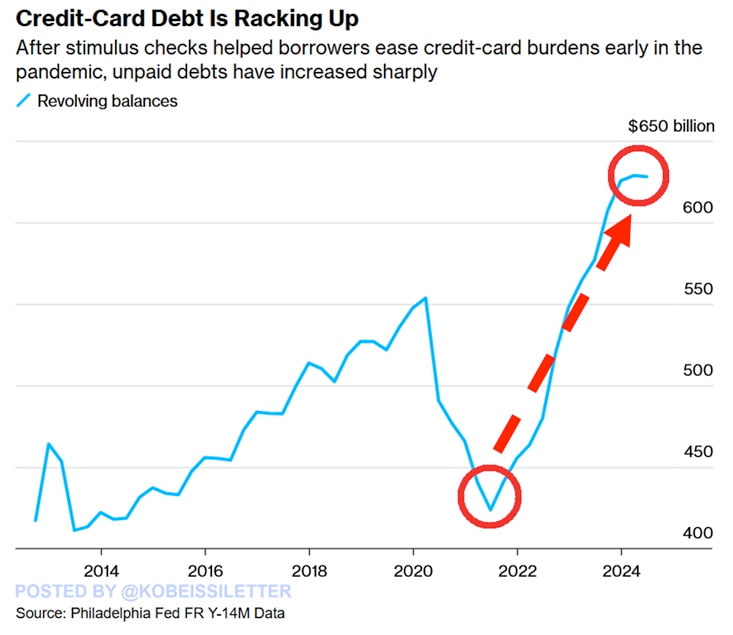

Amid rising living costs and economic uncertainty, American consumers are rolling over a record $628 billion in unpaid credit card debt every month. This unprecedented figure highlights the growing financial strain on households as they contend with soaring prices and depleted savings.

In the meantime, however, the S&P 500 rallied for its best year-over-year performance since 1954. Such remarkable gains in the stock market and other economic indicators have offset a previously growing fear of a recession. Yet, U.S. inflation is leaving its mark in other areas, for example related to the record credit card debt.

As things develop, many Americans look for a change in the political spectrum, which could influence the financial markets. This is demonstrated by the increasing popularity of Donald Trump, with speculated effects in the market.

Inflation and record credit card debt

Over the past three years, revolving credit card balances have surged by $204 billion, marking a 52% increase. At the same time, the average interest rate on credit card debt has jumped to a record 25%, up from 15%.

Consequently, consumers are paying more in interest while struggling to pay down their balances, as highlighted by The Kobeissi Letter.

Moreover, prices in the US have increased by approximately 20% on average. This inflation has pushed more Americans to rely on credit cards for everyday expenses. With $2.3 trillion in excess savings now depleted, many have little choice but to turn to debt.

“US consumers are “fighting” record prices with debt.”

– The Kobeissi Letter

While some struggle with accumulated debts and compounding interest diminishing their purchasing power, innovation stands out in the decentralized finance (DeFi) landscape, with crypto investors farming yield in favorable compounding platforms.

Concerns over debt repayment

On the other hand, concerns about the ability to repay this mounting debt are intensifying. According to a recent survey by the Federal Reserve Bank of New York, the average perceived probability of missing a minimum debt payment in the next three months rose to 14.2% in September. This is the highest delinquency expectation outside of the pandemic since January 2017.

Ted Rossman, senior industry analyst for Bankrate, told CNN Business, “Inflation is gobbling up a lot of the gains people are making. So, even if you’re working, and even if your wages are up, a lot of people are not feeling good about things.”

Furthermore, the burden of debt is not evenly distributed. For individuals earning under $50,000 a year, the probability of missing a payment increased to 20%. Lower-income households are feeling the squeeze more acutely, reflecting growing income inequality.

What is next for unpaid credit card debt in the US?

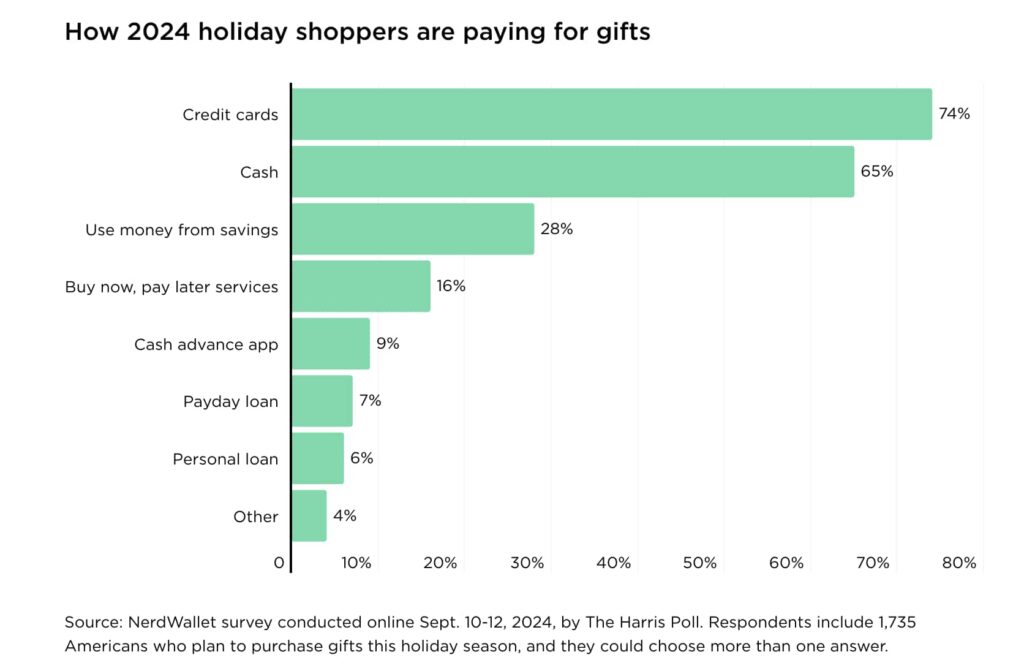

As the holiday season approaches, experts warn that credit card debt could climb even higher. A report by NerdWallet revealed that 28% of shoppers who used credit cards last year haven’t paid off their holiday purchases.

With shoppers expected to spend $1,778 on average this season—a rise of 8% from last year—credit card balances may balloon further.

“Between buying gifts and booking peak-season travel, the holidays are an expensive time of year,” said Sara Rathner, NerdWallet’s credit cards expert, to CBNC. “Not only are consumers at risk of getting into credit card debt, but that debt can stick around long after the decorations come down.”

– Sara Rathner to CNBC

Therefore, financial advisors recommend setting strict budgets and exploring alternatives to traditional gift-giving. Starting holiday shopping early to take advantage of discounts and considering homemade gifts can help keep expenses in check.

In summary, the record-high unpaid credit card debt underscores the financial challenges many Americans face today. With inflation eroding purchasing power and interest rates at peak levels, reliance on credit cards has become a necessity for some.

As Ted Rossman observed, “Inflation is still a big deal; even though it’s come down, I feel that’s still the dominant theme in the economy.”

Consumers are encouraged to carefully assess their financial situations and seek professional advice. By adopting prudent spending habits and exploring debt management options, consumers can navigate these challenging economic times.