Euro (EUR) stablecoins are gaining popularity in cryptocurrency exchanges and among crypto traders in Europe and worldwide. This rise could challenge the U.S. dollar (USD) stablecoin dominance in the cryptocurrency market, fueled by the European Union’s tighter regulations.

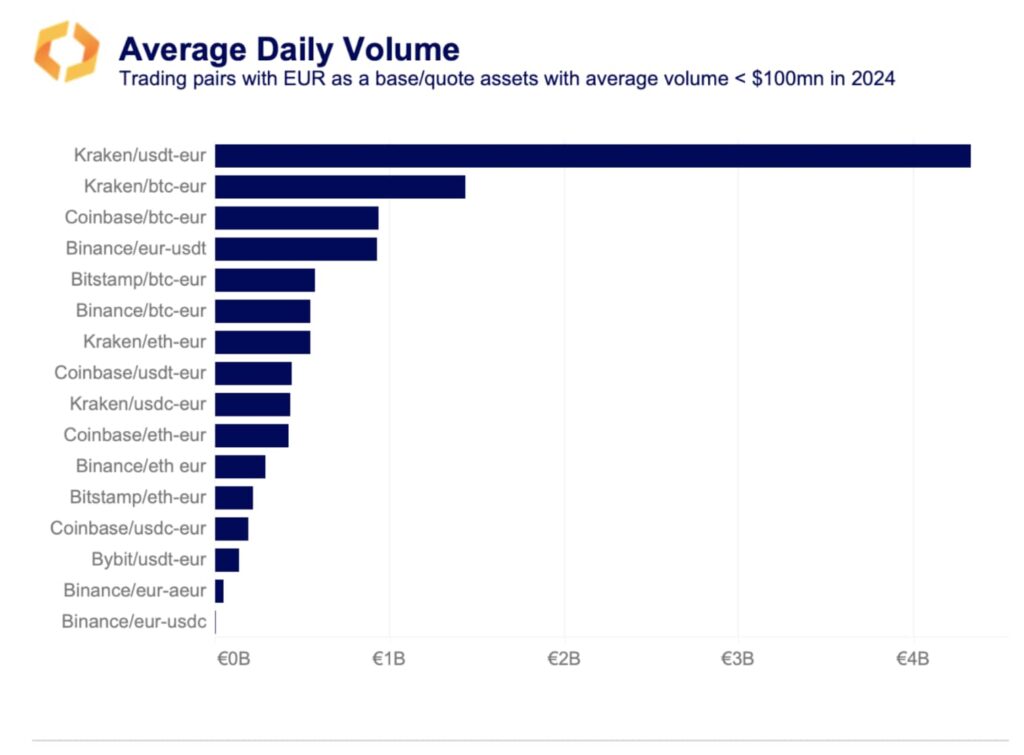

The combined weekly volume of Euro-backed stablecoins has consistently exceeded $40 million since March, marking the longest period on record. Data is from a Kaiko Smart Data Research report published on June 10.

Notably, the report suggests that demand for these stablecoins is finally picking up in European markets, despite Europe traditionally lagging behind the United States. and Asian-Pacific (APAC) in crypto trading.

MiCa and a crypto regulatory tightening in Europe

The impending regulation in Europe, known as the Markets in Crypto Assets (MiCA), is set to shake up the stablecoin market.

Binance recently revealed plans to restrict stablecoins that don’t meet MiCA standards. Meanwhile, Kraken has been actively reviewing which stablecoins comply with the European Union’s standards. Thus, potentially leading to the delisting of non-compliant stablecoins for their E.U. users.

Despite the regulatory challenges, Kraken has no plans to delist Tether’s USD stablecoin (USDT) at this time, as Finbold reported. However, the company will follow all legal requirements, according to Mark Greenberg, Global Head of Kraken’s Asset Growth & Management Business.

EUR-backed stablecoins on the rise, still behind USD’s

Interestingly, Anchored’s AEUR has taken the EUR stablecoin market by storm, commanding more than 50% of the total volume. This EUR-backed stablecoin launched on Binance in December.

