Tether USD (USDT), the largest stablecoin by market capitalization, has reached a significant milestone, surpassing the $120 billion mark.

This growth in circulating supply is often viewed as a precursor to a potential bull rally in the cryptocurrency market, sparking speculation that this could signal the next major upward trend for Bitcoin (BTC) and the broader crypto space.

Tether’s market cap surge: A bullish signal?

As of October 20, Tether’s market capitalization reached $120.16 billion, with over 61% of USDT circulating on the Tron (TRX) network and another 45% on Ethereum (ETH). This increase in Tether’s supply comes at a time when the cryptocurrency market is showing early signs of a potential rebound.

“$USDT hitting $120B is a strong sign of how stablecoins are shaping the crypto space. The balance between Tron and Ethereum circulation says a lot about network preferences.” – Earnscape

Historically, a growing stablecoin supply is seen as a sign of increased buying power among investors, with rising stablecoin circulation often indicating that investors are preparing to inject liquidity into the market, fueling demand for volatile assets like Bitcoin (BTC).

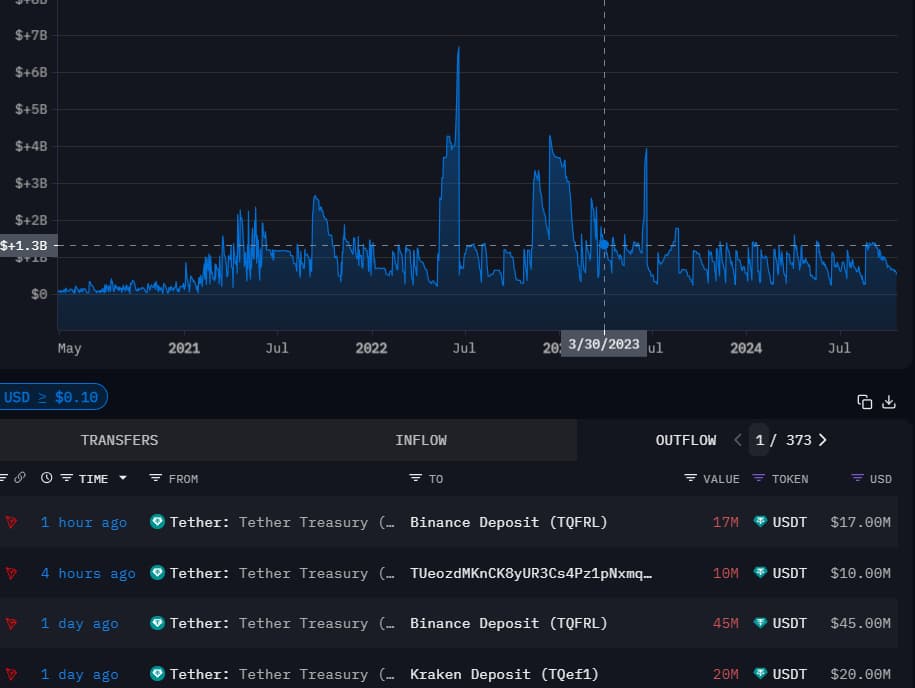

Data from Arkham Intelligence reveals that, in the past 48 hours, Tether’s treasury has sent over $66 million worth of USDT to Binance and another $20 million to Kraken.

These transfers to major centralized exchanges (CEXs) suggest that large-scale investors are gearing up to deploy their stablecoin reserves, potentially pushing the market higher.

This flow of funds into exchanges typically precedes significant buying pressure, creating a favorable environment for a rally.

Is Bitcoin set for a breakout?

The relationship between Tether and Bitcoin is well-documented, with USDT often serving as a liquidity bridge during periods of market turbulence.

Back in August, Tether minted $1.3 billion worth of USDT over five days, coinciding with Bitcoin’s recovery from a five-month low. This liquidity boost helped Bitcoin climb, highlighting the role that Tether’s supply can play in driving market momentum.

As Bitcoin hovers around $68,000, some analysts are optimistic about its next move to $70,000. With $1.67 billion in short positions potentially set for liquidation, experts believe Bitcoin could break through to the $80,000 range.

The increased USDT supply, coupled with recent exchange inflows, adds fuel to this bullish outlook.

Long-term bullish outlook

In the long term, as Bitcoin approaches the key $70,000 resistance level, some crypto analysts are predicting even more explosive growth. Chart patterns suggest that a breakout is imminent, with Bitcoin potentially reaching a peak between $140,000 and $160,000 during this cycle.

Echoing this bullish sentiment, Cryptocon, a well-known market analyst, has identified a potential high of $240,000 based on the Consecutive Candles 9 (CC9) indicator, pointing to a strong long-term outlook for Bitcoin.

A fragile balance: Will Tether drive the next rally?

However, despite the optimistic outlook, concerns about Tether’s dominance remain. The stablecoin now accounts for nearly 69% of the total stablecoin market, and questions about its dollar reserves have lingered for years.

Critics argue that if Tether’s backing is ever proven insufficient, it could lead to a market crash, casting doubt on its role as a reliable liquidity source.

While Tether’s market cap surge has raised hopes for a bull rally, the risks associated with its dominance cannot be ignored.

For now, the influx of USDT into major exchanges, combined with strong buying interest from traders, suggests that a rally rather than a crash is more likely in the near term.

If historical patterns hold true, the influx of USDT could fuel the next leg up for BTC. However, the long-term outlook will depend on both market liquidity and broader confidence in Tether’s financial stability. For now, investors remain cautiously optimistic as the market eyes new heights