Not long after the (repeat) Republican presidential hopeful and former United States President Donald Trump officially announced Ohio Senator J.D. Vance as his running mate, the man in question came into the spotlight, including the details surrounding his asset portfolio.

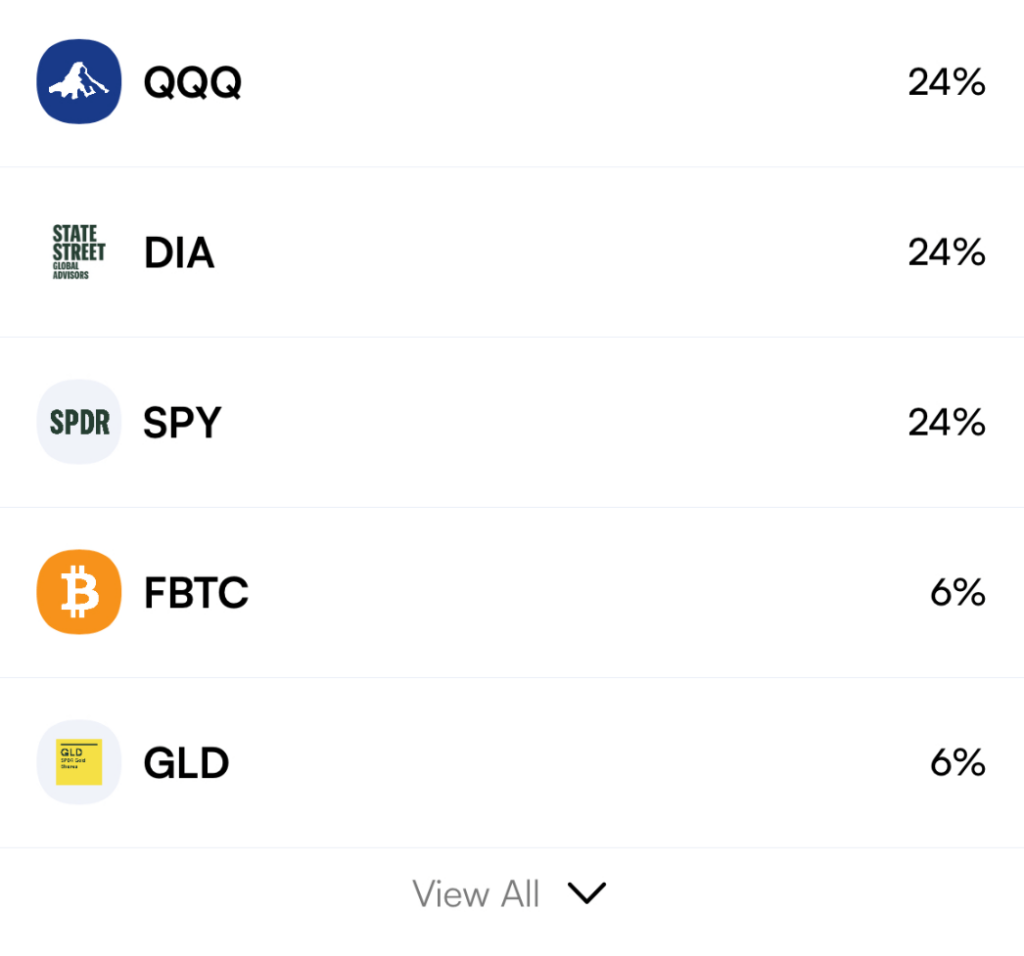

As it happens, the majority of the former venture capitalist’s portfolio consists of Invesco QQQ Trust (NASDAQ: QQQ), SPDR Dow Jones Industrial Average ETF Trust (NYSE: DIA), and SPDR S&P 500 ETF Trust (NYSE: SPY), each contributing to 24%, respectively, per Autopilot stock tracker data on July 16.

According to the platform that also tracks other politicians’ stock trades, including those of Nancy Pelosi, Vance also holds Fidelity Physical Bitcoin ETP (BATS: FBTC) and SPDR Gold Shares (NYSE: GLD), one of the largest gold exchange-traded funds (ETFs) – which make up 6% of his portfolio, each.

Finally, the remainder of his portfolio belongs to other assets, specifically BlackRock’s iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT) with 6%, Rumble (NASDAQ: RUM) with 6%, and ProShares K-1 Free Crude Oil Strategy ETF (CBOE: OILK), which comprises about 2% of Senator J.D. Vance’s portfolio.

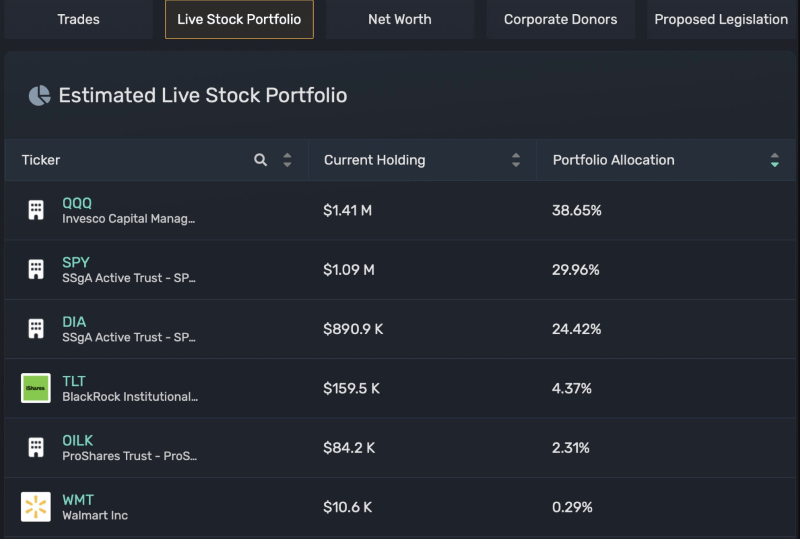

That said, Quiver Quantitative, the trading platform mimicking US politicians’ stock trades, reports that Vance also holds $10,600 in Walmart (NYSE: WMT) shares, which assumes a tiny portion of 0.29% of his publicly traded holdings portfolio, as per the last annual disclosure shared in an X post on July 15.

No trading in office

According to the Quiver Quantitative team, the Ohio Senator accumulated most of his rather large investment portfolio prior to joining Congress, and the platform’s team has observed that he has not purchased any stocks since swearing into office.

It is also important to note that Vance previously worked in venture capital, which the platform pointed out was likely where many of his private holdings, including defense technology Anduril Technologies, gene therapy Kriya Therapies, and in-space transportation company Atmos Nuclear and Space, come from.

Bitcoiner Vice President

Interestingly, the potential US Vice President had also disclosed a purchase of between $100,000 and $250,000 in Bitcoin (BTC), which he purchased through one of the largest crypto exchanges in the world, Coinbase, and reported to the US Senate Financial Disclosures, as Finbold reported earlier.

Taking into account that the price of the flagship decentralized finance (DeFi) asset has risen nearly 290% since Vance’s last annual asset disclosure at the end of 2022, it means that the Senator may own much more than the reported $250,000 in BTC, perhaps even $1 million by now.

To conclude, all these assets add up to J.D. Vance net worth estimated between $3.75 million and $10.495 million, or about $8.7 million, according to Quiver Quantitative, with the addition of his congressional annual salary of $174,000 and the estimated salary of $327,000 from the venture capital firm Narya Capital.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.