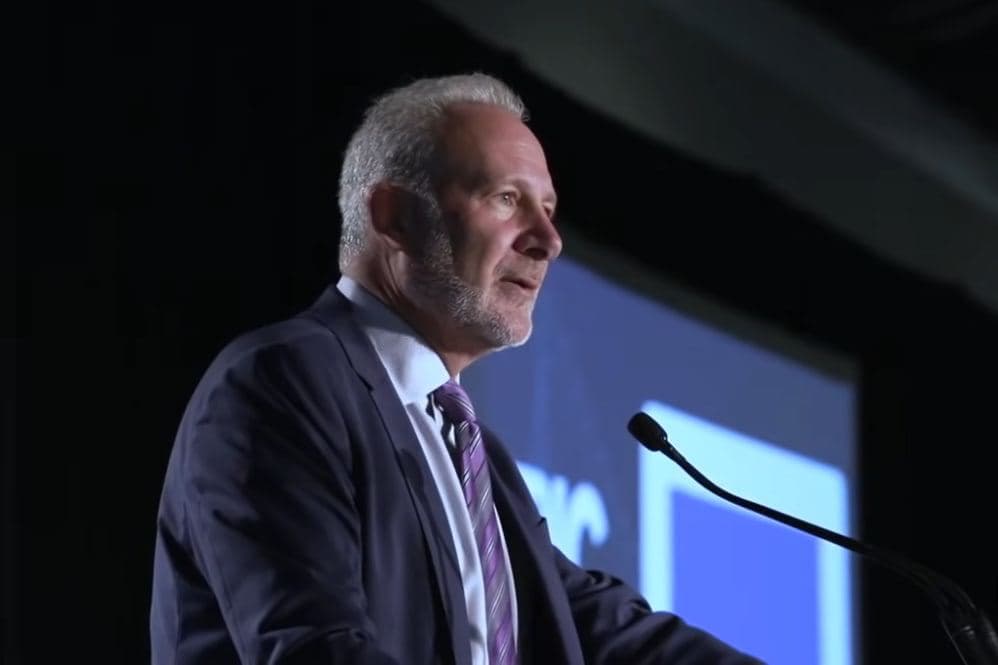

American economist and staunch gold advocate, Peter Schiff, recently asserted in a post on December 4 that Bitcoin’s (BTC) recent surge is attributable to a pullback in gold’s price.

In the same commentary, featured on an X platform, Schiff suggested that Bitcoin’s rally is driven by a “speculative frenzy around spot Bitcoin ETFs” and predicted a “spectacular crash” for the maiden cryptocurrency.

At the same time, Schiff expressed confidence in gold’s resilience, stating the bullion’s “rally is real” unlike Bitcoin’s.

Schiff’s remarks came on the heels of gold touching a new all-time high of over $2,100, however, the precious metal faced a substantial pullback hours after his post, while Bitcoin maintained its position around 18-month highs.

Gold plummets 6% after touching all-time high

In a separate post on Monday, December 4, Schiff weighed in on hold’s recent price rally, saying it is “far more significant than Bitcoin trading above $40K.”

“It’s in uncharted territory, while Bitcoin still needs to rally more than 60% from here just to make a new high.”

– the economist said.

However, it wasn’t long before Schiff’s status waned in relevance. Notably, in less than 24 hours, the bullion plummeted from an all-time high of $2,149 to as low as $2,020, marking a significant decline of approximately 6%.

It closed near $2,030.

Gold lifted by Powell’s comments; Bitcoin breaks above $42K

The initial rally in gold prices was mainly attributed to recent comments by Federal Reserve Chair Jerome Powell that current rates are doing enough to keep inflation under control.

This sentiment expanded investors’ expectations that the US central bank will impose no more hikes, with many now speculating about a potential first rate cut taking place sometime in 2024.

In addition to gold, the excitement for a possible dovish pivot increased investors’ appetite for riskier assets, which has been reflected in Bitcoin’s latest upswing.

The world’s biggest crypto asset broke above $42,000 on Tuesday, though it retreated below that threshold shortly afterward. Nevertheless, it remains up over 10% in the past five trading days and almost 20% on the month.

BTC’s recent surge to 18-month highs was primarily fueled by increasing anticipation that US regulators will approve a spot Bitcoin exchange-traded fund (ETF).

The Securities and Exchange Commission (SEC) is expected to announce its decision by January 10. If granted, this approval would pave the way for the inaugural launch of a spot Bitcoin ETF in the United States.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.