreciation – and it did, its spot price recently reaching its all-time high (ATH), surpassing $2,100 for the first time in history on December 3 (but not before dropping to $1,830 in October).

#3 Silver

Finally, in August, Kiyosaki urged investors to buy another precious metal – silver – before it ran out. Specifically, he drew attention to the fact that silver was becoming scarcer, but its price was still lower than gold, making it a “better bargain as a long-term investment.”

Indeed, the price of silver at that time stood at $22.71 and has since increased to $24.53, which represents an 8% gain over the course of four months. According to InvestingHaven, the price of silver would continue to increase, possibly hitting $48 per troy ounce by either mid-2024 or mid-2025.

Conclusion

All things considered, the ‘Rich Dad Poor Dad’ author is a seasoned investor who understands the markets well, basing his expectations on his knowledge and experience. That said, it does not mean that anyone should blindly follow his advice without doing their own research and understanding the risks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.