Not long after declaring his ‘opportunity cost’ strategy, which involves selling all of his Bitcoin (BTC) possessions, renowned cryptocurrency expert Michaël van de Poppe followed up on his announcement, stating he has, indeed, sold all of his Bitcoin and explaining his reasoning.

As it happens, van de Poppe said his recent actions did not mean he lost his faith in the maiden crypto asset, nor that he expected it to be topped out for this cycle, nor that he had “become a complete believer in Gold,” according to a long X post explanation on May 16.

Ultimate goal: more Bitcoin

Quite the opposite – the professional crypto trader said he did this because he is “aiming to get more Bitcoin back later in the year,” considering “it’s a bull cycle,” and reiterating his earlier doubts regarding the traditional four-year cycle of the flagship decentralized finance (DeFi) asset.

“In the past week, we’ve seen that pension funds, insurance companies, and the biggest hedge funds of the U.S. have been allocating funds towards the Spot Bitcoin ETF. CME Group has announced a futures ETF to be launched, and sooner than later, we’ll be getting option based trading through which Bitcoin becomes a mature asset in the world.”

Therefore, he believes this would gradually reduce the simplicity of the four-year cycle and the impact of the halvings, “as institutions do care more about risk appetite in their portfolio combined with macroeconomic events,” and they will derisk amid liquidity drying up and the dollar strengthening.

Due to these factors, van de Poppe argues “this cycle is, relatively, the final easy cycle to make a lot of money through altcoins” in several ways, but he is choosing the riskiest one – trading “altcoins within the Web 3.0 ecosystem to get more Bitcoin,” where wrong timing could mean losing his BTC.

Why now?

As for his timing, he explained the world is becoming “about getting as much Bitcoin and Gold as you can. Hard assets. Salable assets, because [quantitative easing (QE)] will start sooner than later and inflation is killing your purchasing power, living standard and pleasure in life,” hence “Bitcoin is the outcome.”

Furthermore, “if you’re looking at previous cycles, you would suggest that the rotation from Bitcoin to the altcoins (around the halving) happens prior to the halving. This time it’s entirely different as the markets continued to show strength.”

On top of that, van de Poppe opined that the downward pressure on altcoins has been “unreasonably hard” and that “the upside can’t be denied,” as well as that “DePIN and RWA are going to be massive, more and more traditional companies are transitioning towards the Web 3.0 ecosystem,” which is why:

“It’s time to allocate yourself into this if you want to make a large return.”

Pros and cons

As he pointed out, this strategy could give him a “return of 300-900% in the coming 6-12 months in Bitcoin value,” or even “another 300-600% (…) if Bitcoin stabilizes through that period, (…) through which you could say that 900-4500% is the ballpark of a potential return for the coming 12-24 months in this super cycle.”

On the other hand, van de Poppe stressed that the downside of his bet could be “relatively huge,” as he is currently “down around 20% already in a matter of 1-2 weeks on the overall investment,” and that he could lose 50-80%, but that he was fine with that, “as I’ll find ways of continuing my life to generating income anyway.”

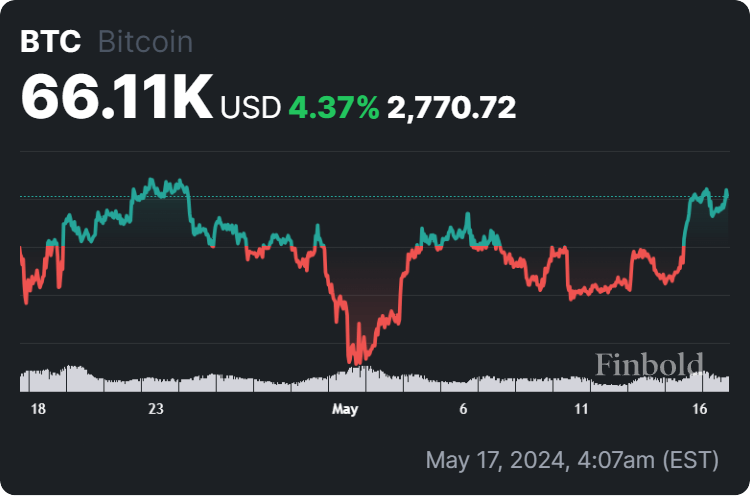

Bitcoin price analysis

Meanwhile, Bitcoin is currently trading at the price of $66,110, which suggests a modest advance of 0.26% in the last 24 hours, a more significant gain of 4.80% across the previous seven days, and an accumulated advance of 4.37% on its monthly chart, as per data on May 17.

All things considered, Michaël van de Poppe’s strategy might make sense, but he is an experienced trader with full awareness of all the risks and downsides, so doing one’s own research is critical before attempting to emulate his practices, particularly as trends in this sector can change suddenly.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.