With global markets reacting to the crisis in the Middle East, pitting Israel and Iran, industry experts are on edge regarding how the situation will evolve.

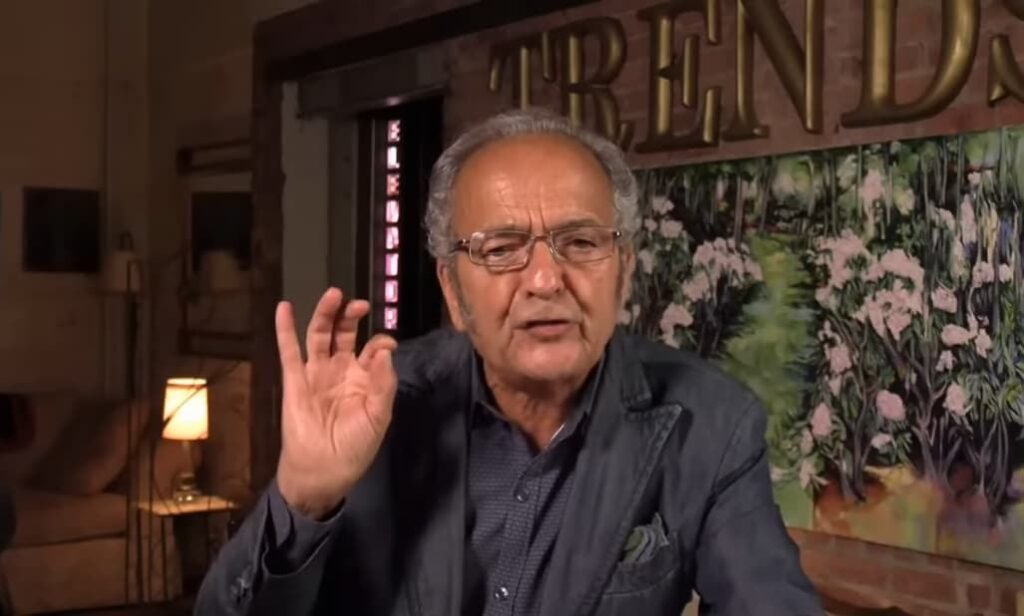

In this context, renowned American trend forecaster and geopolitical analyst Gerald Celente has warned about the tensions’ potential ramifications. Speaking during an interview with GoldSeek published on April 12, Celente predicted a dire outcome for the global economy.

The expert cautioned that oil prices could skyrocket if the conflict escalated into a military confrontation. Such a development, Celente argued, would have catastrophic consequences for the global economy, potentially triggering a widespread financial crash.

“Middle East Meltdown, we warned this was going to happen. <…> If this is a military conflict, you’re going to see oil prices go to above $130 a barrel that is going to crash the global economy and the global equity markets. We are on the verge of that,” Celente warned.

Reaction to possible economic fallout

Celente further elaborated on the potential fallout, suggesting that the collapse of banks would be inevitable in such a scenario.

In response to the impending economic turmoil, Celente predicted that central banks, particularly the Federal Reserve, would resort to drastic measures to stabilize the situation.

“When the banks go bust, that’s going to bring down everything. <…> What the Federal Reserve will do is dump in as much money as they can to ratchet it up, and that’s going to drive oil, gold prices up higher,” he added.

Additionally, Celente has foreseen a significant uptick in the prices of precious metals, particularly gold, as investors flock to safe-haven assets amidst the prevailing uncertainty. He projected that with gold having already surged to unprecedented highs, the commodity is poised to reach approximately $3,000 per ounce by the culmination of 2024.

Notably, the trendsetter has previously voiced concerns about the precarious state of the global economy amidst escalating tensions. As reported by Finbold in October, Celente cautioned that the world is standing on the edge of a potentially catastrophic event.

In his assessment, Celente highlighted the already evident decline of the global economy, citing growing debt levels and rising interest rates as key indicators of distress.

Featured image via Stansberry Research YouTube.