An Ethereum (ETH) whale, dormant for eight years, has woken up and started selling over $1.3 billion in profits. The whale has held a $2.4 million initial ETH investment since 2016, accumulating a 558-fold return by November 2024.

As Lookonchain reported, the whale acquired 398,889 ETH for a $6 average cost per token, totaling $2.4 million. As developed, the purchases happened between January 18 and March 20, 2016, distributed among 28 Ethereum addresses.

On November 7, the whale started activating some of its addresses, so far selling 73,356 ETH for $224 million. By posting time, the investor still holds 325,533 ETH, worth $1.09 billion with Ethereum priced at $3,368.

Other Ethereum whales’s activity

As what some analysts are forecasting to be “the biggest crypto bull run ever,” wealthy investors of the second-largest cryptocurrency by market cap are on the move with significant buying and selling activities.

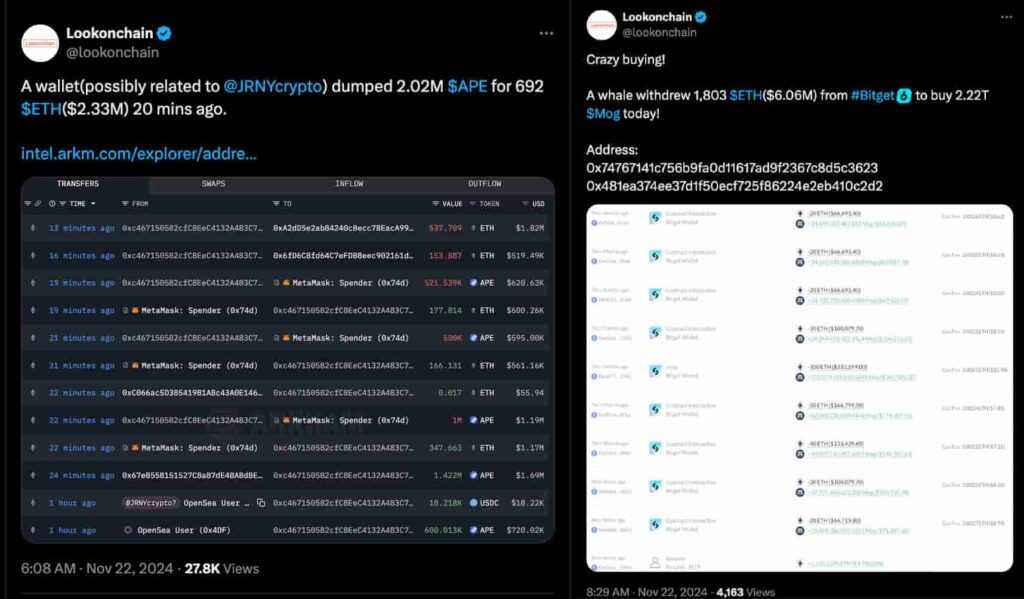

Besides the reported $1 billion-worth eight-year dormant whale, Lookonchain has also spotted two other Ethereum whales making huge waves.

For example, a wallet “possibly related to JRNY Crypto” traded $2.33 million worth of Apecoin (APE) for ETH. The address 0xc467150582cfC8EeC4132A483C76101D3636f598 exchanged 2.02 million APE for 692 ETH, showing pessimism on Apecoin and optimism on Ethereum.

On the other hand, an Ethereum whale withdrew $6.06 million worth of ETH to buy the memecoin $Mog. While bullish on the Ethereum ecosystem, this millionaire investor signals a belief that Mog could outperform ETH short-term.

Ethereum (ETH) price analysis

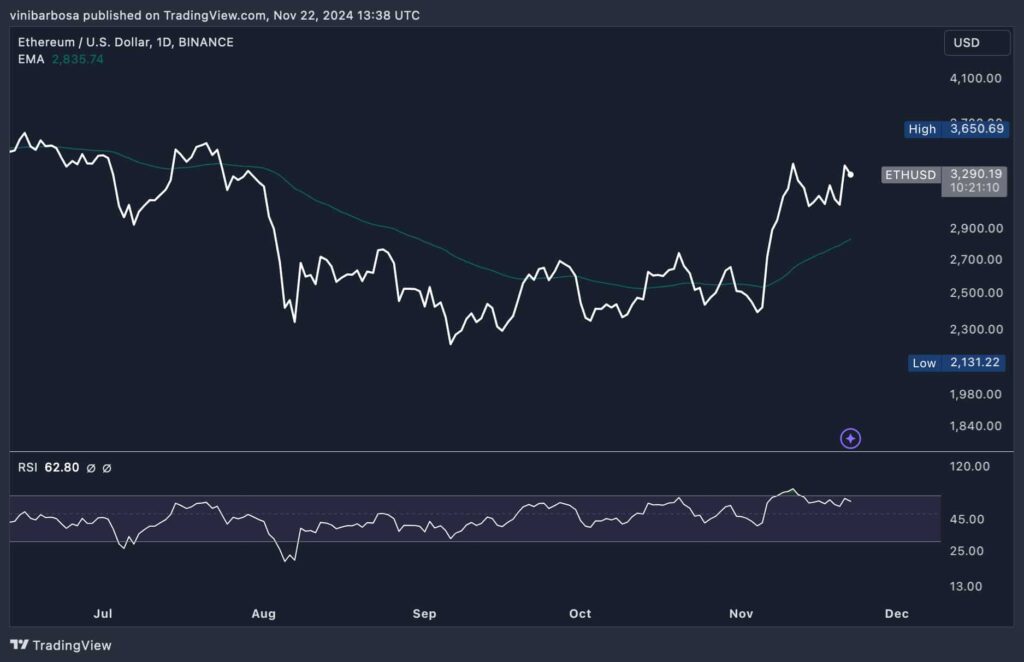

Interestingly, Ethereum’s price has dropped by 2% in the last 24 hours, following Bitcoin’s (BTC) $100,000 psychological resistance rejection. Trading at $3,290 by press time, ETH is still holding strong momentum in the daily chart.

The daily relative strength index (RSI) marks 62.80, while the price holds above the $2,835 50-day exponential moving average.

Ethereum is one of the most popular cryptocurrencies drawing the attention of giant institutional investors like BlackRock (NYSE: BLK). Being the leading “utility altcoin,” ETH enthusiasts await to see what further developments will bring in 2025.

Featured image from Shutterstock.