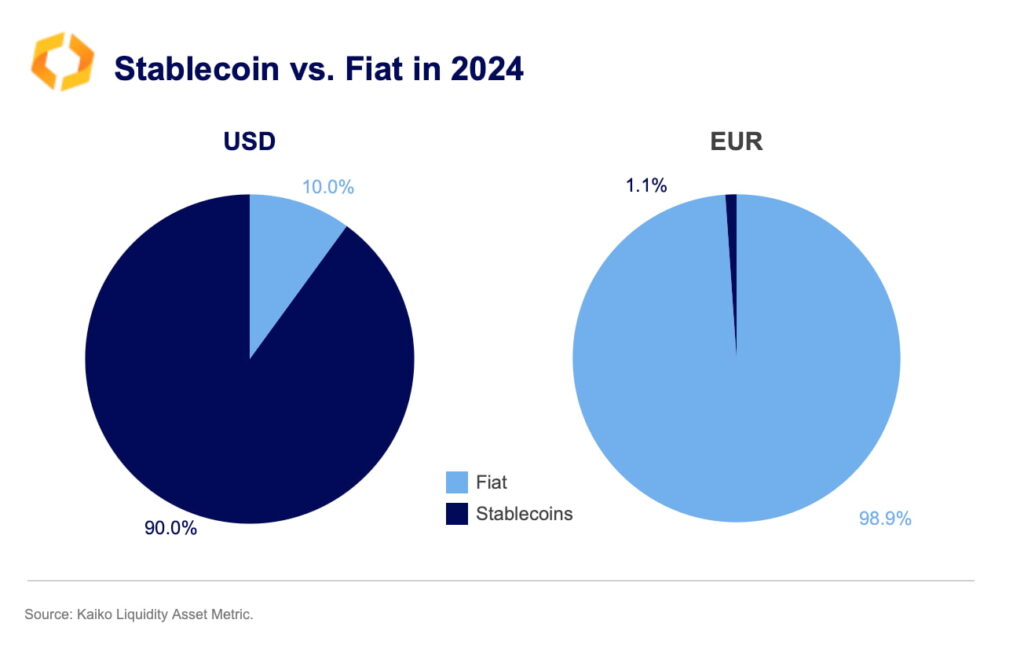

Still, USD-backed stablecoins continue to dominate the crypto market. These dominating cryptocurrencies have nearly 90% of all transactions executed relative to the USD. On the other hand, Euro-backed stablecoins have a 1.1% share against the EUR, as per Kaiko‘s report.

Patrick Hansen, Senior Director of EU Strategy and Policy at Circle (USDC stablecoin issuer), commented on the Kaiko report. Hansen stated that the 1.1% figure for euro-denominated crypto transactions using EUR-stablecoins is an all-time high. In an X post on June 13, Circle’s director also commented on his forecasts for the stablecoins market in Europe.

“It was basically zero a few years ago. If you ask me, it will only continue to grow from here, and MiCA’s entry into application will contribute to creating more attractive EUR-stablecoin liquidity and volumes. Let’s check again in 6-12 months.”

– Patrick Hansen, Circle

MiCa and EUR stablecoins

It is important to note that, contrary to popular belief, MiCA does not introduce entirely new regulations for fiat-backed stablecoins. Instead, it confirms that stablecoin issuers must be regulated as electronic money institutions (EMIs) under the existing electronic money directive (EMD).

On that note, Jón Egilsson explained misunderstandings on MiCa and stablecoins for CoinDesk’s Consensus Magazine on February 6. Egilsson is co-founder and the chairman of Monerium and former chairman of the Icelandic Central Bank’s supervisory board.

“The EU’s comprehensive crypto guidance does not introduce entirely new regulations for fiat-backed stablecoins. Instead, it affirms existing rules that many current issuers are not yet following.”

– Jón Egilsson

Additionally, he warned that the lack of regulatory enforcement in Europe has allowed unregulated fiat stablecoins to be listed on European exchanges, putting compliant European companies at a disadvantage and European consumers at risk. The apparent reward for U.S. issuers employing a “break things first, fix later” approach creates an unfair competition dynamic.

As the European Union prepares to implement MiCA later this year, the EUR stablecoin market is likely to continue growing. Therefore, compliant issuers will potentially gain an advantage over those operating without the necessary e-money licenses, the former central banker concluded.