Gold recently reached a record high of $2,789.86 per ounce, reinforcing its status as a premier safe-haven asset amid growing economic and political uncertainties worldwide.

With a combination of factors such as declining U.S. Treasury yields, impending election concerns, and supportive technical indicators, the metal appears well-positioned for a continued rally toward new highs.

Key drivers fueling gold’s rally

One of the primary catalysts for gold’s upward trajectory has been a slight decline in U.S. Treasury yields, which has bolstered the appeal of non-yielding assets like gold.

Although U.S. bond yields remain relatively high, recent declines have prompted investors to pivot to gold. Additionally, the Federal Reserve’s cautious stance on rate cuts has tempered expectations, maintaining dollar strength and providing support for gold’s price.

This balance is reflected in October’s Consumer Confidence Index, which rose to 108.7, marking the largest single-month increase since early 2021. However, with the U.S. economy showing resilience, this strength in the dollar acts as a limiting factor, keeping some of gold’s gains in check.

Upcoming economic data are also set to impact gold. The Nonfarm Payrolls (NFP) report, set for release on November 1, is expected to highlight continued strength in the labor market, which could signal economic resilience.

Should the NFP data show significant job creation, the Federal Reserve may take a more conservative approach to rate cuts, potentially bolstering the dollar. Yet, if the NFP report reveals signs of labor market softening, this could reignite Fed rate cut speculation, creating a more supportive backdrop for gold.

Political uncertainty and safe-haven demand

Political factors have intensified gold’s appeal as a safe-haven asset. As the U.S. election race between former President Donald Trump and Vice President Kamala Harris tightens, market volatility is expected to rise, with investors bracing for any market shake-ups.

This uncertainty has increased demand for gold, which serves as a hedge against potential political and economic disruptions.

Additionally, geopolitical tensions in the Middle East, exemplified by recent escalations between Israel and Hamas, have raised concerns of further instability, fueling gold’s safe-haven appeal

Why 2025 could be ‘extraordinary’ for Gold

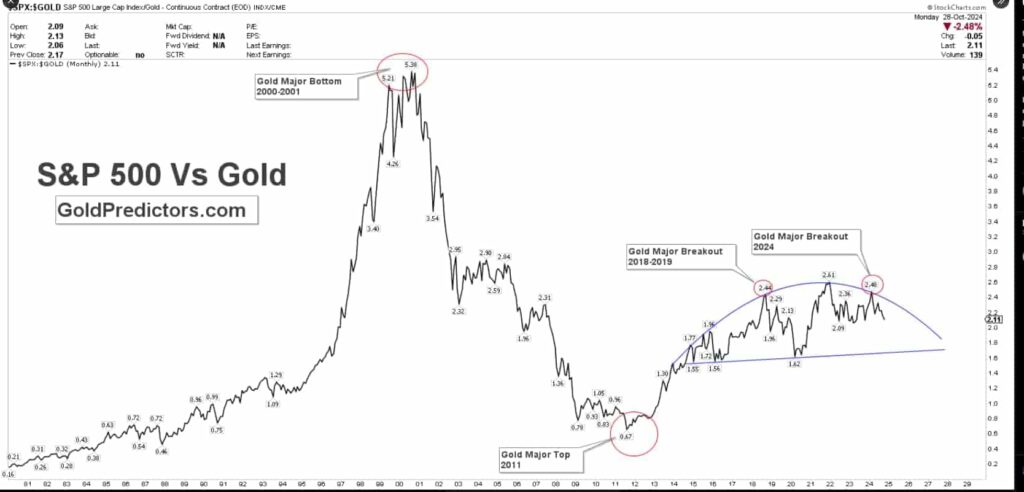

According to an analysis shared by Gold Predictors on October 29, the S&P 500 to Gold ratio is signaling a potential turning point for gold, marking one of the key catalysts for what could be an extraordinary year in 2025.

“The SPX to GOLD ratio forms the top, signalling a potential continuation of the long-term bull run in gold. The ratio has peaked at key resistance and is likely to decline. Historically, drops in this ratio have often aligned with strong rallies in gold.”

– Gold Predictors on X

The recent highs in gold prices, coupled with an anticipated decline in this ratio, suggest that investors may be shifting from equities to safe-haven assets like gold amid growing uncertainty. Historically, declines in the S&P 500 to Gold ratio have aligned with significant rallies in gold as risk-averse investors seek stability outside stocks.

Building on this view, some market analysts suggest the surge in gold prices may also be a cautionary signal of an impending “black swan” event, such as a stock market crash. Author Robert Kiyosaki echoes this concern, noting that high gold prices often align with growing investor unease, possibly foreshadowing a broader market downturn.

Adding to this momentum, gold is on track for one of its strongest annual performances, marked by substantial inflows into related exchange-traded funds.

In conclusion, gold’s record highs reflect its strength as a safe-haven asset amid global uncertainty.

With economic indicators, election concerns, and geopolitical tensions shaping investor sentiment, gold is well-positioned for continued gains.

As market dynamics shift, 2025 holds strong potential for gold to reach new heights, underscoring its enduring appeal as a stable investment in turbulent times.