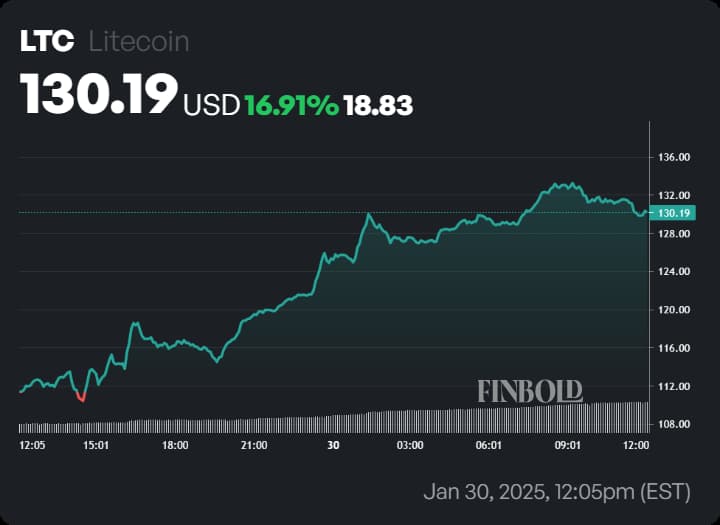

After a sharp downturn earlier in the week, triggered by the emergence of China’s artificial intelligence (AI) model, DeepSeek, Litecoin (LTC) has rebounded strongly, surging nearly 17% in the last few hours to trade at $130 at the press time.

With Bitcoin (BTC) also regaining strength following the Federal Reserve’s decision to hold interest rates steady, market sentiment has turned bullish once again.

Amid this renewed momentum, Finbold turned to DeepSeek AI, one of the primary factors behind the recent market downturn, to analyze Litecoin’s long-term trajectory and predict where LTC is likely to stand by the end of 2025.

DeepSeek sets Litecoin price target for year-end

By providing further context along with search functionality and DeepThink (R1) enabled, DeepSeek quickly identified the key factors driving Litecoin’s performance.

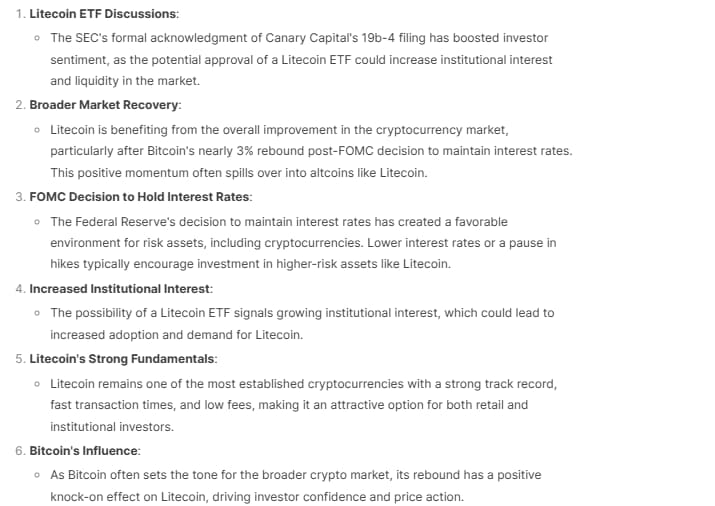

The ongoing Litecoin ETF discussions remain a crucial catalyst, as investor sentiment surged following the SEC’s formal acknowledgment of Canary Capital’s 19b-4 filing.

This milestone marks a significant step in the approval process, raising expectations that Litecoin could follow Bitcoin’s path with a spot ETF approval, potentially unlocking greater institutional interest and liquidity.

The AI model also identified that Litecoin has benefited from improving broader market conditions, particularly after Bitcoin rebounded nearly 3% following the Federal Open Market Committee (FOMC) decision to maintain interest rates.

This pause in rate hikes has instilled optimism across both crypto and equity markets, reinforcing bullish sentiment and contributing to Litecoin’s recent price momentum.

When provided with additional derivatives data, the AI model notes that Litecoin’s long-term outlook appears increasingly bullish. The 35.33% rise in open interest to $706.13 million suggests growing capital inflows, while trading volume surging 293.83% to $2.30 billion reflects heightened market activity.

The Binance LTC/USDT top trader long/short ratio at 2.4691 also indicates that traders are heavily favoring long positions.

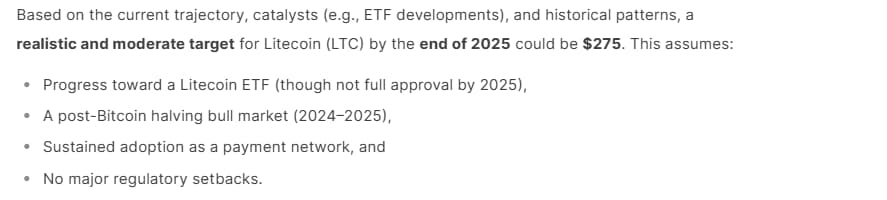

Based on all the above factors, the AI model projects a target of $275 for Litecoin. If open interest continues rising, institutional traders maintain their long bias, and ETF speculation gains further traction, LTC could sustain its bullish momentum into 2025.

This projection aligns closely with technical analysis by TradingShot, which anticipates a breakout to $255 this year, further strengthening the broader bullish outlook for Litecoin.

However, broader market conditions and macroeconomic factors will ultimately determine whether these targets can materialize.

Featured image via Shutterstock