With less than 10 days left until the next Bitcoin (BTC) halving, during which the reward for mining one block will go down from 6.25 BTC to 3.125 BTC, the event will have major implications for not just the flagship decentralized finance (DeFi) asset but the cryptocurrency market as a whole.

Indeed, with the upcoming BTC halving date narrowed down to April 17, 2024, there are two main things to keep in mind in order to be fully prepared for it, as observed by a team of experts over at the blockchain and crypto analytics platform IntoTheBlock on April 5.

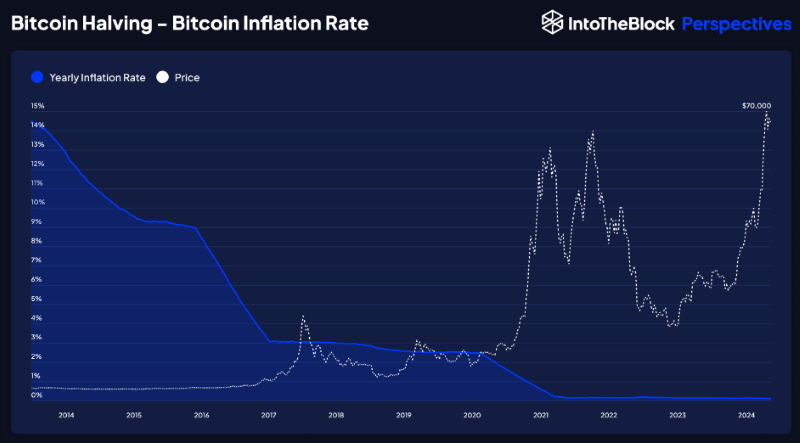

#1 Bitcoin inflation rate

The first is the fact that the block reward dropping from 6.25 BTC to 3.125 BTC will cause the yearly inflation rate to drop to around a mere 0.8%, which means “fewer new Bitcoins entering the market, thus decreasing the potential sell pressure.”

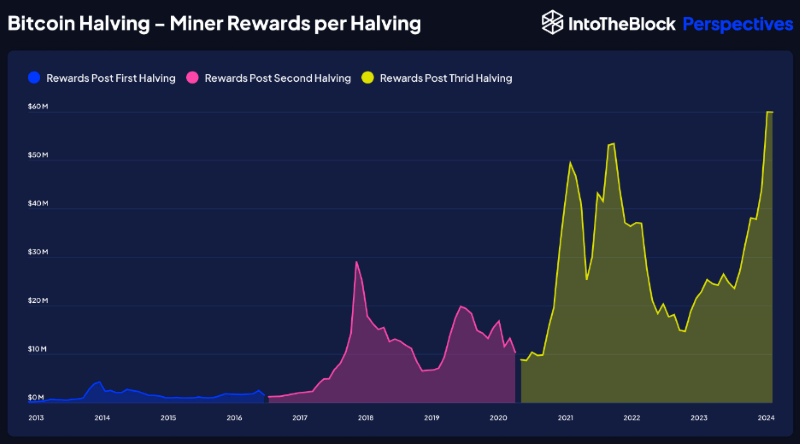

#2 Bitcoin security

At the same time, however, the “miner revenue in USD is at an all-time high (ATH), as the price appreciation of Bitcoin has counteracted the lower emission rate,” which “means it stays profitable for miners to secure the network,” allowing for the chain’s security to remain high.

Bitcoin price prediction

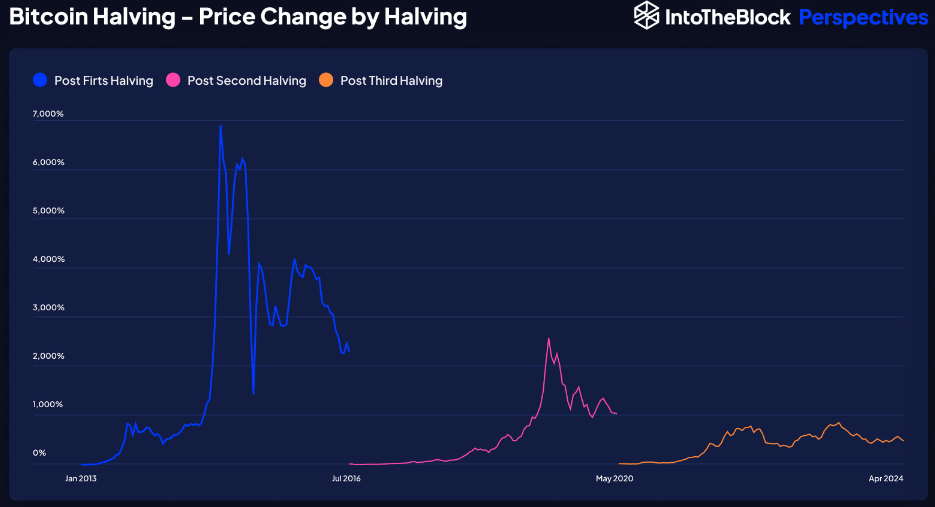

As a result of the above two factors, the price of Bitcoin should increase after the halving, considering it has done so consistently in the previous halving events, thanks to the growing market demand and the reduced rate of introduction of new BTCs.

That said, the gains might be smaller than before, as “the percentage increase in price post-halving diminishes over time,” the team said, pointing out that Bitcoin marked “a staggering 4,802% return” after the first halving, but that the rate has declined after subsequent Bitcoin halving dates.

In conclusion, the upcoming Bitcoin post-halving price rally could be a lot less impressive than the previous ones as:

“It is reasonable to assume that future percentage increases are likely to continue decreasing.”

Bitcoin price analysis

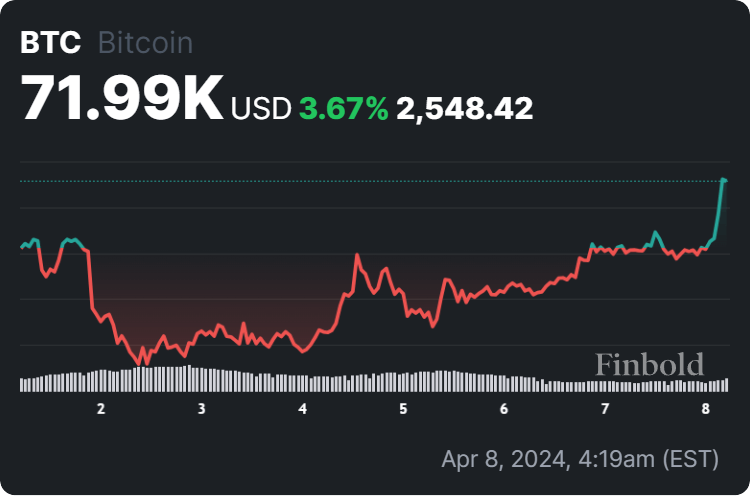

At press time, Bitcoin is trading at the price of $71,990, recording a 4.21% increase in the last 24 hours, adding up to the 3.67% gain across the previous seven days, and advancing 5.46% over the past month, according to the latest charts retrieved on April 8.

All things considered, the upcoming halving spells price gains for the largest asset in the crypto sector by market capitalization, and the Bitcoin whales seem to be well aware of it, as evident in one of them accumulating a whopping $90 million worth of BTC in a single month, as Finbold reported on April 7.

Having said that, it is important to remember that things in this industry can sometimes flip trends, so carefully watching the developments and doing one’s own research can assist in providing an approximate but in no way definitive or perfectly accurate Bitcoin price prediction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.