Amid significant developments in different markets and across industries, hard assets like gold, silver, and cryptocurrencies seem to be teetering at the edge of a massive bull cycle, at least according to one crypto trading expert, who has referred to them as must-haves in portfolios.

As it happens, renowned crypto analyst Michaël van de Poppe has observed the “extremely low (…) valuations of Crypto & Gold, Silver compared to the Dollar & Equities,” adding that “we’re on the edge of a big bull cycle in hard assets overall, commodities included,” in his X post on May 22.

In other words, he suggested that investors should accumulate in their portfolios exactly these “hard assets” – crypto, gold, and silver – today, while they are still cheap in comparison to the United States dollar and stocks, as the “big bull cycle” could start at any moment, judging by the chart patterns.

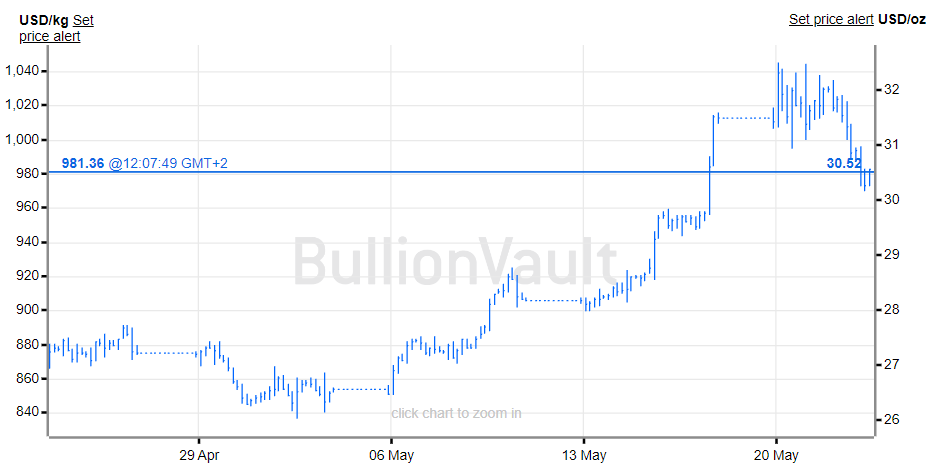

Precious metals price analysis

Indeed, gold is currently trading at the price of $2,364.39 per ounce or $76,016.82 per kilogram, recording a decline of 0.75% on the day, dropping 0.83% across the week but still recording an increase of 2.85% on its monthly chart, according to the latest data retrieved on May 23.

At the same time, the price of silver at press time stood at $30.52 per ounce or $981.36 per kilogram, which suggests a 1.29% drop in the last 24 hours but nonetheless an increase of 4% over the previous seven days and an accumulated advance of 13.72% across the past month.

Cryptocurrencies price analysis

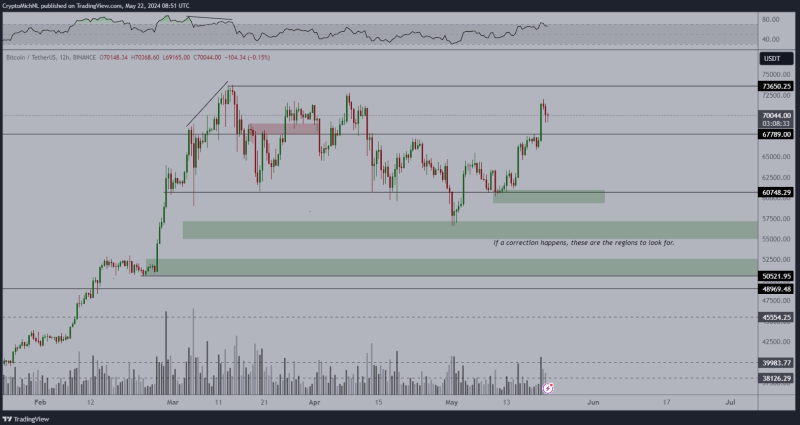

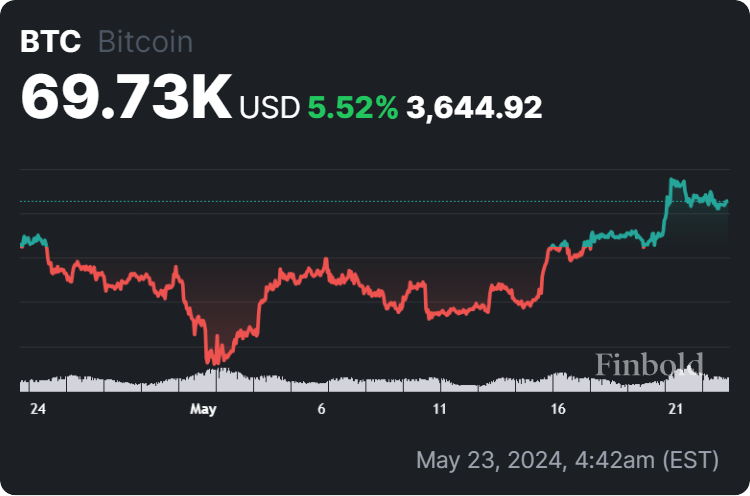

Meanwhile, in terms of digital assets, van de Poppe has earlier observed that the crypto market representative, Bitcoin (BTC), was “slowly consolidating,” adding that he was “expecting a retest at the $68K mark, before a continuation upwards,” and reiterating that the “trend is clearly upwards.”

Specifically, Bitcoin is presently changing hands at the price of $69,730, which represents a modest loss of 0.49% on its daily chart, while the flagship decentralized finance (DeFi) asset clings to the 5.07% gain across the past week and a growth of 5.52% in the last month.

It is also worth noting that van de Poppe has earlier highlighted that altcoins like Ethereum (ETH) were still heavily undervalued, with most of them being “down 70% against Bitcoin,” sharing his expectations that altcoins would “do way better (…) in the coming months,” as per his X post on May 21.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.