Zug, Switzerland, November 19th, 2025, Chainwire

The dYdX Foundation recently hosted its Monthly Analyst Call for November, providing an overview of protocol activity, governance developments, institutional integrations, and ecosystem program performance. The session is part of the Foundation’s ongoing effort to deliver transparent, structured updates to analysts, tokenholders, and ecosystem partners.

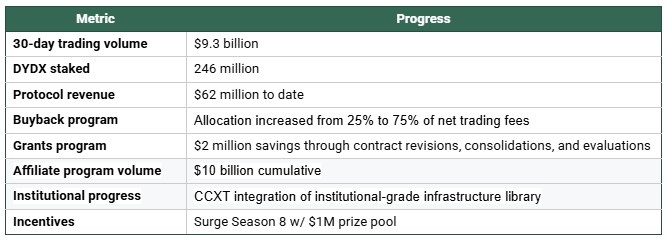

A key development in November was the community’s vote and approval of an increase in the protocol’s buyback allocation from 25% to 75% of net trading fees. This adjustment – proposed and ratified through on-chain governance – directs a greater proportion of fees toward ongoing DYDX buybacks, the change strengthens long-term value alignment between network participants and the protocol.

Over the past 30 days, the protocol facilitated $9.3 billion in trading volume, supported by resilient participation across both discretionary and systematic traders. Network security remained robust, with approximately 246 million DYDX staked – representing ~30% of circulating supply.

Operational efficiency remains a priority for the ecosystem. Since the relaunch of the Grants Program in August, the Foundation has implemented a more rigorous funding framework, resulting in ~$2 million in annualized savings through contract revisions, consolidations, and impact-based evaluations. These efficiencies enable resources to be directed toward areas with the highest strategic importance, including infrastructure, research, and developer tooling.

The Affiliate Program continued to demonstrate durable performance, contributing $10 billion in cumulative referred trading volume. This channel remains a meaningful driver of market participation and global user acquisition.

The ecosystem also benefited from the recent integration with CCXT, a widely used infrastructure library supporting thousands of trading systems, market-making strategies, and automated execution tools. The integration materially expands the accessibility of dYdX markets within institutional and programmatic trading environments, reinforcing dYdX’s positioning in the on-chain derivatives sector.

Charles d’Haussy, CEO of the dYdX Foundation, commented: “dYdX focus remains on transparency, operational efficiency, and ensuring the protocol continues to mature in a sustainable and community-aligned way. The November updates reflect solid network activity and meaningful progress across governance, grants, and institutional integrations.”

About the dYdX Foundation

The dYdX Foundation is an independent not-for-profit organization based in Zug, Switzerland. Its mission is to support the current and future implementations of the dYdX protocol and foster community-driven governance and growth across the ecosystem.

Disclaimer

The content here is for informational and educational purposes only; it should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security. All figures and charts are based on the most accurate data available and may be subject to updates. For more details, please see https://www.dydx.foundation/terms-of-use

Contact

Winfred K. Mandela

dYdX Foundation

[email protected]