Gold is defying odds, such as the rising dollar, to hit new highs amid underlying concerns about continuing this momentum after the November 5 United States presidential elections.

Besides gold, general uncertainty exists regarding how the markets and various investment products will react if Donald Trump or Vice President Kamala Harris wins.

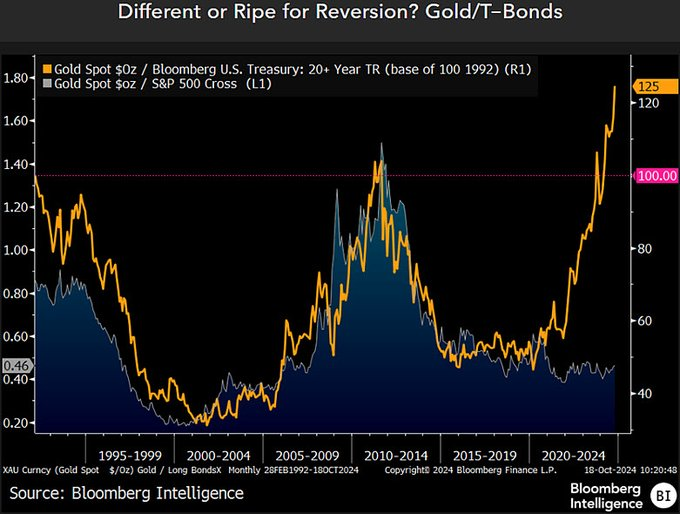

To this end, analysis indicates that the precious metal’s surge relative to U.S. Treasury bonds is looking increasingly unsustainable, particularly if Harris wins, according to Bloomberg Intelligence Senior Commodity Strategist Mike McGlone in an X post on October 22.

The expert’s data highlighted how the yellow metal outpaced the performance of 20+ year Treasury bonds. This divergence, marked by gold’s parabolic rise, mirrors conditions historically followed by sharp corrections.

According to McGlone, this setup might be especially vulnerable if Harris wins. Notably, gold’s recent rise above $2,700 mirrors past bull cycles during economic uncertainty, but parabolic rallies often correct after overperformance.

“Is Gold Getting Too Hot vs. T-Bonds? Gold’s parabolic run vs. US Treasury-bond prices appears unsustainable, especially if Harris wins the presidency,” McGlone noted.

Harris’ impact on gold demand

A potential Harris presidency could increase gold demand amid economic concerns. However, the strategist alluded that if Harris implements policies that stabilize bonds, gold’s appeal as a hedge may fade, leading to a price reversion.

Additionally, her proposed corporate tax hike could trigger a stock market crash, further impacting gold’s outlook.

Although various factors influence the price of gold, the political aspect introduces a new twist. In this case, several analysts have also considered what to expect for the precious metal if VP Harris wins the White House.

For instance, Matthew Jones, a precious metals analyst at Solomon Global, believes investors should expect some uncertainty regardless of who clinches the presidency.

With Harris backing increased government spending, Jones noted that gold might rally, citing that inflation could rise in such an environment.

“Uncertainty often leads to volatility, and both are known to be big price drivers for gold. <…> Such expenditure could lead to higher budget deficits, which might weaken the dollar and increase inflation expectations. <…> A Harris win could lead to a gold price increase, primarily due to anticipated government spending, inflation concerns, market volatility and potential regulatory changes, Jones said.

However, he emphasized that the actual impact will depend on the specific aspects of her policies.

What next for gold price

Gold has surged in 2024, primarily driven by geopolitical tensions in the Middle East, recent recession fears, and high interest rates. Although the Federal Reserve rate cut was implemented, concerns remain regarding the high figures even as the institution seeks to lower inflation below 2%.

Based on recent price movements, some analysts, such as McGlone, project that the metal will reach the $3,000 spot.

Amid these sentiments around gold, concerns about a potential crash persist, with some analysts warning that the trend could signal an upcoming black swan event, such as a stock market crash.

Finally, technical indicators also hint at a cautious future outlook, with the metal being in its most overbought position in five years, as reported by Finbold.