The stock price of Trump Media (NASDAQ: DJT), the social media company owned by former U.S. President Donald Trump, is experiencing short-term positive momentum, which has triggered investors’ interest in how the equity is likely to trade in the future.

Notably, the stock has recorded double-digit gains of 11%, trading at $17 during the last session on September 13. This momentum is welcomed, considering that DJT has seen a notable sell-off in recent weeks, plunging over 23% in the past month.

DJT’s rebound followed the September 10 presidential debate between Trump and Vice President Kamala Harris, after which the stock initially plummeted.

Investor sentiment around the stock turned positive after Trump announced he had no intention of selling his stake in the company. Speculation about a possible sale had emerged because Trump and other executives of Truth Social’s owner, Trump Media & Technology Group, will be free to sell shares in the coming week after the six-month lock-up period expires.

In this case, Trump will be able to sell about 60% of his shares in the company on September 19 if the stock price stays above $12 or on September 25 if it falls below $12 per share.

DJT stock price projection

Looking ahead, Finbold consulted OpenAI’s ChatGPT-4o artificial intelligence (AI) tool for the next DJT stock price projection. According to the AI platform, Trump Media’s stock will likely be influenced by several factors, including news cycles, political developments, and financial performance.

In a bullish scenario, ChatGPT-4o noted that the stock could be positively impacted by favorable news about Trump’s business, strong company performance, a successful campaign, and bullish economic momentum.

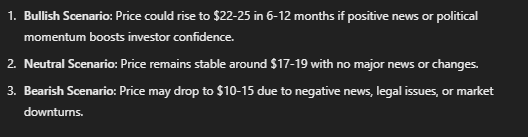

The AI platform projected that DJT could trade between $22 and $25 over the next six to 12 months if it takes a bullish stance.

In a neutral stance, where no significant news is affecting the stock, the AI tool predicts that DJT will likely trade at $17-19 over the same period.

In a bearish environment, the stock could drop to $10-15 in the next six to 12 months. Bearish factors to watch for include Trump’s political controversies, legal challenges, or the underperformance of associated businesses. A downturn in the broader market or profitability challenges could also lead to a sharp decline.

DJT stock fundamentals

It’s worth noting that Trump Media’s stock has been primarily impacted by political developments surrounding the former president. For example, back in July, the stock surged 60% following a failed assassination attempt on Trump, which increased his odds of winning the presidential election.

Notably, DJT tends to soar as the odds of a Trump second term increase. Indeed, after the September presidential debate, prediction markets suggested Trump had regained momentum against VP Harris, which saw DJT rally over 6%.

These fundamentals remain in play as Trump lashed out at Nasdaq in a Truth Social post on September 13 for halting the trading of DJT while threatening to move the stock to the New York Stock Exchange (NYSE).

However, technical indicators currently exhibit bearishness, with sentiment retrieved from TipRanks showing a consensus of “sell,” with a rating of 12. The one-day gauges for technical consensus align with a “sell” at 3, while moving averages indicate a “strong sell” at 9.

In summary, political developments around Trump are the primary driver of DJT’s performance, and the outcome of the November polls will significantly impact the stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.