The European Central Bank (ECB) posted a new blog on February 22 criticizing Bitcoin (BTC). Notably, the last time it happened, on November 30, Bitcoin was trading at $17,000, three times less than the current $51,500.

In this recent post, the authors compare the Bitcoin ETFs’ approval in the United States to “the naked emperor’s new clothes.” Citing that Bitcoin has failed as a global decentralized digital currency:

“Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.”

– Ulrich Bindseil and Jürgen Schaaf, writing for the ECB

Picks for you

According to the European Central Bank, the fair value for BTC is zero. Thus, in the entity’s words, the described boom-bust cycle will lead to massive collateral damage and redistribution of wealth.

ECB doubles down on its previous critics of Bitcoin

These aspects were previously addressed in ECB’s “Bitcoin’s Last Stand” post on November 30. Now, the European Central Bank argues some of the concerns mentioned then have been recently validated.

First, they reiterate that “Bitcoin transactions are inconvenient, slow, and costly.” As reported by Finbold, a Bitcoin transaction fee reached the average global daily income on December 6.

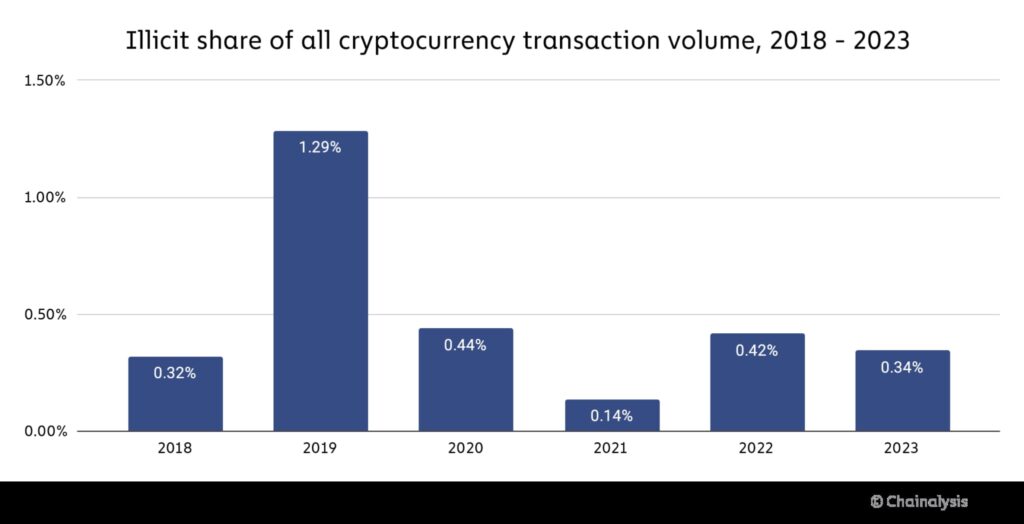

On the other hand, the ECB again mentions how Bitcoin’s use is highly concentrated on criminal activities. However, a Chainalysis report identified that only 0.34% of all cryptocurrencies’ transaction volume from 2018 to 2023 belonged to illicit activities.

Additionally, the central bank slammed Bitcoin as “not suitable as an investment” and warned on the issues related to mining and proof of work.

Manipulation and speculative bubble

Moreover, the European Central Bank raises a serious accusation of historical price manipulation “and other types of frauds.”

The post mentions scams and fraud perpetrated by centralized entities. Also, allegations of fake centralized exchange volume suggest these issues appear when centralized influence over the cryptocurrency market exists.

A report by Forbes previously explained that more than half of Bitcoin trades were fake in 2022.

“More than half of all reported trading volume is likely to be fake or non-economic. Forbes estimates the global daily bitcoin volume for the industry was $128 billion on June 14. That is 51% less than the $262 billion one would get by taking the sum of self-reported volume from multiple sources.”

– Forbes

In conclusion, the ECB warns that “price level is not an indicator of its sustainability,” calling BTC a speculative bubble. The European Central Bank urges Bitcoin investors to be cautious and centralized regulatory interference.

Interestingly, the latter have not prevented criminal activities, fraud, manipulation, or speculative bubbles in other highly regulated financial markets or fiat currencies over the history of humanity. Instead, facilitated them through lobby, cartelization, and the maintenance of monopolies.