Recent earnings releases for some U.S. automotive giants fell short of expectations. Ford (NYSE: F) reported a miss on earnings, while experts expect that General Motors (NYSE: GM) will have limited growth in the second half of 2024 despite a better-than-expected Q2 report.

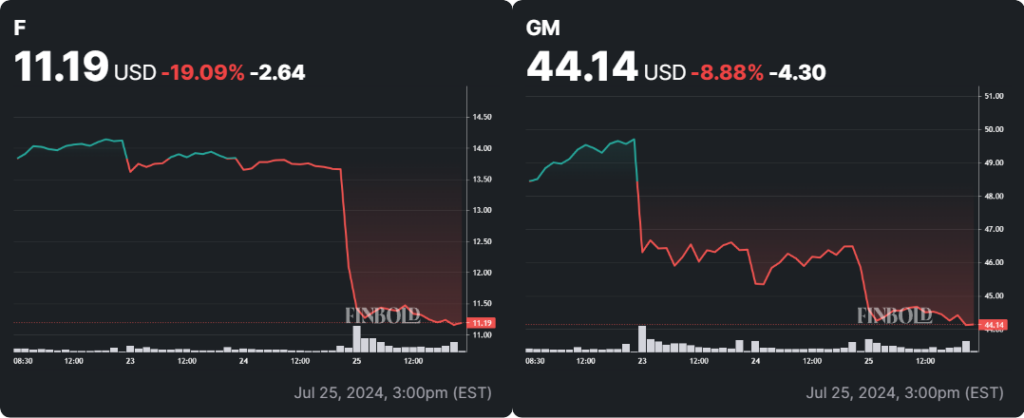

Consequently, both companies experienced notable declines in their share prices during the following trading sessions.

In the past five days, Ford stock retraced 22.87% with a single daily retrace of 18%, the largest since November 19, 2008, while General Motors shares experienced a 10.85% drawback over the same period, with most of the losses coming after their earnings reports on July 23 and July 24.

This significant pullback prompted investors to worry about the overall state of the U.S. automotive industry and whether further trouble is ahead.

EVs are not as popular as they used to be

The excitement around electric vehicles (EVs) is diminishing as automakers, including Tesla (NASDAQ: TSLA), General Motors, and Ford, scale back or delay their EV plans.

In an earnings announcement, General Motors stated it is further delaying the launch of a second U.S. electric truck plant and the Buick brand’s first EV.

Additionally, GM is indefinitely postponing the production of its Cruise Origin autonomous vehicle and is working to restructure a joint venture in China with SAIC due to ongoing losses.

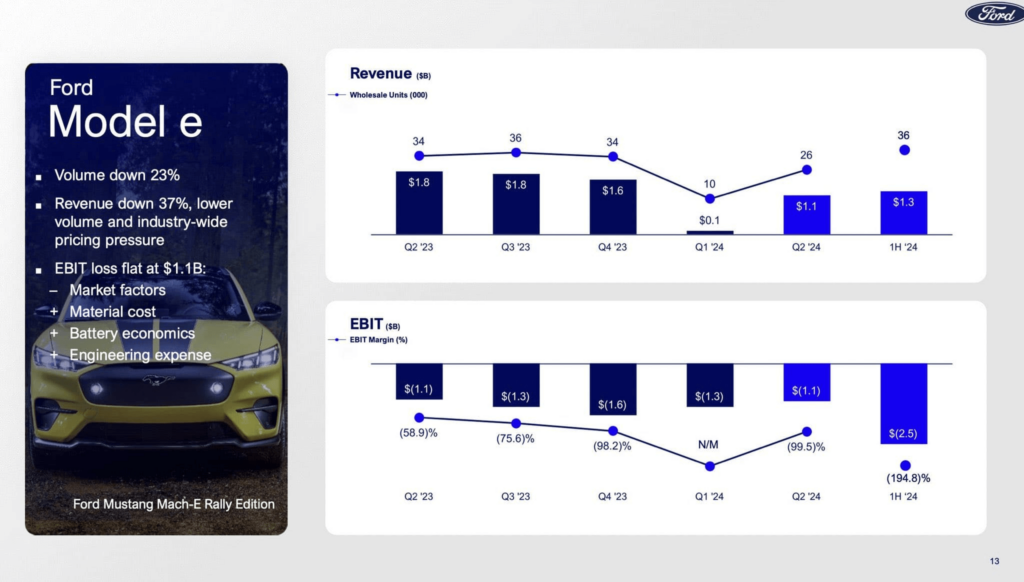

Ford is also facing significant challenges in its EV segment. The company expects to lose $5 billion in its electric vehicle business this year alone, translating to a loss of approximately $44,000 for every EV they produce. Ford’s EV sales were down a staggering 37% last quarter.

On July 23, Tesla announced its second consecutive quarterly revenue decline, reporting a 7% drop to $19.9 billion from $21.27 billion in the same period last year. Consequently, Tesla shares closed 2.04% lower.

The EV industry is undergoing a reality check after years of hype, during which automakers made optimistic sales forecasts and set ambitious growth targets for their EV models.

Competition with China is hurting U.S. carmakers

Legacy American carmakers face setbacks in their EV ambitions due to fierce competition from Chinese EV manufacturers, which has sparked a global price war.

Last week, General Motors retracted its earlier forecast of achieving one million units of EV production capacity in North America by the end of 2025.

Similarly, Ford has shifted its strategy, using a Canadian plant originally designated for future electric vehicle production instead of manufacturing larger, gasoline-powered versions of its flagship F-Series pickup truck.

The ongoing tariff war between the U.S. and China complicates a problematic situation for carmakers, who continue to lose ground to their Chinese rivals due to cheaper production and labor costs.

Experts have differing opinions on the U.S. automotive industry

Some experts believe that the current slump is caused by the decreasing net income numbers and customer demand, causing plummeting car prices in return.

However, not all experts agree. As mentioned in an interview with Yahoo Finance, CarGurus director of industry insights and analytics Kevin Roberts said:

“The auto industry as a whole is still quite healthy. I think we’re in a bit of a rebalancing right now, and that’s what we’re feeling, and we’re starting to see this earnings season.”

Roberts believes the industry will adapt with innovative approaches, such as creating newer and more affordable models to attract customers.

The EV models are a futuristic approach, and the only problem is whether the adoption curve will become steeper, thus benefiting traditional carmakers on shorter notice.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.