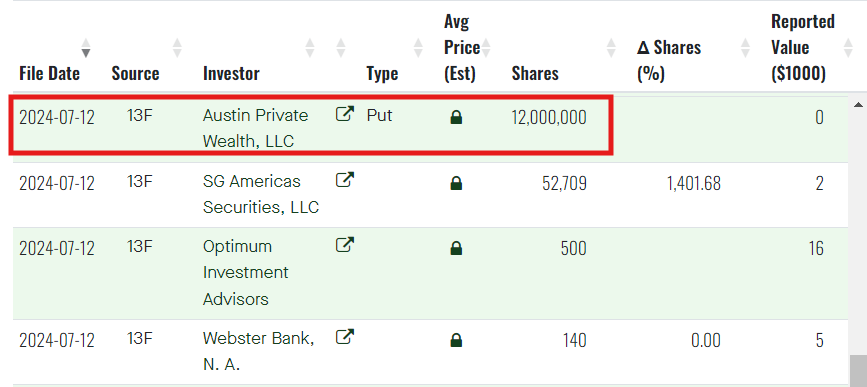

After reports that Austin Private Wealth made a massive put bet on Donald Trump stock one day before the assassination attempt on the former United States President and the financial services company’s clarification that it was all a ‘filing error,’ another update aims to shed more light on the matter.

Indeed, amid conspiracy theories that APW somehow knew about the shooting before it happened, considering the timing of the bet against Trump Media (NASDAQ: DJT), the company made an update on July 22, in which it tried to make things clearer on the incorrect filing and subsequent amendment.

Clerical error?

As a reminder, shortly after the botched assassination attempt, reports came out that the $1 billion Texas asset manager had shorted 12 million DJT shares, but APW apologized and said it had made a clerical error in a statement on July 17, after which it filed an amended 13F form for the quarter ending June 30 no longer showing the position.

According to its original statement, the company said that:

“No client of APW holds, or has ever held, a put on DJT in the quantity initially reported. The correct holding amount was 12 contracts, or 1,200 shares – not 12 million shares, as was filed in error. (…) We deeply regret this error and the concern it has caused, especially at such a fraught moment for our nation.”

Still, some social media users remained unconvinced, so the investment advisory firm addressed the public with another statement, named ‘FAQs about Austin Private Wealth’s 13F EDGAR SEC filing error,’ reiterating that it had never bought 12 million puts on DJT, and explaining that:

“13F filings are self-reported and may contain inaccuracies. These reports do not cause any trades to be placed. Amendments do not mean that a change was made to an actual trade. Amendments are corrections of a filing that was incorrect and did not properly reflect actual positions.”

How did the error happen?

Concerning the sheer size of the filing error, the company suggested that “the processor may have mistyped a number into a spreadsheet formula, erroneously removed a decimal, multiplied by 100 twice, or any number of possibilities,” as “we were not present when this error occurred.”

As for the DJT positions missing from the amended form, while other smaller options positions remained, the company said the “total holdings of the underlying stock and related options were below the de minimis amount (or threshold) for actual reporting” after the correction, arguing that:

“Small option positions that are included in the amended report are included because the underlying stock position was above the de minimis amount, either in dollar value, number of shares, or both. Likewise, a large option position would result in reporting an underlying stock that is below de minimis amounts.”

Elsewhere, DJT, the stock at the center of the controversy was at press time recording the price of $30.58, down 1.53% on the day, declining 13.82% across the week, as well as dropping 22.50% in the past month, albeit gaining 74.36% since the year’s turn, according to the data on July 26.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.